Platinum is once again the best-performing precious metal today, gaining 3.5% and reaching 4-year highs.

The metal has staged an impressive rebound of nearly 30% from its lows on April 7, 2025 — a point that coincided with the peak of trade war tensions linked to Donald Trump.

- Today, we’re seeing continued weakness in the U.S. dollar, which is down over 0.3%, helping to lift sentiment in the metals market. Investors are not only turning to platinum but also eagerly buying silver, which has climbed to levels not seen since 2011 — now trading above $36 per ounce.

- The potential de-escalation of trade tensions is boosting the overall outlook for metals, and platinum has now logged six consecutive weeks of gains. Key drivers remain geopolitical uncertainty, concerns over sovereign fiscal debt (including in the U.S.), and economic slowdown risks, all within an environment of elevated inflation and economic fragility.

- Platinum prices are being supported not only by renewed interest in physical metals, driven by the expanding M2 money supply from major central banks, but also by tight supply expectations in the spot market, improving industrial demand sentiment, and technical speculative flows coming from the gold and silver markets.

Another supportive factor is the renewed interest from jewelry houses and designers, indirectly influenced by shrinking profit margins on historically expensive gold. This shift has redirected market attention toward platinum — a metal that, in recent years, had fallen out of favor. Interestingly, platinum is rarer than gold, adding to its long-term appeal.

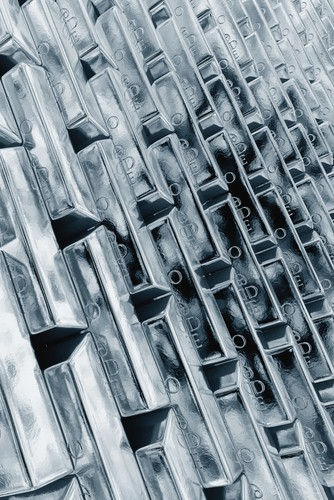

PLATINUM (D1 timeframe)

Source: xStation5

VIX drops 10% amid Wall Street rebound attempt🗽

3 markets to watch next week - (17.10.2025)

Fed's Musalem remarks on the US economy and tariffs🗽

Precious metals decline 📉Gold down 2%; Silver loses 4%