OPEC+ is set to announce output levels for November today. Cartel's meeting will begin at 1:00 pm BST. Expectations are for a major production cut with markets positioning for a 1-1.5 million barrel reduction in recent days. However, media reports surfaced over the past couple of hours suggesting that a cut as big as 2 million barrels may be made. On top of that, UAE officials said that today's meeting will be groundbreaking and will see a change in OPEC+ policy. However, it should be noted that OPEC+ is already producing below an agreed-on quota and JPMorgan says that even if no agreement is reached, cartel members would still lower their production on their own. As such. JPMorgan expects oil prices to retest $100 per barrel area in the final quarter of 2022. Meanwhile, UBS said that with such high output cut expectations, a reduction smaller than 0.5 million barrels could be seen as negative for prices.

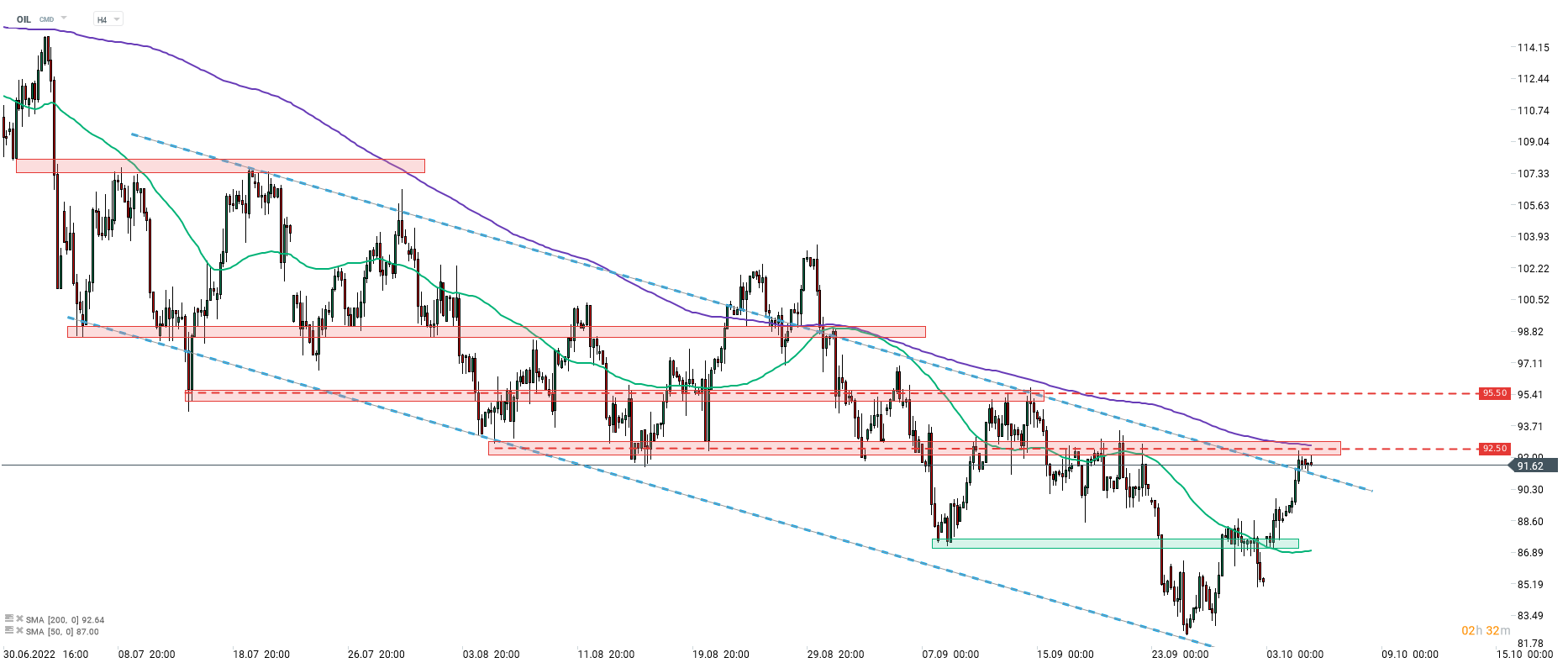

Taking a look at Brent chart (OIL) at H4 interval, we can see that oil price has been trading in a downward channel for some time. A break above the upper limit of the channel occurred this week. However, advanced was halted later on as price started to struggle near $92.50 support zone. Some sideways trading can be spotted since suggesting that market is in wait-and-see mode ahead of OPEC+ decision.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉