Oil prices make another jump today, following a break above previous post-pandemic highs at the end of the previous week. Brent (OIL) moved to a fresh 7-year high today and reached a daily high just slightly below $88 per barrel. Oil traders look past rising Omicron case count around the world and new restrictions being imposed. Goldman Sachs came out with a new forecast for Brent expecting price to average at $96 per barrel this year and $105 per barrel in 2023. Goldman sees Brent price surpassing the $100 mark in the third quarter of this year. Apart from that, supply disruptions in Libya and Kazakhstan have not been fully resolved yet, which is also boosting the fundamental outlook for higher prices. Last but not least, Houthi launched a drone attack on an airport in the United Arab Emirates, sparking fears that the situation in the Middle East, a key oil producing region, may get more tense soon.

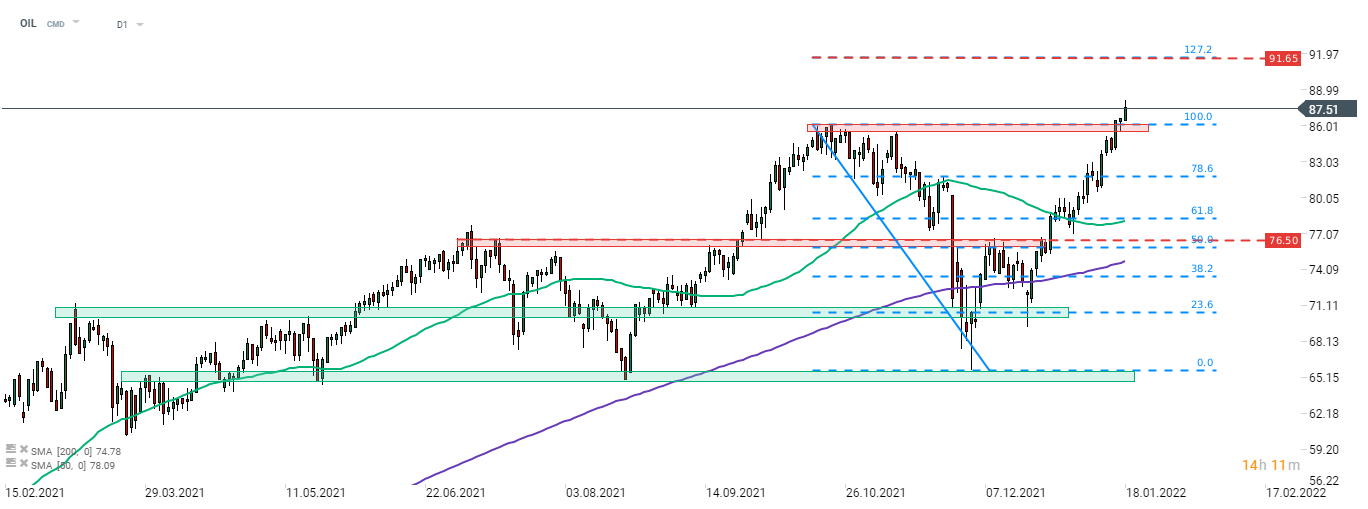

A look at the OIL chart shows a massive over-30% rally off the December lows. Price broke above the resistance zone in the $86.00 area at the end of last week and the upward move is being continued this week. The next support level to watch is marked with the 127.2% exterior retracement of a October-November 2021 drop ($91.65).

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉