Unlike the Federal Reserve or Bank of England, the Bank of Japan did not decide to change the level of interest rates today. Interest rates were left unchanged with short-term target rate remaining at -0.1%. Target yield for 10-year bonds was also left unchanged at 0%. The Bank said that the Japanese economy continues to pick up as a trend but recent geopolitical developments made the outlook somewhat worse. Exports and imports are expected to be affected by supply chain disruptions while inflation expectations are seen increasing gradually. The BoJ noted that the impact of the Russia-Ukraine war is very uncertain but it stands ready to react to changing conditions. However, guidance was left unchanged and still states that short- and long-term interest rates will remain at current or lower levels for the time being.

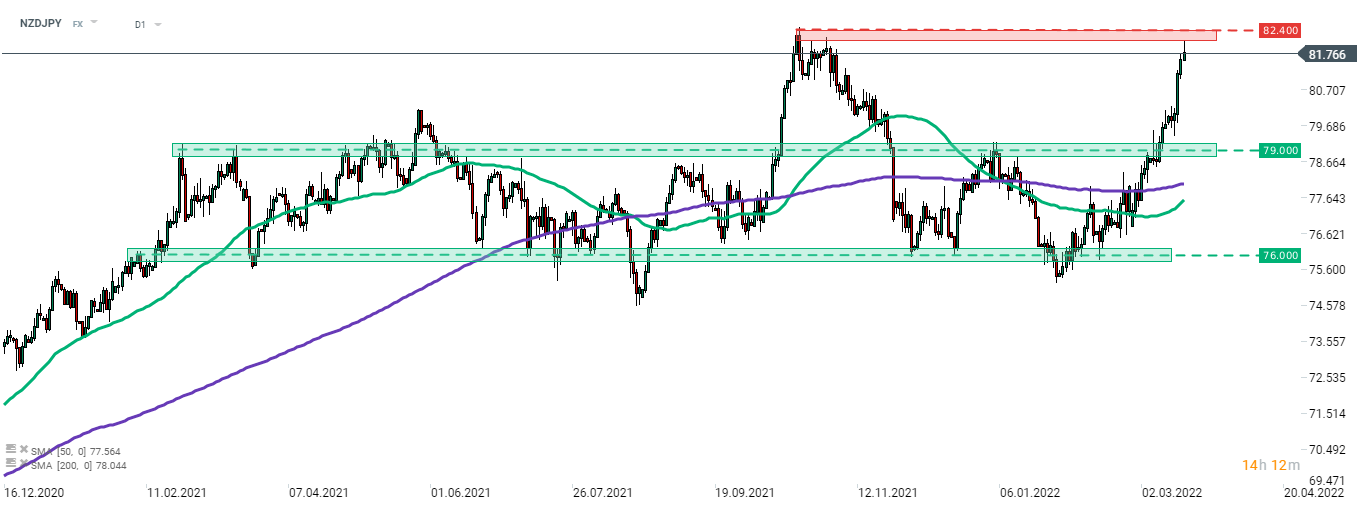

While Japanese yen is one of the worst performing major currencies today, overall impact of BoJ decision on the market was rather minor. Taking a look at NZDJPY chart, we can see that the pair continues upward move launched at the end of January 2022. Pair is approaching highs from Q4 2021 in the 82.40 area. Note that this area also marked a range of the upside breakout from previous trading range. The first test of the area today proved to be a failed one and NZDJPY pulled back slightly. In case pull back deepens, a test of the upper limit of the previously broken trading range at 79.00 cannot be ruled out.

Source: xStation5

Source: xStation5

Three markets to watch next week (27.02.2026)

BREAKING: GDP collapse in Canada; US producer inflation accelerates🚨

Chart of the Day: EURUSD in Consolidation Ahead of Macro Data from Europe and the US

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)