European assets had a rough start to today's trading with EUR being one of the worst performing G10 currencies and indices from the Old Continent trading lower. Drops deepened following the release of German retail sales data at 7:00 am GMT earlier today. The German report turned out to be a big disappointment with retail sales plunging 6.4% YoY in December (exp. -1.9% YoY). On a month-over-month basis sales were 5.3% lower (exp. +0.2% MoM). German CPI data was also set to be released today at 1:00 pm GMT but the German statistics office had to delay release until next week due to technical issues. Nevertheless, the week will still be interesting for EUR traders as ECB is still set to announce rate decisions on Thursday (1:15 pm GMT).

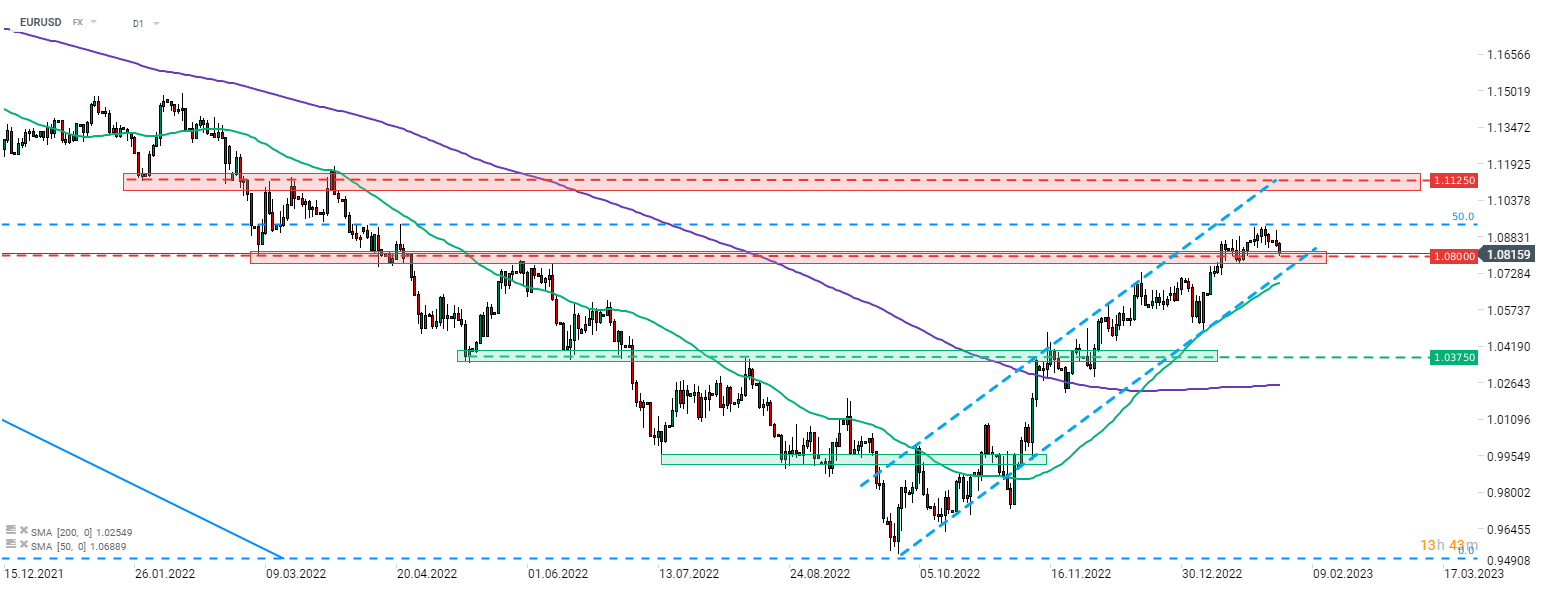

Taking a look at EURUSD chart at D1 interval, we can see that the main currency pair has halted recent advance after reaching 50% retracement of a downward move launched in January 2021. The pair pulled back and is now looking towards a test of a recently broken 1.08 price zone. However, this time it may be tested as a support. Note that the lower limit of the upward channel can be found slightly below the 1.08 zone and a break below those two technical supports could herald a deeper downward move.

Source: xStation5

Source: xStation5

Morning wrap (26.12.2025)

BREAKING: US jobless claims below expectations!🚨

Chart of the day: USDJPY (24.12.2025)

Morning Wrap (24.12.2025)