The British pound is in the spotlight this morning. Times reported that the Truss government will delay a 1 percentage point cut to income tax rate until 2024. This is another sign that the UK government is taking a U-turn on its fiscal plans after they have triggered a meltdown on the UK debt market and forced the Bank of England to act in the bond market. New UK Chancellor of Exchequer Jeremy Hunt (appointed on October 14, 2022) is set to make a statement on the government's fiscal plans today at 11:00 am BST. This could be the announcement of what parts of the fiscal plan may be scrapped or delayed and will surely draw the attention of GBP traders.

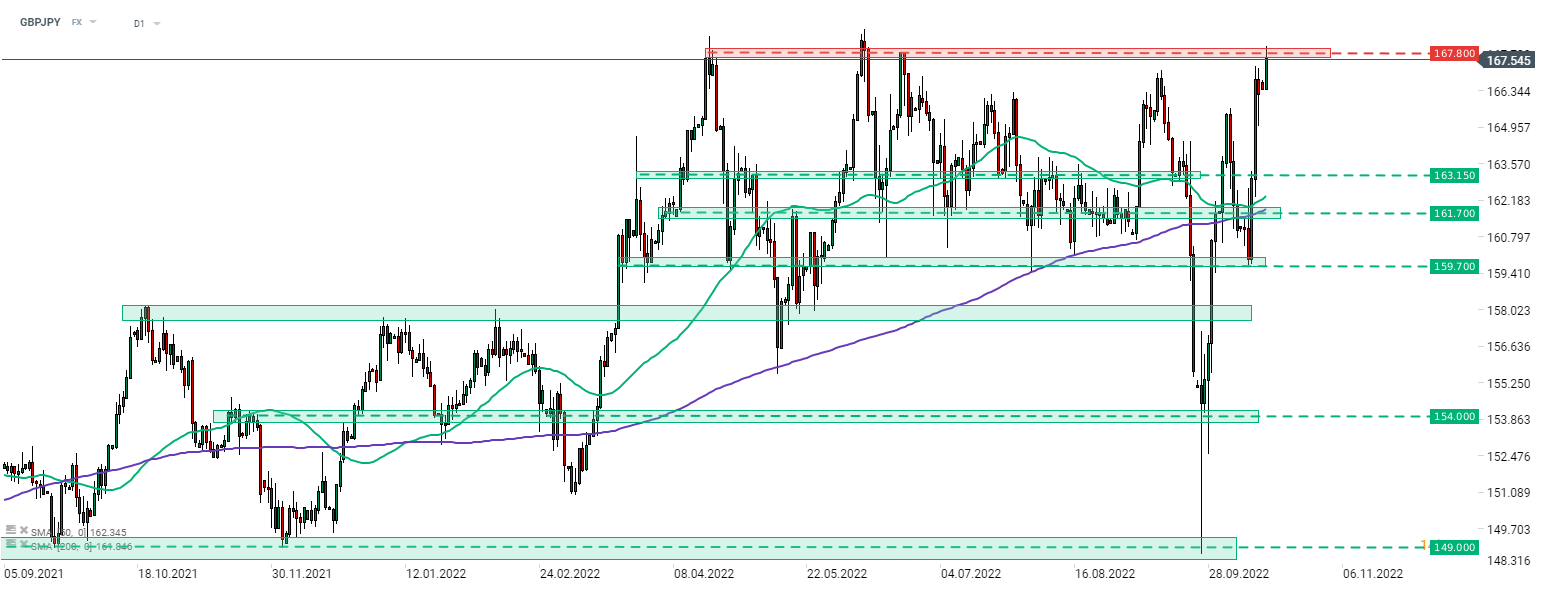

Taking a look at GBPJPY chart at D1 interval, we can see that the pair has fully recovered from its recent slump and is testing the 167.80 resistance zone, marked with local highs from the first half of 2022. A break above would result in the pair reaching the highest level since the 2016 Brexit referendum.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️