Expectations of the Fed becoming more hawkish are on the rise following recent comments from US central bankers. Almost every Fed member that has spoken out recently called for a more hawkish policy. As a result, interest rate derivatives price in a 50 basis point rate hike at a meeting in May and it is also becoming a dominating expectation among major commercial banks. As a result, US dollar is getting a lift. However, even bigger moves can be spotted on the bond market. US yields are spiking with 10-year market rate jumping above 2.5% - the highest level since April 2019. An increase in US yields, however, means that bond prices are dropping.

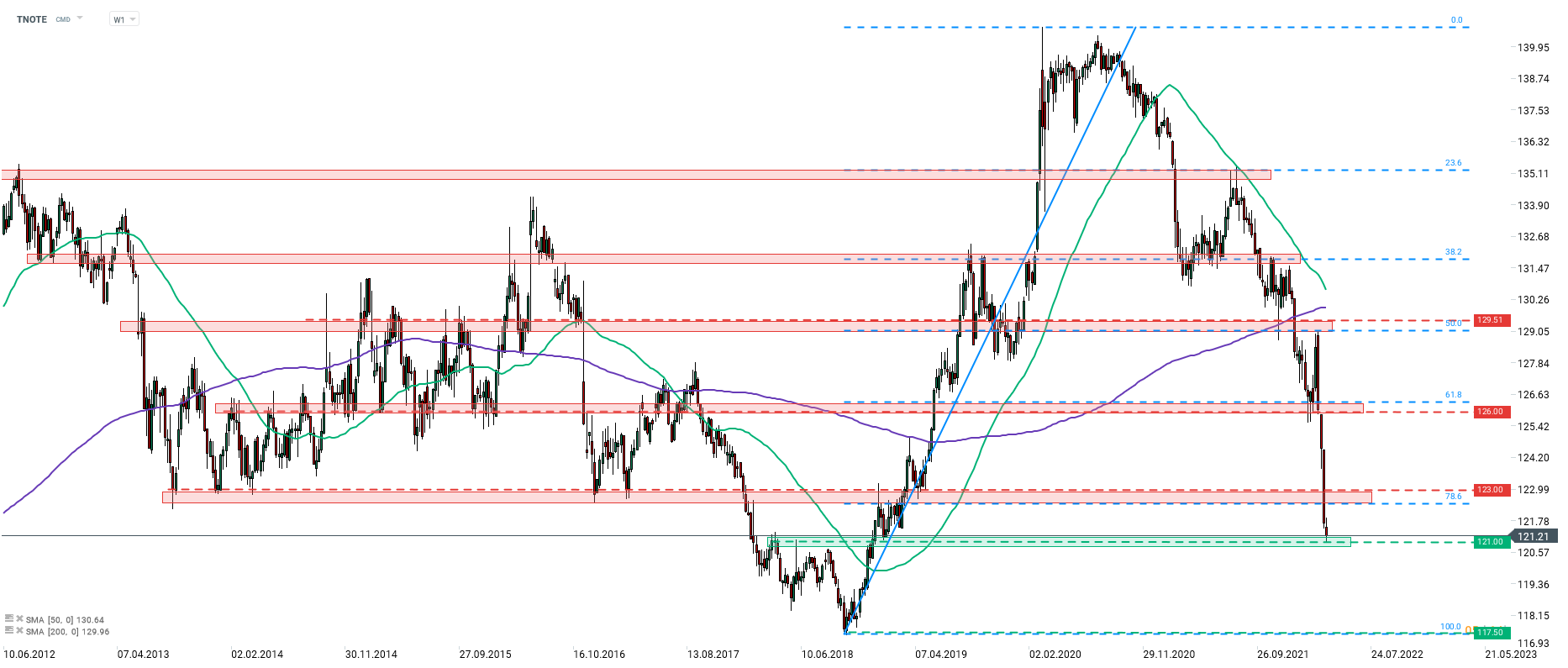

Taking a look at a weekly chart of US 10-year bond (TNOTE), we can see that price has been freefalling since the beginning of Russian invasion of Ukraine in late-February 2022. Following a strong downward move last Friday, price broke below the 78.6% retracement of the upward move launched in September 2018. Decline is being continue at the beginning of a new week with a test of the 121.00 support zone. A break below would open the way towards late-2018 lows in 117.50 area.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%