Minutes from the latest meeting of the European Central Bank's Governing Council are a highlight in today's economic calendar (12:30 pm BST). FOMC minutes released yesterday turned out to be a rather hawkish one with the US central bank signaling that it will not hesitate to tighten policy at an even faster rate if the situation requires it. Such a strong hawkish message is not expected from the European Central Bank. However, the document may provide some crucial insight. The ECB has announced at the latest meeting that rate hikes are coming but it is still uncertain how long the cycle will go and how high rates will increase. While clear answers to these questions are unlikely to be found in ECB minutes, some guidance may be provided.

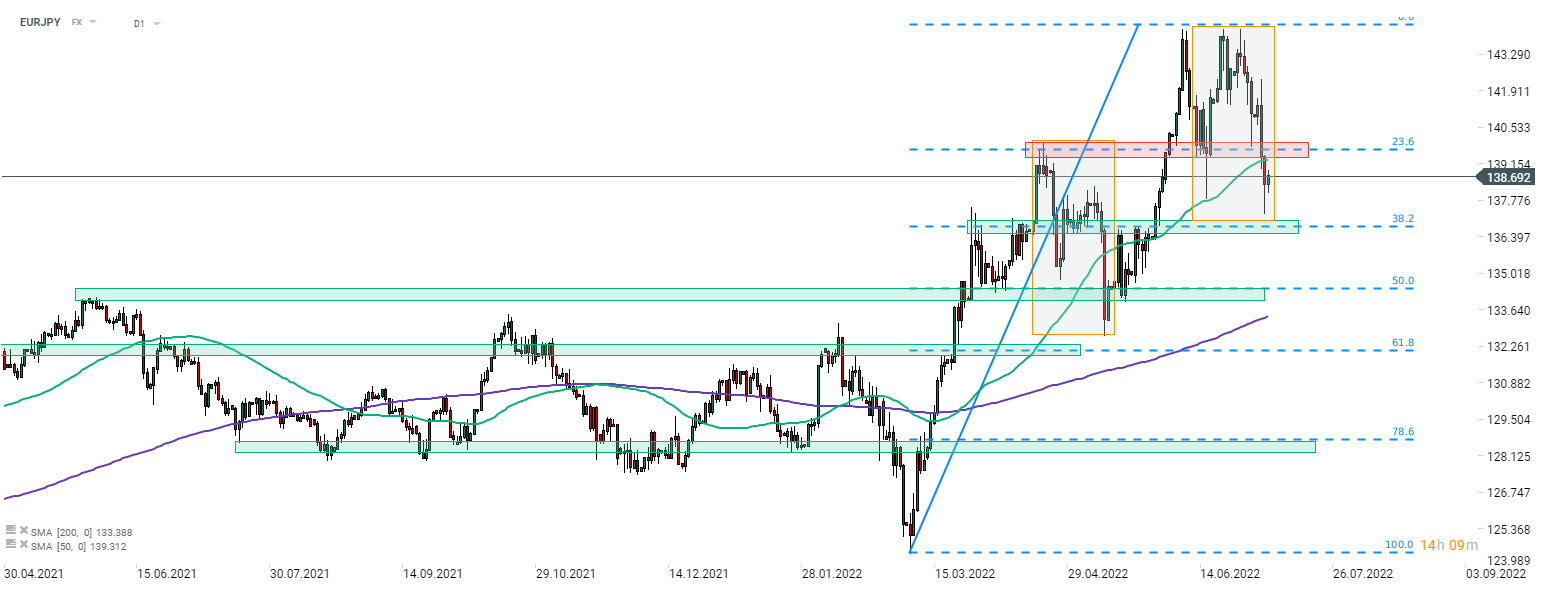

Taking a look at EURJPY chart at D1 interval, we can see that the common currency has lost some ground against the Japanese yen recently, even as JPY has been a rather weak performer recently. Nevertheless, uptrend seems to be still in play as the pair manages to stay above the lower limit of a market geometry in the 137.00 area, which is also marked with 38.2% retracement of the upward move started in March 2022. As long as the price stays above the 137.00 area, technical outlook continues to favor bulls.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%