Monetary policy decision from the Bank of England is a top macro event of the day. UK central bank is expected to announce a third consecutive 25 basis points rate hike today at 12:00 pm GMT. Inflation running rampant is likely to cement the decision but a lot of the attention will be paid to forward guidance. This will be the first BoE meeting after beginning of Russian invasion of Ukraine and investors want to hear whether war has changed BoE's outlook on the economy. Major UK banks expect BoE to hike rates only one more time after today before pausing for the remainder of the year.

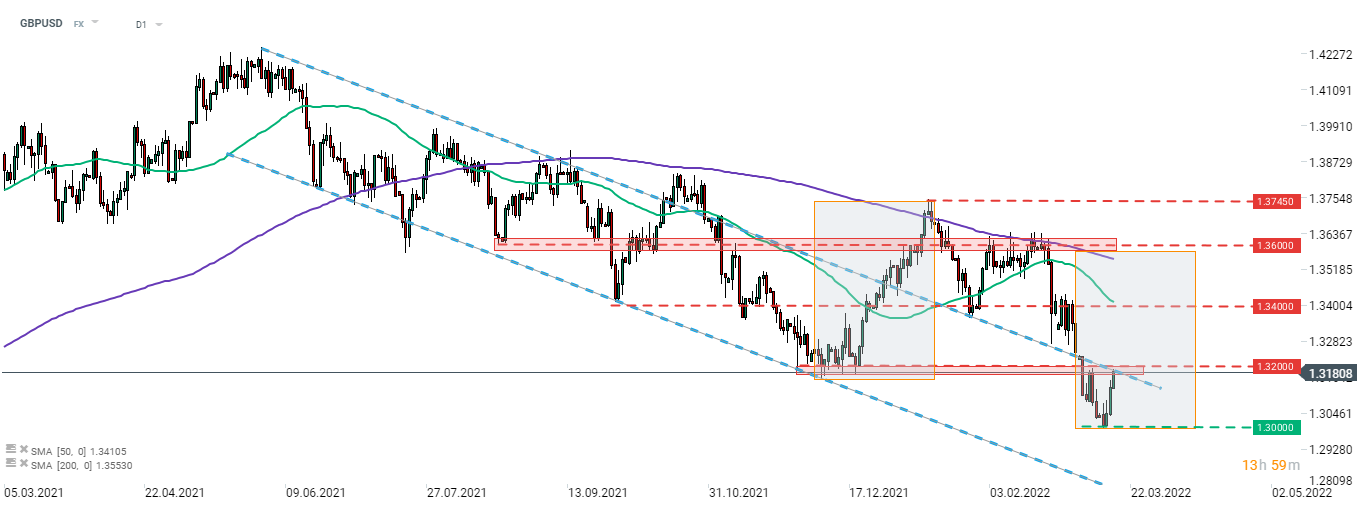

Taking a look at GBPUSD chart at D1 interval, we can see that downtrend on the pair continues. GBPUSD dropped back into the range of the previously broken downward channel but has managed to halt decline at 1.3000 and started to recover afterward. Resistance zone at 1.3200 is being tested at press time. It is marked with the upper limit of the aforementioned channel as well as previous price reactions. Key support to watch is the upper limit of the Overbalance structure at 1.3600 and a break above it could hint at trend reversal. Trend reversal would be confirmed with a break above previous local high at 1.3745.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)