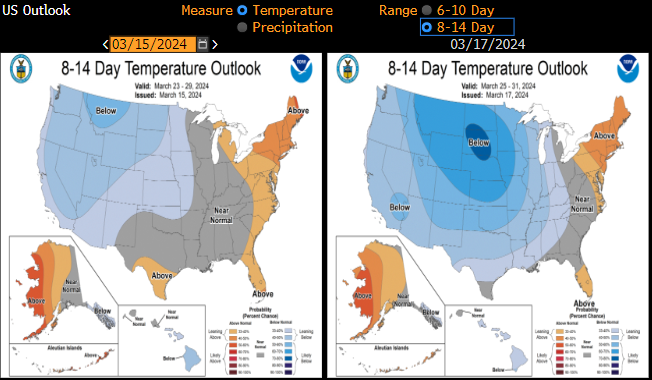

US natural gas prices (NATGAS) launched new week's trading with a bullish price gap and continued to gain during the Asia-Pacific session. The move looks to be triggered by new weather forecasts for the United States. While winter heating season in the United States, which runs from October until the end of March, is almost over, new 8-14 day forecasts point to below-average temperatures across the US mainland, including in key heating regions. This suggests that demand for power, and in turn for natural gas, may increase in the coming days. While pre-weekend forecasts also pointed to below-average temperatures, they are now seen across a broader part of the US mainland.

Taking a look at NATGAS chart at H1 interval, we can see that the price bounce off the 1.65 support zone and climbed to the 1.75 resistance, marked with local highs from Thursday and Friday last week. This area is being tested at press time. A break above would pave the way for a test of the 1.785 area.

Source: xStation5

Source: Bloomberg Finance LP, NOAA

Gold and silver rebound after the sell-off 📈

OIL: prices continue to rise despite the US Navy escort proposal for ships📌

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood