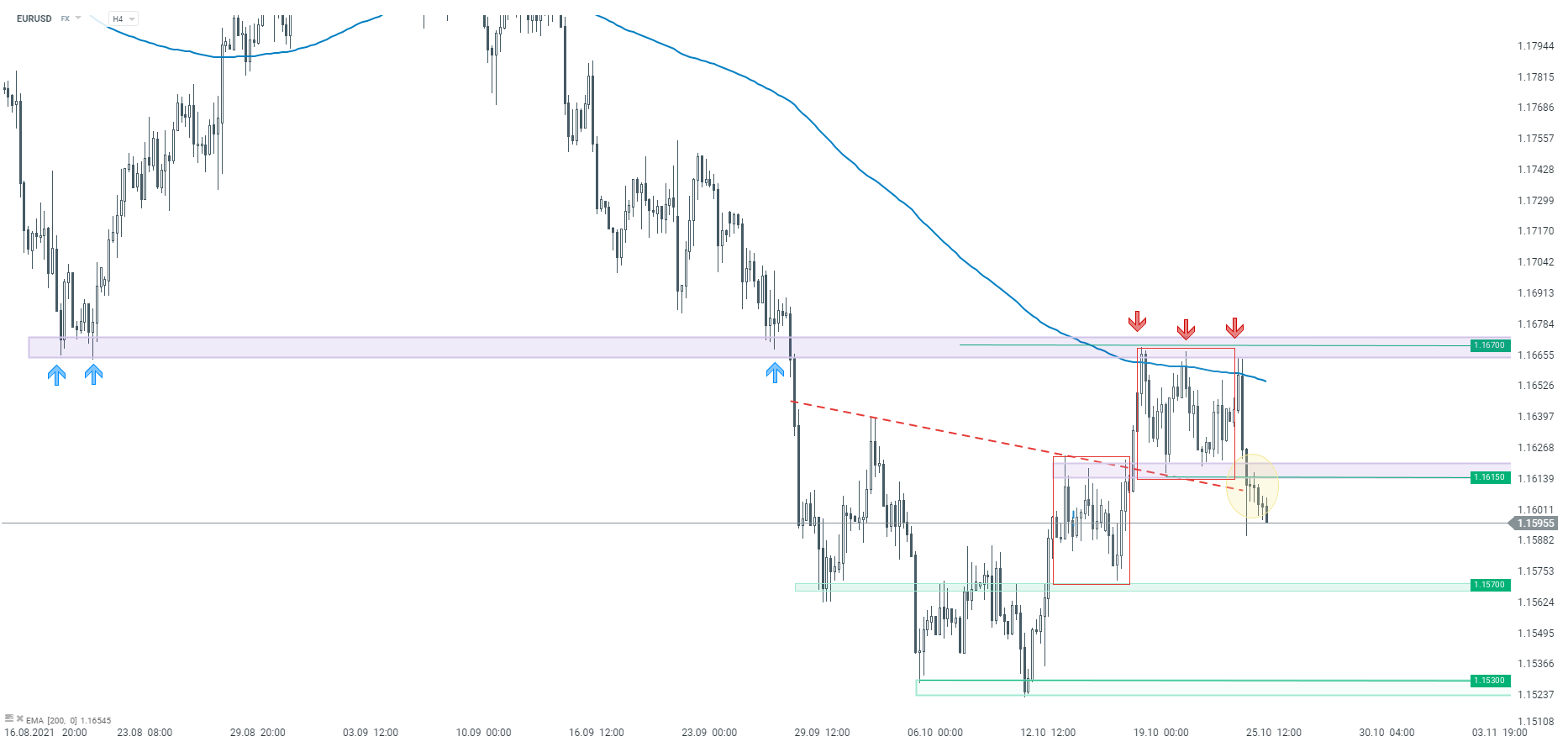

The main currency pair - EURUSD - traded sideways in the 1.1615-1.1670 range for the past few days. However, a downside breakout occured yesterday and the move is being continued today. Note that the lower limit of the range also marked the lower limit of the local market geometry and a break below suggests, at least in theory, a reversal of the short-term trend to bearish. The next support level to watch can be found ranging around 1.1570 handle, and is marked with the previous price reactions.

US dollar has regained some ground recently as traders reacted to hawkish pre-meeting comments from Fed members. Consensus right now seems to be that taper announcement will come during a FOMC meeting next week and that tapering will be launched immediately. Meanwhile, ECB is scheduled to meet this week but the meeting is not expected to be a gamechanger. Derivatives market do not price-in a pick-up in volatility around this week's ECB decision. Euro could experience some more volatile moves should ECB President Lagarde may some strong comments opposing rate hikes. However, given that rate hikes in Europe are most likely years away and Lagarde tends to send a rather balanced message, it is not the base case scenario.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)