The Federal Reserve will announce the latest monetary policy decision today at 7:00 pm GMT. A decision to accelerate the pace of tapering of asset purchases looks like a done deal. Powell even said himself that the winding down of the QE programme may end a few months earlier. Markets are now positioning for QE exit in March 2022, rather than in mid-2022. Such a development paves way for earlier start of rate hike cycle. Having said that, Fed members' views on rates will be key tonight. Dot-plot released in September projected a single rate hike in 2022 and there is a feeling that a dot-plot released today will match market expectations and point to 50 basis points of tightening next year.

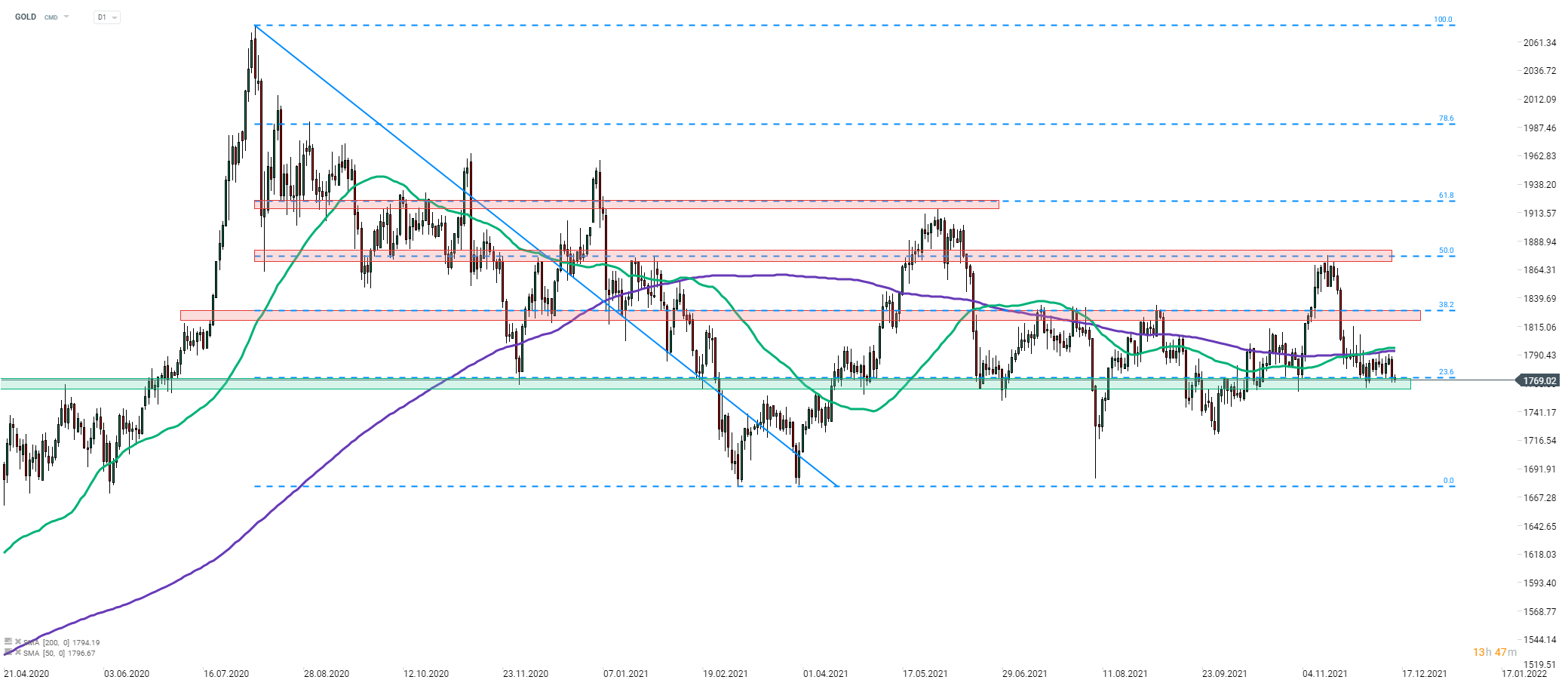

This is the baseline ahead of today's meeting and any market moves will depend on direction as well as scale of deviation from expectations. Should we see dot-plot unchanged with median pointing to a single rate hike next year, USD may weaken while gold and equities should benefit. Taking a look at the GOLD chart at the D1 interval, we can see that the price has been struggling to deliver a bigger move in either direction in recent weeks. Gold traded sideways with 200-session moving average (purple line) acting as resistance and 23.6% retracement of the August 2020 - March 2021 downward move ($1,770). Price has been respecting retracements of the aforementioned downward move therefore in case of a break above the aforementioned 200-session moving average, bulls attention will shift to resistance marked with 38.2% retracement ($1,830).

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉