The Reserve Bank of Australia announced a 50 basis point rate hike after a meeting today. This put the main interest at 1.35% - the highest level since mid-2019. This was also the first back-to-back 50 basis point rate hike in RBA's history as the Bank embarked on a record-paced tightening in an attempt to rein in inflation. Interest rate futures are now pricing in around 170 basis points of additional RBA tightening by the end of this year. However, economists say that a streak of recent upbeat data, like for example retail sales, makes it unlikely for the RBA to follow in Fed's footsteps and deliver a 75 basis point move. Instead, the Bank is expected to continue with 50 basis point rate hikes in the coming meetings.

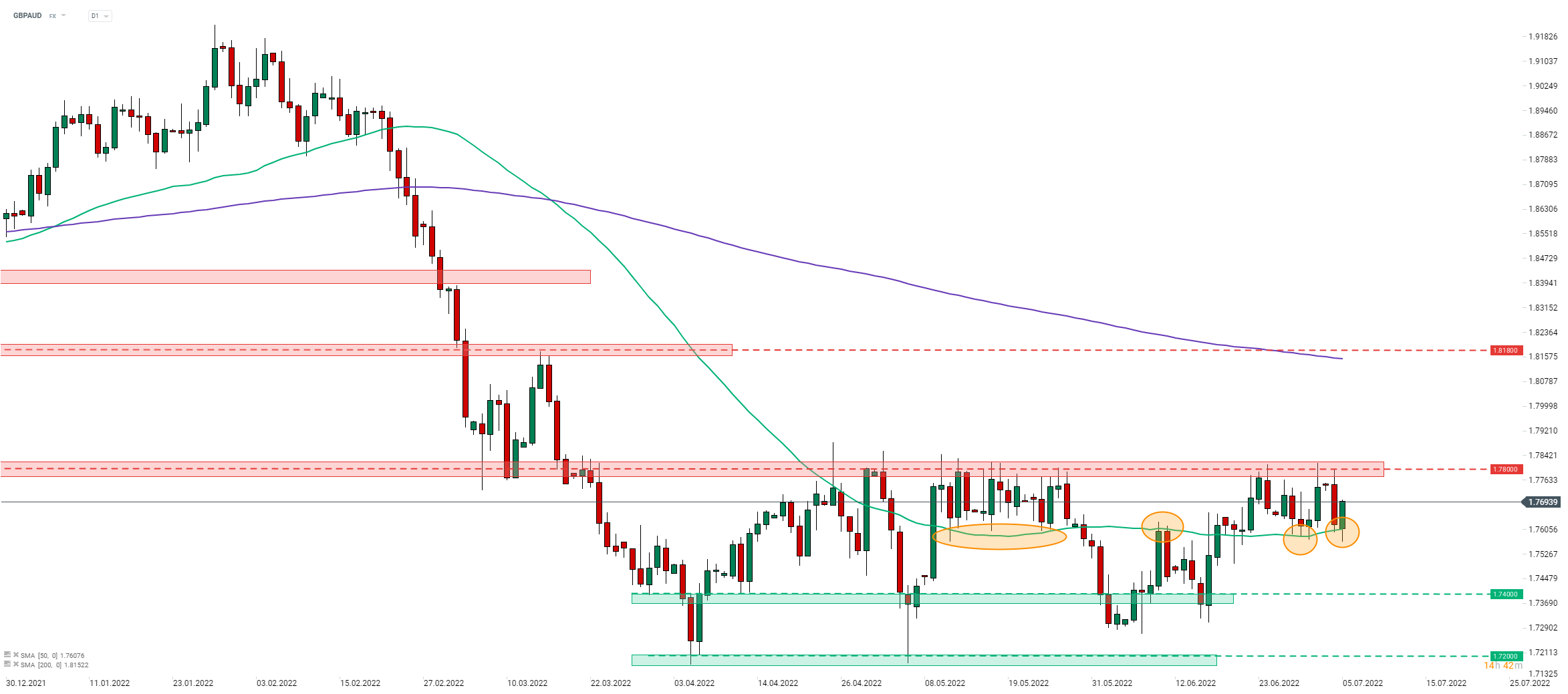

AUD barely experienced any reaction to the RBA decision as a 50 bp rate hike was expected and priced in. The Australian dollar has later lost some ground and is now one of the worst performing G10 currencies. Taking a look at GBPAUD at D1 interval, we can see that the pair made an attempt at breaking below 50-session moving average (green line) earlier today. However, bears failed to push the pair below and a recovery move was launched. Note that this moving average has served as a turning point a few times already (orange circles). Should the recovery move continue, a resistance zone in the 1.78 area will be the first target for buyers. The pair may experience some elevated volatility after 10:30 am BST as BoE is expected to release a financial stability report and remarks from BoE Governor Bailey will follow at 11:00 am BST.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)