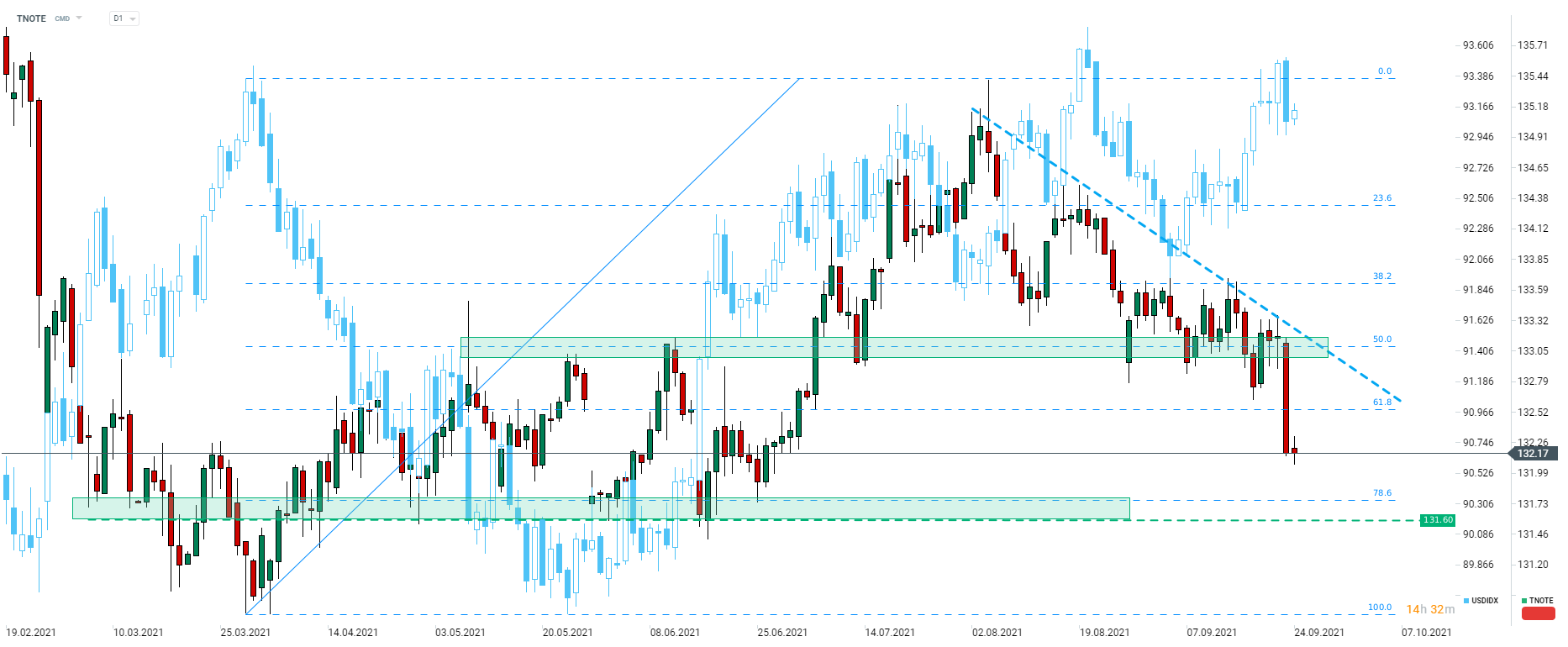

While the FOMC meeting this week was quite hawkish, it failed to trigger large moves on the market. Fed gave the most clear hint on when tapering may start and when it may end but stock markets and US bonds did not see an immediate, large reaction. This changed yesterday with TNOTE moving lower, a move that was supported by Bank of England's hawkish hold. UK bonds experienced a sell-off and bonds from Europe and the United States followed.

TNOTE pulled back from the swing area marked with the 50% retracement of the upward move launched in March 2021 yesterday. A steep drop has pushed the price below the 61.8% retracement as well and TNOTE now trades at the lowest levels since late-June. Interestingly, yesterday's move was not accompanied by strengthening of the US dollar (USDIDX, blue overlay on the chart below) , which is usually the case during US bond sell-offs. The near-term support zone to watch can be found ranging between 131.60 and 78.6% retracement (131.75).

Note that there is number of speeches from Fed members scheduled for today therefore USD and US bonds may experience elevated volatility in the afternoon.

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%