Announcement of new UK fiscal measures last Friday triggered a massive sell-off on GBP and UK bond markets. Markets expected that the Bank of England will act to ease the situation but they expected an intra-meeting rate hike. However, BoE decided to delay QT, which was set to begin next Monday, and instead launched a temporary QE programme, vowing to purchase long-dated UK bonds in whatever quantity is necessary to calm the situation.

This has led to only short-term relief on GBP market but it should be said that the FX rate was not BoE's target. BoE's goal was to address the spike in UK yields and they managed to push 10-year UK yields down to beginning-of-the-week levels, near 4%. This eased the situation but underlying factors behind the bond meltdown remain unchanged and there is a lot of uncertainty over what will happen after October 14, when bond purchases are set to end. Moreover, scope for those reasons to change is rather slim given that UK Prime Minister Truss defended her policies today saying that this is a "right plan" for the United Kingdom and that difficulties are not limited to the UK only but rather are a global problem.

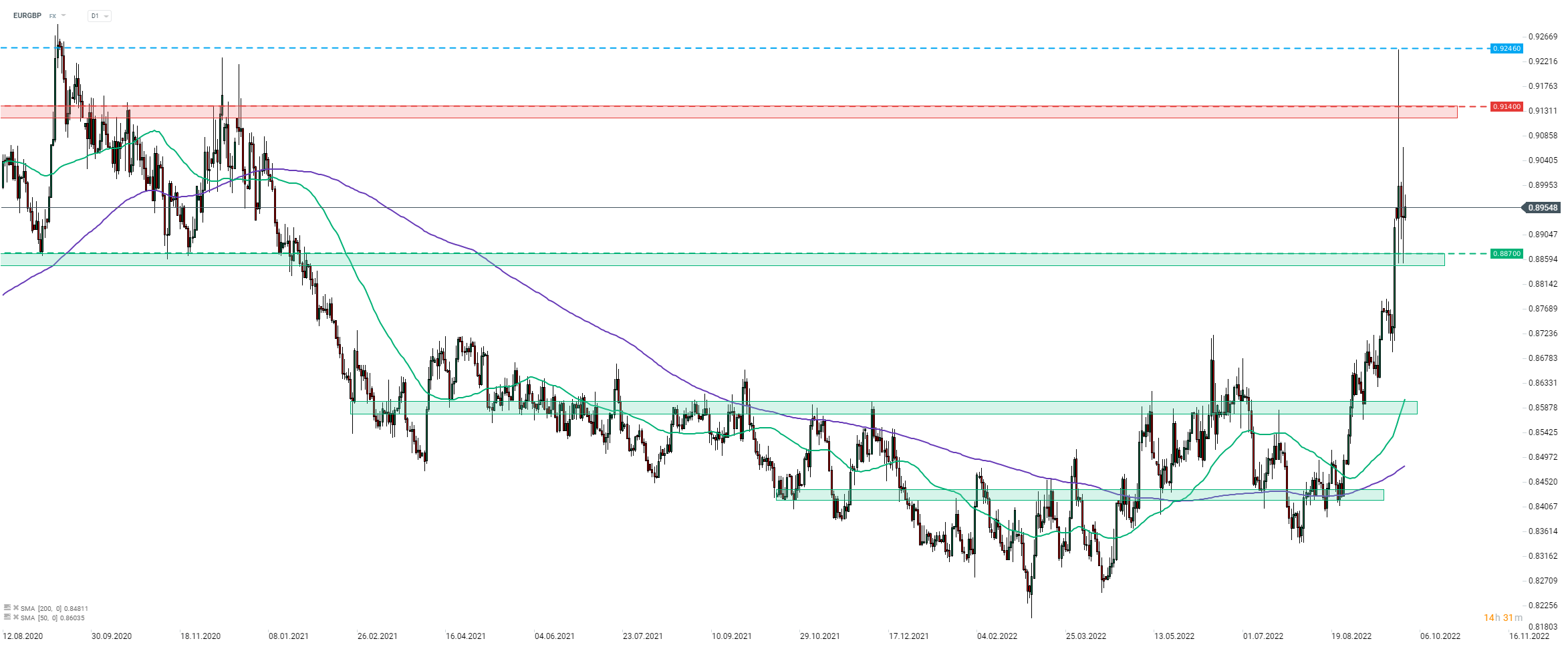

Taking a look at EURGBP chart at D1 interval, we can see that the pair jumped to the highest level since mid-September 2020 on Monday before pulling back. While the pair stays at elevated levels, a mid-term 0.8870 price zone provided support in recent days. The pair may experience elevated volatility later today during release of German CPI data for September (1:00 pm BST) as well as BoE speakers in the afternoon (Ramsden, Tenreyro and Pill). BoE speakers may be more interesting as they are likely to touch on the topic of the newly announced QE.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%