Release of US jobs data for November is a key macro event of the day. NFP report will be published at 1:30 pm GMT and is expected to show a 200k increase in US employment, down from a 261k increase in October, while the unemployment rate is seen remaining unchanged at 3.7%. While investors would usually look at NFP data for hints whether Fed will change its approach to policy moves, this may not be the case today as we have received some strong hints earlier this week from Fed Chair Powell and other Fed members that December meeting may result in 50 bp rate hike, rather than a 75 bp rate move. A softer-than-expected NFP reading would confirm this view.

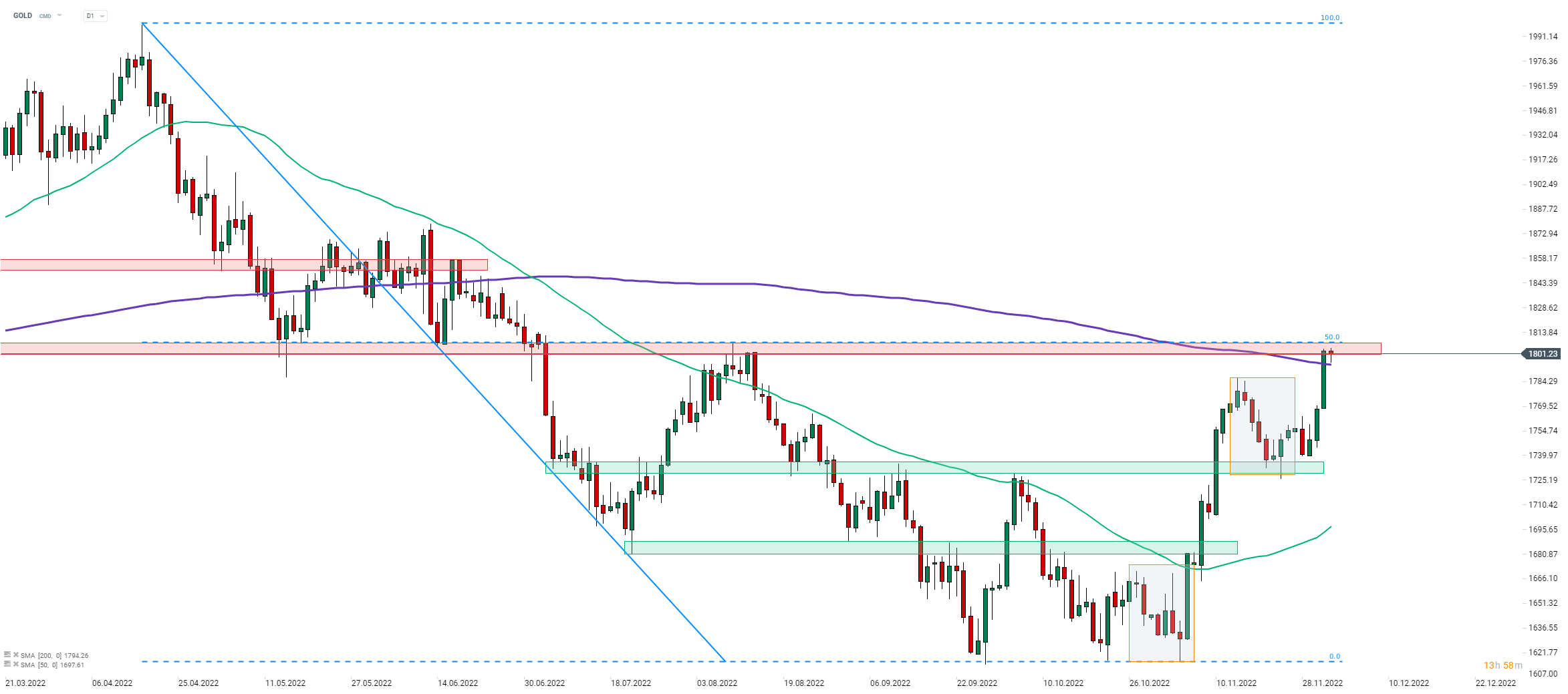

A dovish pivot from Powell earlier this week triggered massive moves on the market - US indices rallied while USD took a big hit. Weakening of US dollar allowed gold to accelerate rebound following recent brief downward correction and price of the precious metal climbed above recent local high from $1,786.50 per ounce. Upward move did not stop there - price continued to move higher and broke above the 200-session moving average (purple line) for the first time since mid-June 2022. Resistance zone ranging between $1,800 mark and 50% retracement of the downward impulse launched in April 2022 is being tested at press time and NFP data may be a trigger for make-or-break.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉