NZDCAD is the currency pair that may see some moves in the coming hours. Release of Canadian CPI data for January, scheduled for 1:30 pm GMT today, is likely to trigger some CAD-volatility. Data is expected to show deceleration in headline price growth from 6.3 to 6.1% YoY. Simultaneously to CPI reading, Canadian retail sales print for December will be released and is expected to show an increase, following last month's headline drop.

Another source of volatility for the pair will be the rate decision announcement from the Reserve Bank of New Zealand that will come at 1:00 am GMT on Wednesday. Majority of economists expected a 50 basis point rate hike but there is some concern that RBNZ may slow the pace of or even pause rate hikes following a recent cyclone hit that has caused significant damage across the country. While 25 bp rate hike could be on the table, a pause seems unlikely. RBNZ, however, is likely to send a cautious message and communicate that it will wait with taking any bigger actions until the better extent of the damage is estimated.

Tuesday, 1:30 pm GMT - Data from Canada

-

CPI inflation for January. Expected: 6.1% YoY. Previous: 6.3% YoY

-

Headline retail sales for December. Expected: +0.5% MoM. Previous: -0.1% MoM

-

Retail sales ex-autos for December. Expected: 0.0% MoM. Previous: -0.6% MoM

Wednesday, 1:00 am GMT - Reserve Bank of New Zealand rate decision

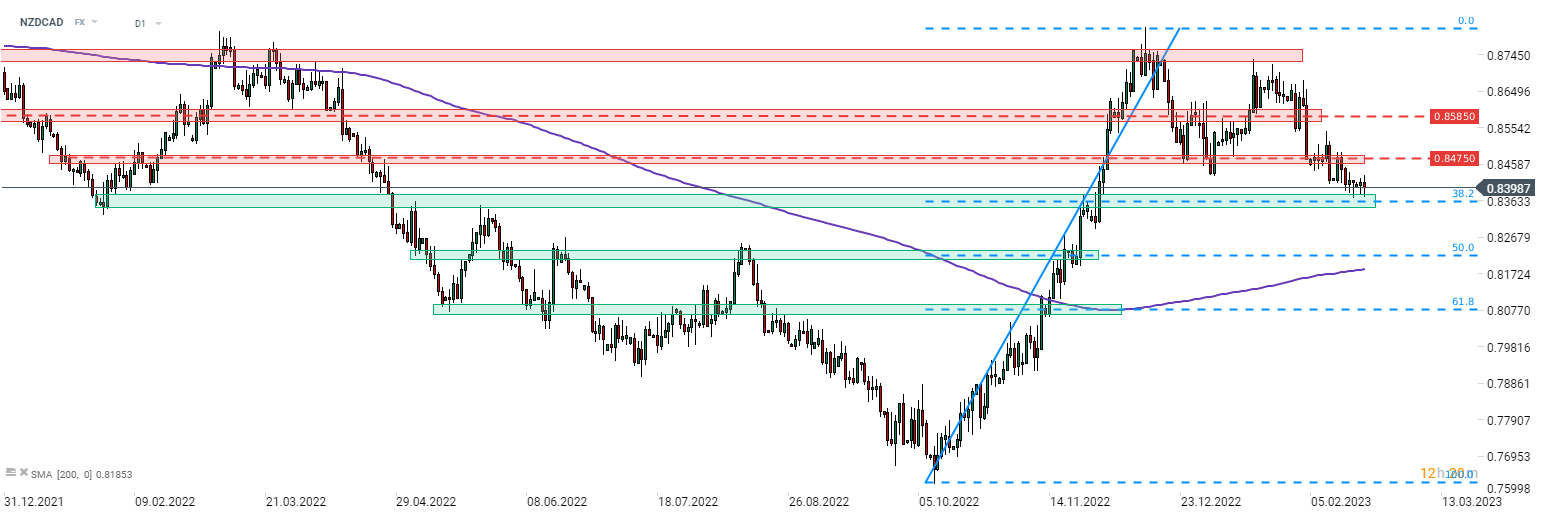

Taking a look at NZDCAD chart at D1 interval, we can see that the pair has recently halted upward move and started to pull back. Pair dropped to the lowest level since late-November 2022 but it looks like a bottom of the current downward impulse may have been found at 38.2% retracement in the 0.8350 area. The pair has been struggling to break below this area in recent days and should RBNZ go on with a 50 bp rate hike and commit to its hawkish stance, a recovery move could be launched.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)