Gold price climbed last week amid a still-tense situation in the eastern part of Ukraine. The West continues to insist that Russia is planning an invasion while Russia continues to deny those claims, saying that no such move is planned. Gold took a hit overnight as risk trades benefitted from reports of a potential Biden-Putin summit. However, a Kremlin spokesman said in the morning that there are no concrete plans for such a meeting yet but it could be called in any moment if its needed. Equities shed some gains following those comments while gold jumped. Situation around Ukraine is likely to keep gold moving in the near future and may turn out to be a bigger mover for gold than Fed due to its unexpected and uncertain nature.

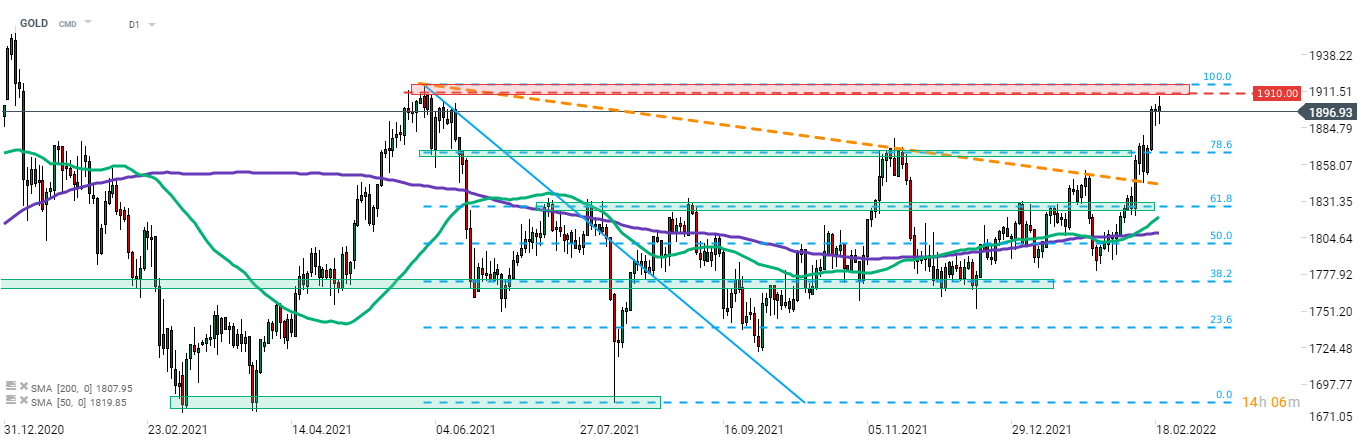

Taking a look at the GOLD at D1 interval, we can see that the price of the precious metal managed to break above the resistance zone ranging around 78.6% retracement of the downward move started in June 2021 ($1,865 area). Precious metal continues to move higher and tested resistance zone ranging above $1,910 today. Bulls failed to push the price above however. Today's daily close, and more precisely whether price closes above or below $1,900, may be key for near-term outlook.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉