Bank of England is scheduled to announce a monetary policy decision today at 12:00 pm GMT. There is no clear consensus for the meeting as economists polled by Bloomberg are almost 50-50 split on what to expect. Half of them expects BoE to leave rates unchanged while the other half expects a 15 basis points rate hike. Interest rate derivatives are pricing in a hike today. Whatever the decision will be, it surely won't be unanimous. While BoE Governor Bailey has recently said that the Bank should act, he did explicitly say that it should act now. Lack of a rate hike today could cement the decision for December meeting. With high expectations for today's meeting, lack of a rate hike could be negative for GBP. Rate hike should be more or less neutral.

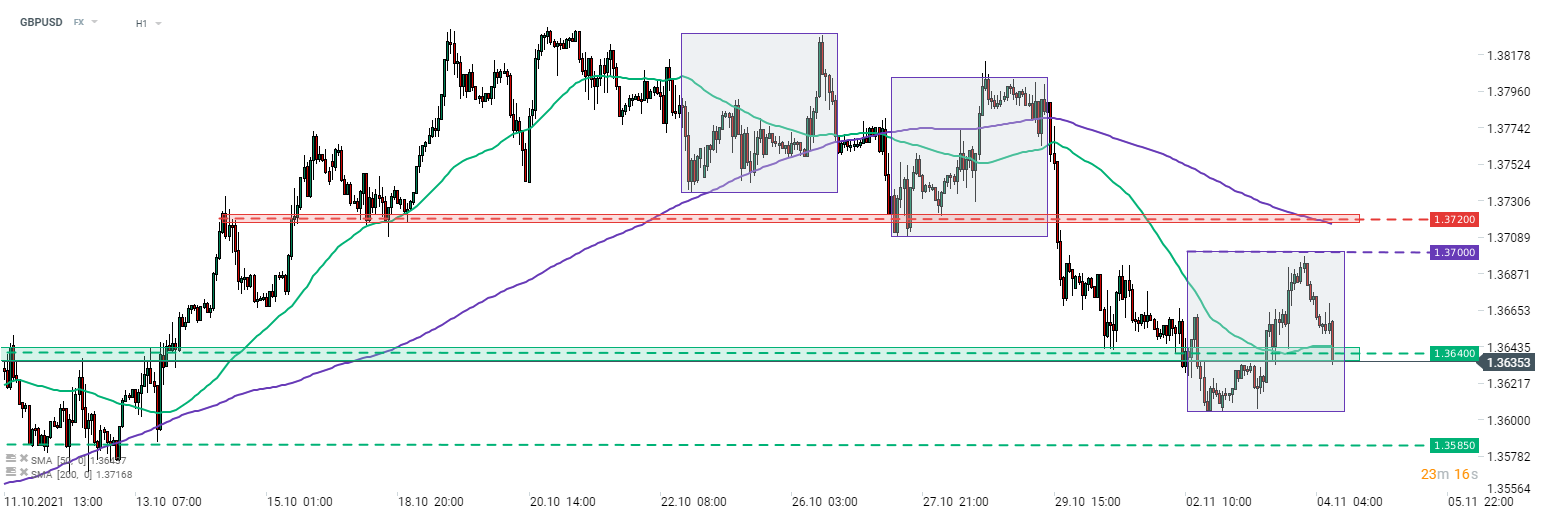

A look at GBPUSD at H1 interval shows that the pair has been trading in a downtrend since October 20, 2021. The most recent upward impulse was halted near the upper limit of a local market geometry at 1.3700. The pair turned lower later on and is currently attempting to break below the support at 1.3640, where the 50-hour moving average can also be found (green line). Recent lows near 1.3600 will become the next target for beas in case of a break below 1.3640.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%