Weekend meeting of OPEC+ group was watched closely but was not expected to result in any changes to the level of agreed output cuts. This turned out to be partially true. While OPEC+ decided not to deepen output cuts, it has agreed to extend the current output cut agreement through 2024. However, Saudi Arabia announced that it will make a voluntary output cut of 1 million barrels per day. The cut was announced for July only but Saudi officials already warned that it may be extended if the situation requires it.

Baseline production levels were adjusted for 2024 and it could be seen as somewhat bearish. This is because production quotas were redistributed from countries that struggled to meet production targets to countries that have spare production capacity. As a result, it may lead to better compliance with production targets across the group and, in turn, to higher combined production.

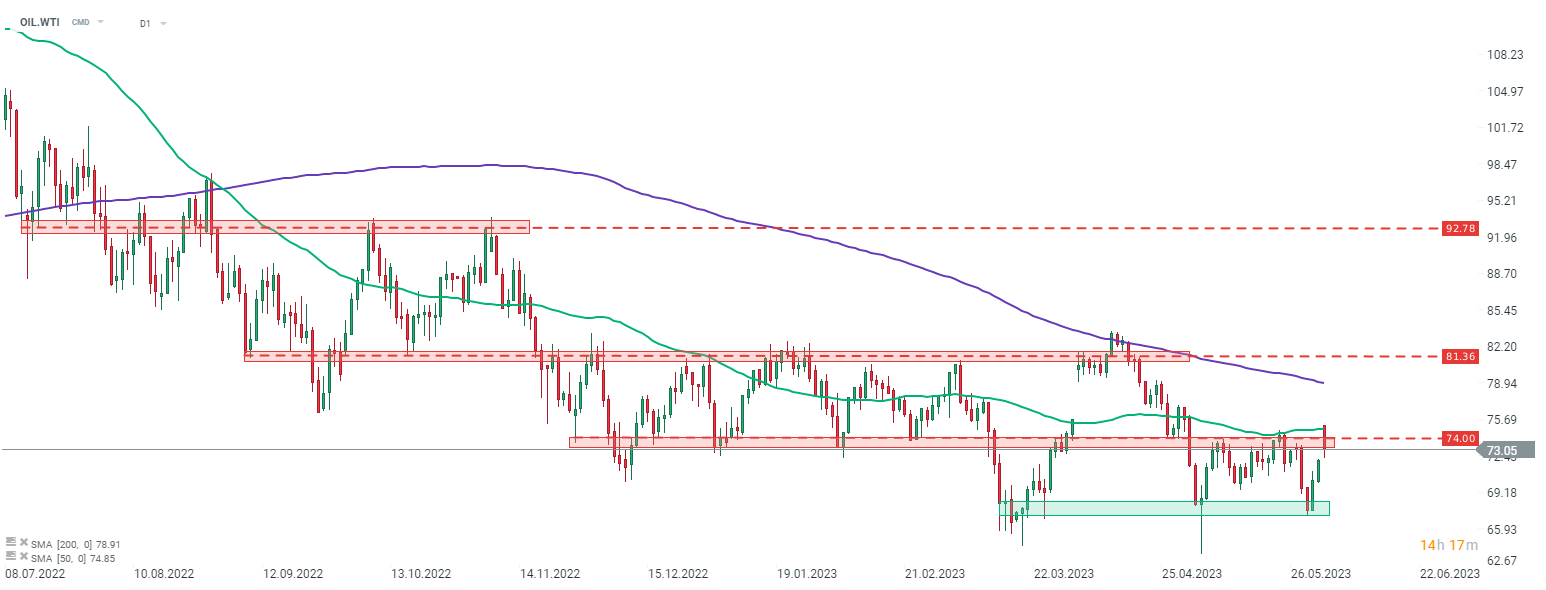

Taking a look at WTI chart (OIL.WTI) at D1 interval, we can see that the price launched a new week with a big bullish price gap. While Brent (OIL) jumped around 1.7% at the beginning of a new week, WTI opened with an around-4% price gap. OIL.WTI jumped above the $73-74 per barrel resistance zone and tested 50-session moving average (green line). However, bulls failed to break above it and gains started to be erased as the Asian session progressed. Price has almost completely filled the bullish price gap but has bounced off the daily lows since.

Source: xStation5

Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Oil Under Pressure as G7 Decision Remains Pending

US Open: Oil too expensive for Wall Street!

OIL: Prices soar to $120 a barrel; Israel bombs Iran's oil facilities 📌