The Federal Reserve left rates and QE taper timeline unchanged yesterday but strongly hinted that the first rate hike will come in March. Moreover, Fed Chair Powell did not rule out that interest rates may be raised during each of this year's meetings. On top of that, Powell also said that reduction of the balance sheet will begin sometime after the first rate hike. Current market expectations are for the first rate hike in March and beginning of QT in June. Interest rate derivatives market is now pricing in 5 rate hikes from the Fed this year.

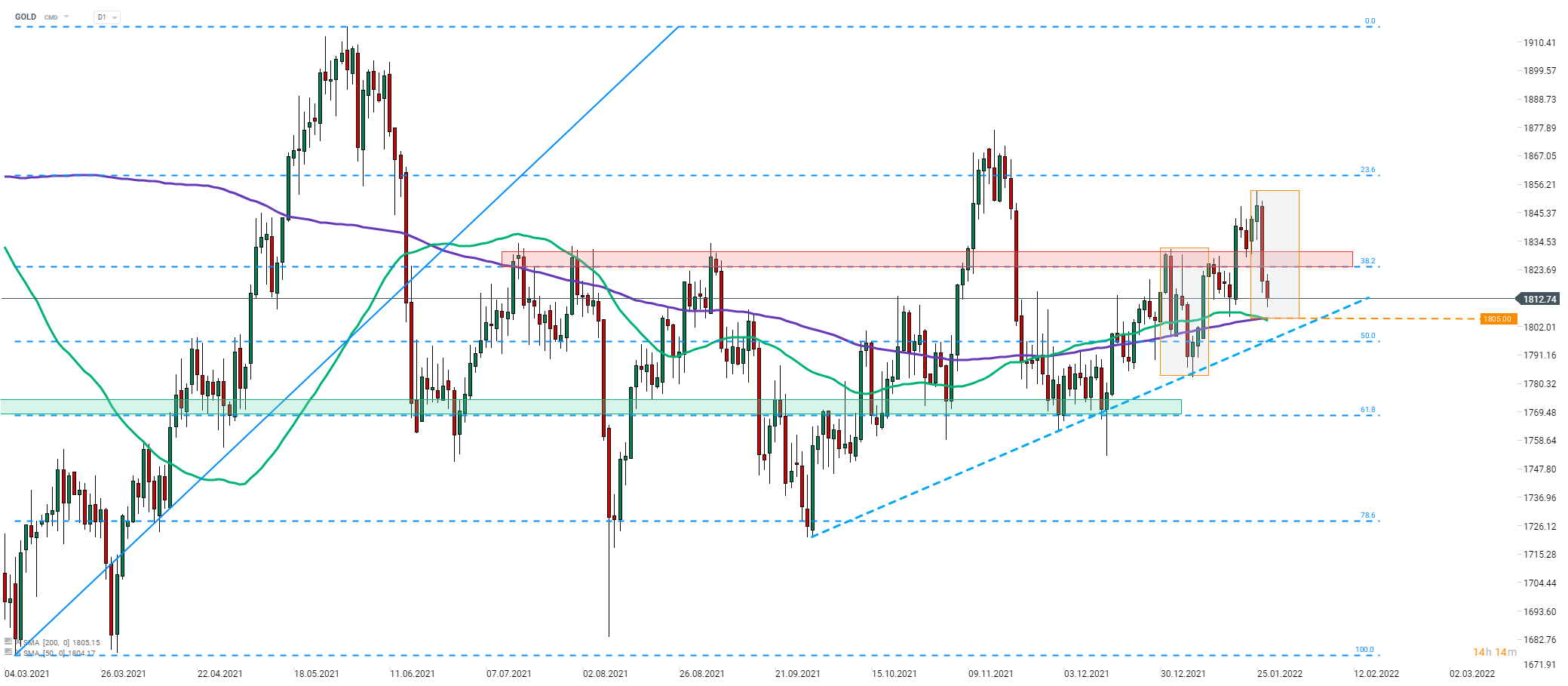

As monetary tightening is coming and it looks like it may be quicker than previously expected, the US dollar jumped following the FOMC decision on Powell's presser. Stronger USD as well as outlook for policy tightening turned out to be negative for precious metals. Taking a look at the GOLD chart at a daily interval, we can see that the price of the precious metals slumped yesterday. Gold pulled back below the $1,825 price zone marked with 38.2% retracement of the March-June 2021 upward move. The nearest support to watch can be found in the $1,805 area, where 50- and 200-session moving averages can be found as well as the lower limit of market geometry.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉