After today's strong labor market data from the United Kingdom, the British pound is one of the strongest currencies on the forex market. However, declines in the EURGBP pair are being tempered by an equally strong euro. Today, the rate is testing the 0.8700 level from above.

The macro data from the UK were not surprising enough to influence a change in the trend on the EURGBP currency pair. Nevertheless, the report for September showed a strong labor market with signs of weakening on the horizon. From August to October 2023, the UK recorded a decrease in the number of job vacancies, marking the 16th consecutive quarter of decline, with a decrease in 16 out of 18 industry sectors. Despite this, there was a significant annual increase in regular pay (7.7%) and total pay (7.9%), partly influenced by one-off Civil Service payments. After adjusting for inflation, the real annual growth rates for total and regular pay were 1.4% and 1.3%, respectively. The published report also showed a slight decrease in employment to 75.7%, unemployment rate remains low at unchanged level of 4.2% and an unchanged economic inactivity rate at 20.9% for the period from July to September 2023.

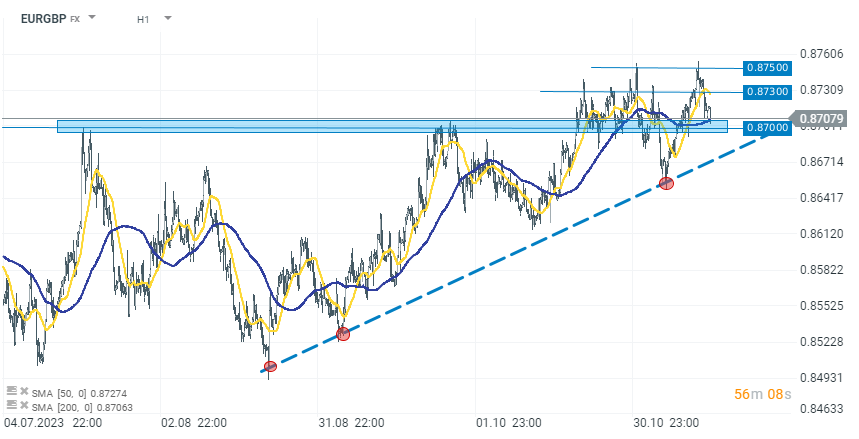

On the chart, we see that the EURGBP rate remains in an uptrend. After the recent breakthrough above the 0.8700 level and reaching local highs at 0.8750, a correction occurred. Currently, we are observing a test of the 0.8700 zone from above, which coincides with the 200-session SMA average. If the bulls manage to defend this level, we can expect another attempt to break above 0.8750. Source: xStation 5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)