The pound is recording sharp losses against all G10 currencies (GBPUSD: -0.2%, GBPJPY: -0.7%, EURGBP: +0.25%) in the aftermath of a UK labor report that underscored a progressive softening in the jobs market. This surprise uptick in unemployment suggests that the Bank of England’s recent dovish hold may, in fact, be already falling behind the curve.

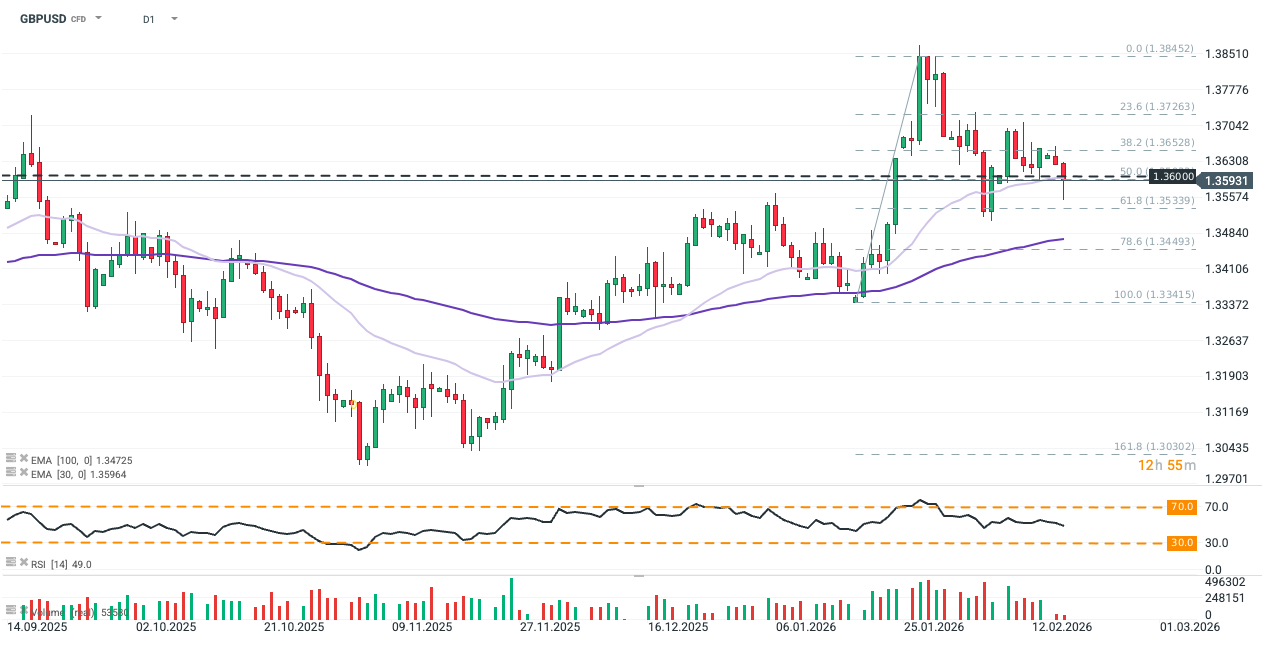

GBPUSD dropped sharply below the key support level at 1.36000 following the labour data release. Dip buyers limited the decline by brining the pair back to the 50.0 Fibonacci retracement level coinciding with 30-day expontential moving average (EMA30; light purple), although the price seems reluctant to recover above the above-mentioned key level. Source: xStation5

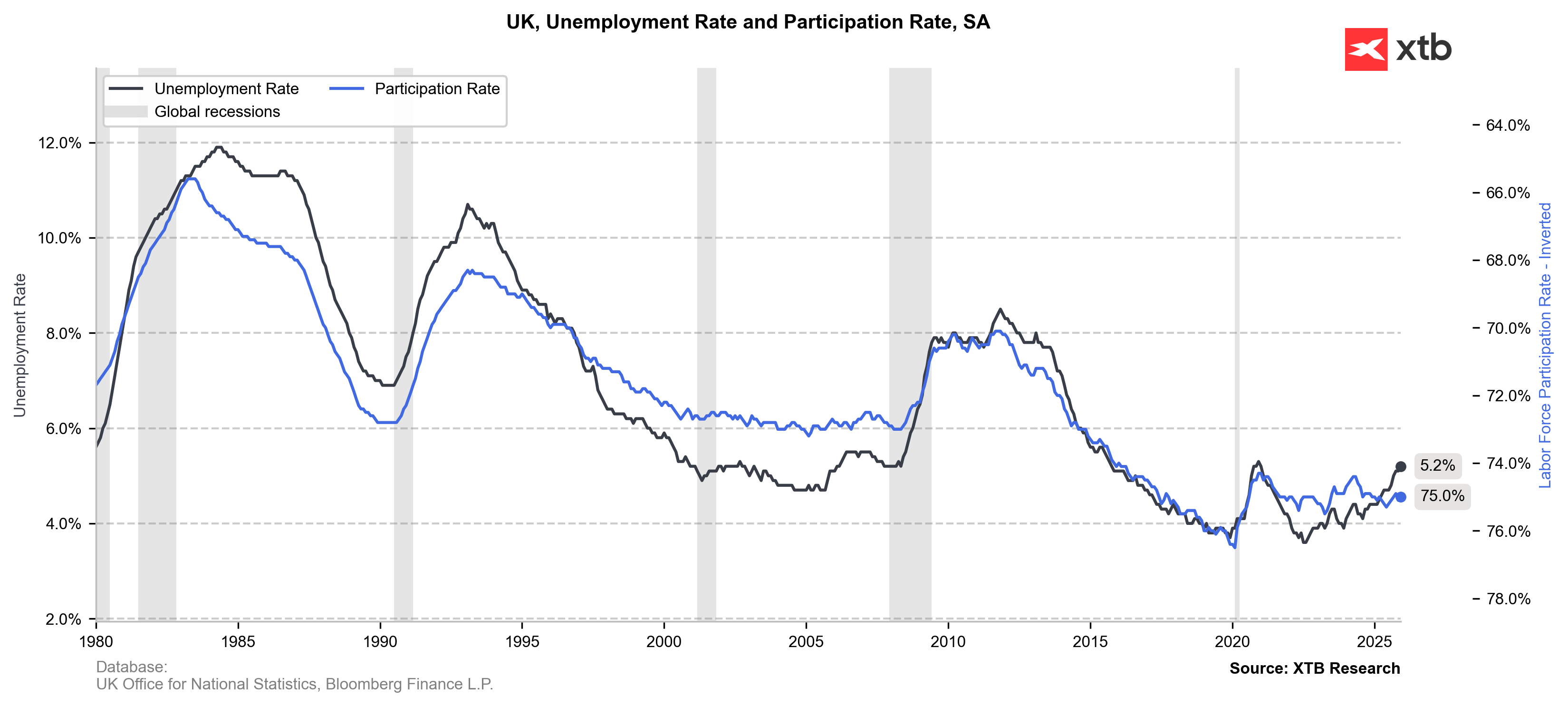

Unemployment Climbs to 5.2%

After holding steady at 5.1% for two months, the UK’s unemployment rate climbed to 5.2% in December (exceeding the Bloomberg consensus of 5.1%). This marks a nearly five-year high, edging closer to the 5.3% peak seen during the pandemic.

Concurrently, average earnings growth cooled from 4.5% to 4.2%, while stagnant vacancy figures confirmed mounting slack in the labor market — highlighting a distinct lack of hiring momentum as layoffs persist. Particularly alarming are the early January estimates for year-on-year employment change, which indicate a loss of over 134,000 jobs over the past year (-11k m/m), despite a backdrop of previously persistent inflation.

UK unemployment rate reached its highest since COVID. Source: XTB Research

BoE Outlook: Acceleration Toward Easing

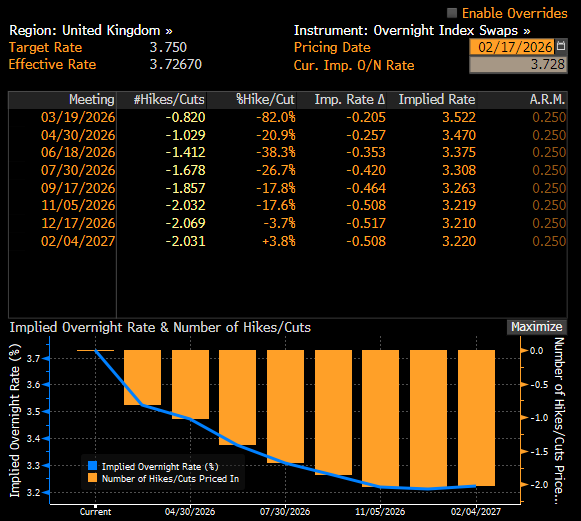

This data has accelerated bets on Bank of England (BoE) rate cuts in the coming months. Although the recent decision to hold rates at 3.75% was already perceived as dovish due to the narrow 5-4 MPC vote split, the deteriorating labor outlook will likely force a re-evaluation of the timing for easing. Swap markets are now pricing in an 82% probability of a March cut, with two total reductions anticipated by the end of 2026.

However, it will likely take months for businesses to feel the benefits of lower rates and regain the confidence to resume hiring, especially given the headwinds of a higher minimum wage. Additionally, recent payroll tax hikes are expected to dampen consumer confidence and spending, stifling the economic activity required for firms to break out of current stagnation. This suggests that without more aggressive monetary easing, the UK remains at risk of being trapped in a low-growth environment, notwithstanding recent marginal gains in labor productivity.

Source: Bloomberg Finance LP.

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

Crypto up 4 % despite tension📈