Oil price ticks higher due to a combination of factors impacting both supply and demand. Positive US economic growth and Chinese stimulus measures have boosted demand expectations. On the supply side, tensions in the Middle East, particularly the attack on an oil tanker in the Gulf of Aden and concerns over disruptions in oil supply, have added support to oil prices. Additionally, a significant drawdown in US crude stockpiles suggests tighter supply, further pushing up prices. This is also complicated by rising a geopolitical risk, following the drone strike by Iran-backed militants in Jordan, which killed three US troops and the strike of a fuel tanker in the Red Sea.

- Middle East tensions, particularly the Houthi military operation targeting an oil tanker in the Gulf of Aden.

- Three American soldiers were killed and more than 34 were injured in a drone attack on a US military base on the Jordan-Syria border. Biden stated that the attack was organized by "radical militant groups supported by Iran” and retaliatory actions are planned.

- Increase in US oil rigs as reported by Baker Hughes, indicating potential changes in oil production levels.

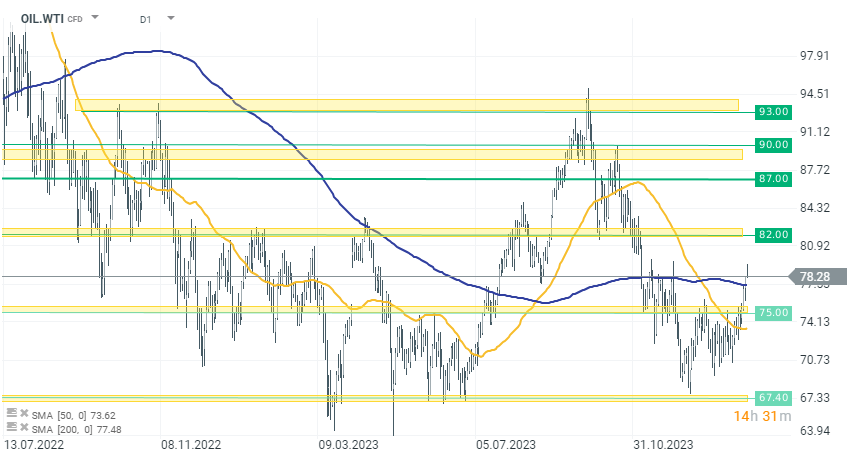

Looking at the oil prices (OIL.WTI), we observe a rebound in prices after the formation of a double bottom around $67.40 per barrel. After the breakout, the price surpassed another resistance at the $75 level, which is currently the nearest support zone. From below, oil quotes are still supported by the 200 SMA average. The nearest range or resistance of the current upward movement is the $80-$82 per barrel zone.

Source: xStation 5

Daily Summary: End of the week in the red, tech rally waning

🔝Silver Jumps 10% Weekly, up 120% YTD

Chart of the day - SILVER (12.12.2025)

BREAKING: UK GDP and manufacturing lower than expected 📉Final German CPI in line with expectations