Release of the US CPI data for January is a key event of the day. Report will be published at 1:30 pm GMT and is expected to boost volatility on the USD and gold markets. Market expects acceleration in headline price growth to 7.0% to 7.3% YoY while core CPI is expected to accelerate from 5.5% to 5.9% YoY. As acceleration in price growth is almost certain, focus will be on how the actual reading deviates from expectations. If data once again shows higher price growth than market expects, some weakness can surface in equities and gold while USD should receive a boost as it could mean that Fed will be more aggressive with policy tightening.

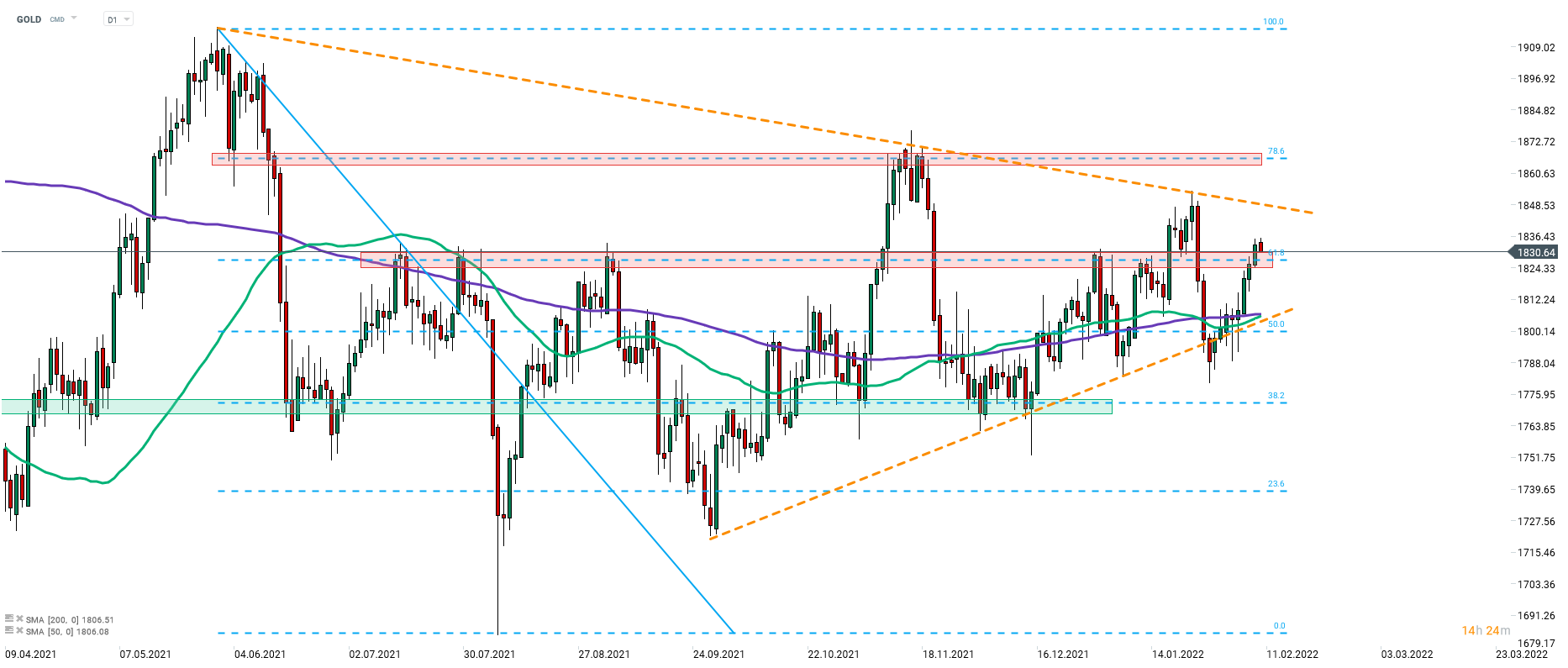

Taking a look at the GOLD chart at D1 interval, we can see that the price of the precious metal broke above the resistance zone marked with 61.8% retracement of the mid-2021 correction ($1,827). Upward move is taking a pause today but unless we see a break back below the aforementioned price zone, continuation of gains looks to be the base case scenario. However, a major resistance can be found in the $1,850 area - the upper limit of a symmetrical wedge pattern. A break above it could herald a larger upward move. On the other hand, should the price break back below the $1,827 price zone, a test of the lower limit of the pattern in the $1,805 area cannot be ruled out. Note that $1,805 area is also marked with 50- and 200-session moving averages.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30