EURUSD is in the center of attention today. After a months-long drop, the euro is nearing parity with the US dollar. It was almost 20 years ago when the main currency pair traded at 1.00 for the last time. What are the reasons for EUR underperformance? On one hand, implications of the Russia-Ukraine war play a big role. Energy prices in Europe spiked as gas flows were being limited and now there is a real risk of complete halt to gas supply from Russia. This would most likely lead to a recession on the Old Continent, especially in gas-dependent countries like Germany. Another reason for weak showing of common currency is the European Central Bank. ECB has been very slow compared to other major central banks when it comes to policy tightening and is yet to deliver its first rate hike. Meanwhile, Fed embarked on an aggressive rate hike cycle providing support for the US dollar, which is also benefiting from safe haven flows. As a result, EURUSD keeps moving lower.

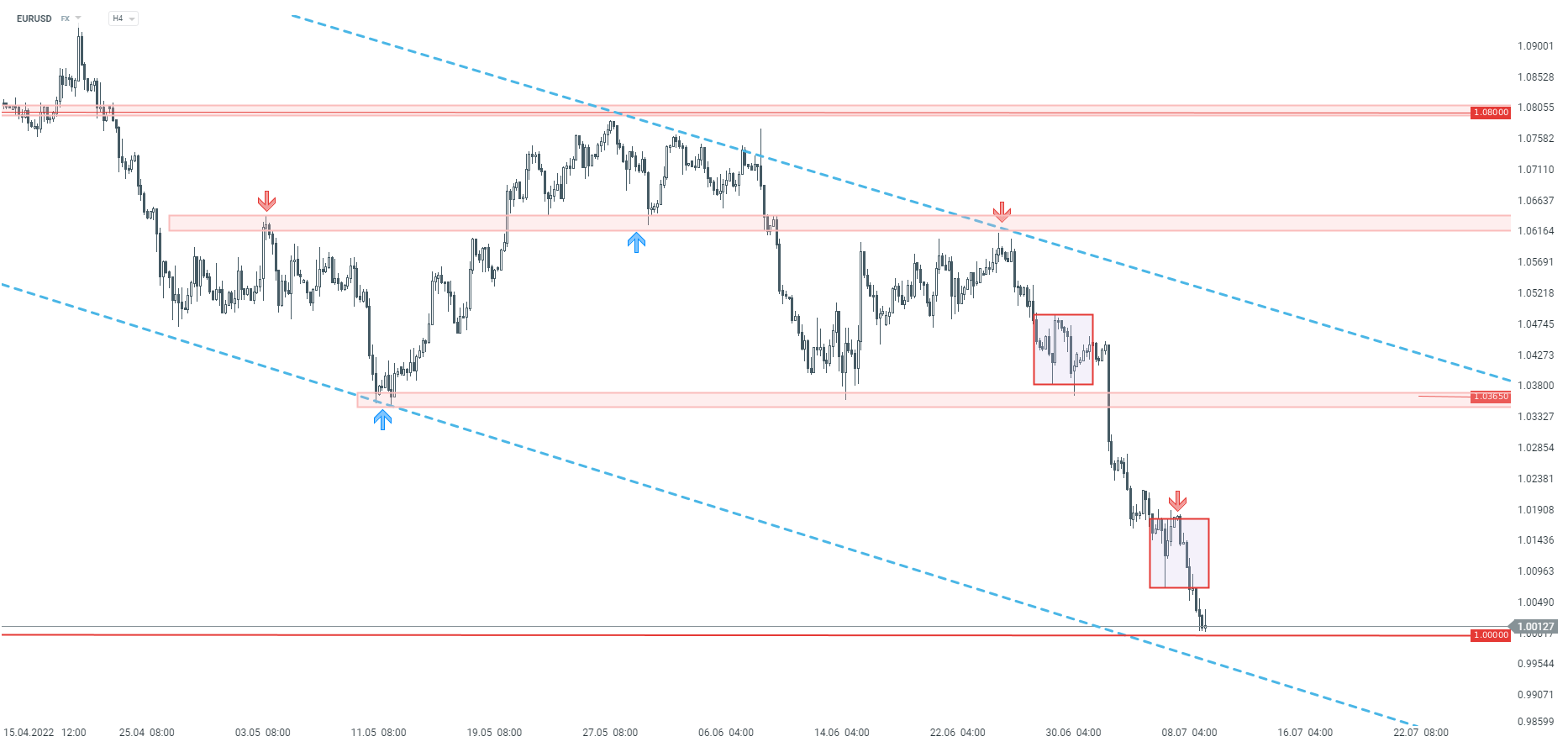

Taking a look at EURUSD chart at H4 interval, we can see that the pair is pulling back following a failed attempt of breaking above the upper limit of the downward channel. Pair broke below recent local low and is now heading towards the lower limit. However, traders should expect some support in the 1.00 area due to the psychological nature of this level. The lower limit of the channel can be found slightly lower at 0.9950.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)