Today as well as the next two days may be crucial for the US tech sector as 5 mega-tech companies are set to report earnings for calendar Q3 2022. First reports - from Alphabet (GOOGL.US) and Microsoft (MSFT.US) - will come after the close of the Wall Street session today. Meta Platform (META.US) will report tomorrow after the close of the session while Amazon (AMZN.US) and Apple will report on Thursday, also after close. Reports from this group of stocks may set the tone for a broader tech sector. Some of the reports already released, like the one from Snap, hinted that ad-related businesses may be struggling, meaning that Alphabet and Meta may be set for a poor quarter. News hit the markets yesterday saying that Apple will boost pricing of its services. When it comes to Amazon, the report will show how the consumer is holding up amid increased macroeconomic uncertainty and spiking inflation. Also, reports from Amazon and Microsoft will provide an outlook on the cloud sector.

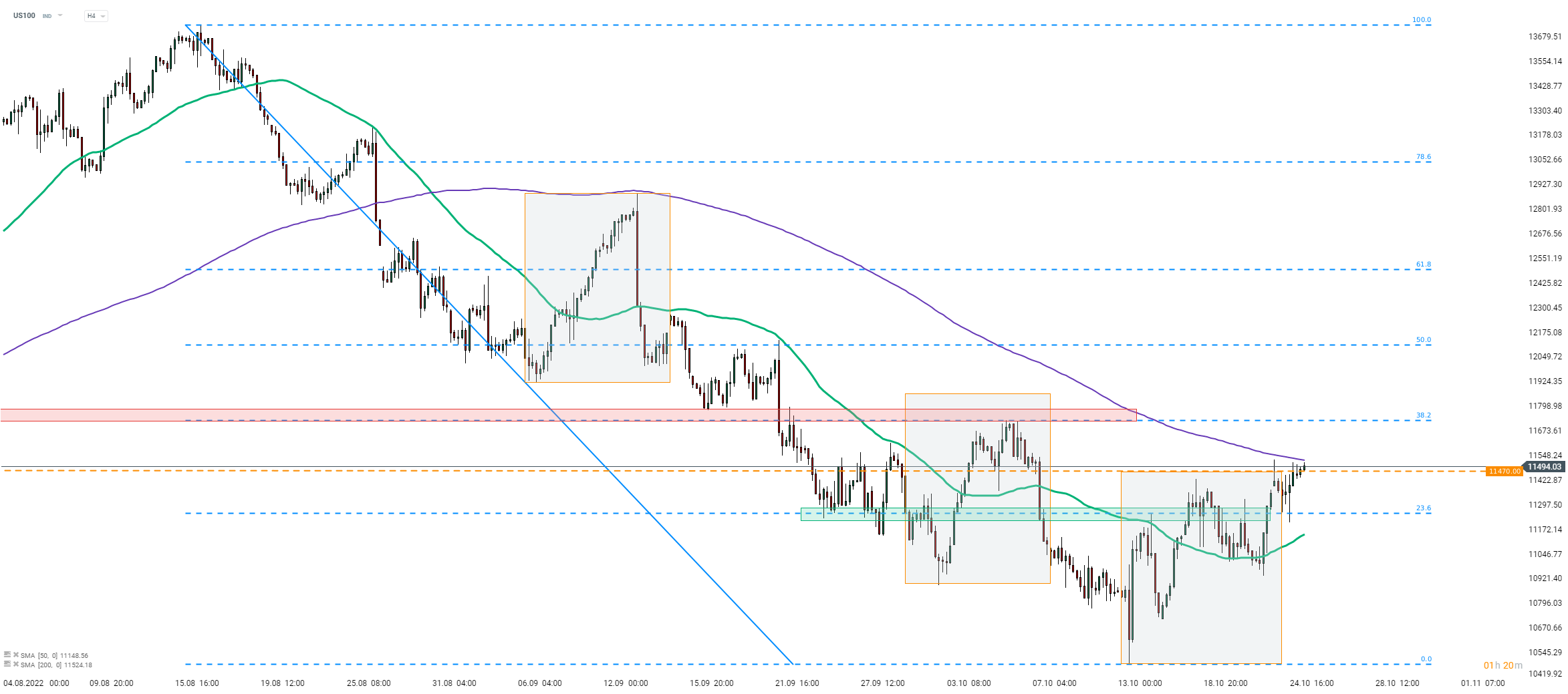

Taking a look at Nasdaq-100 chart (US100) at H4 interval, we can see that the index is making a break above the upper limit of a local market geometry. However, another important resistance can be found slightly above this hurdle - 200-period moving average (purple line). As a result, the whole area surrounding 11,500 pts handle can be seen as an important resistance. Should we see a break above it, the next target for bulls could be 38.2% retracement of the downward impulse launched in mid-August in the 11,725 pts area.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes