US stock markets moved higher during the first trading session of a new week. So far it looks like markets are completely ignoring the FOMC taper that is expected to be announced tomorrow in the evening. Accelerating inflation does not look to be having a big impact on the market valuations either as investors are focusing on the ongoing Q3 earnings season. Almost 300 members of the S&P 500 index have already reported results for the third quarter and results of more than 80% of those companies have beat expectations. Supply chain issues are a common theme during earnings presentations and a big share of companies hint at the negative impact of those extending into early-2022.

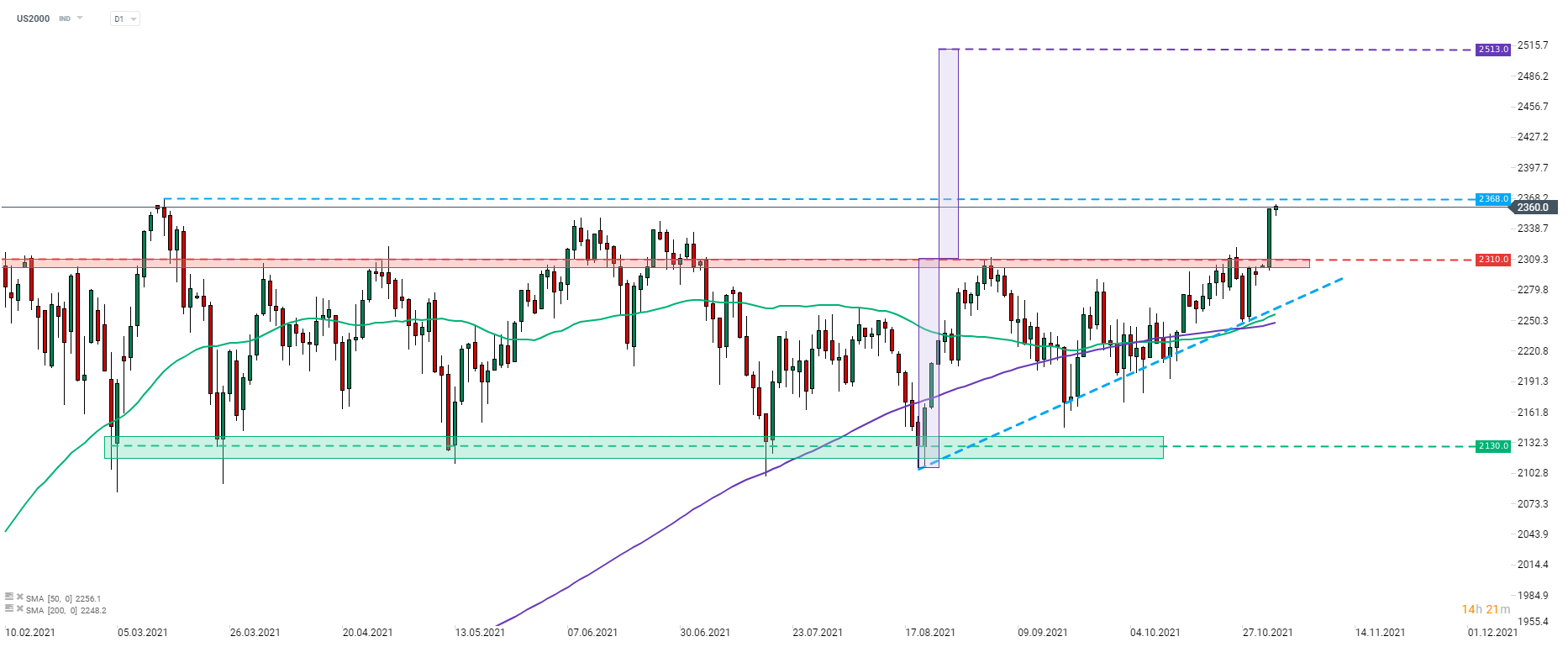

While all major US indices gained yesterday, it was the small-cap Russell 2000 (US2000) that stood out. The index rallied a massive 2.65% yesterday and climbed to the highest level since mid-March, just a touch below all-time highs (2,368 pts). US2000 broke above the 2,310 pts resistance zone yesterday, that marked the upper limit of the triangle pattern. A textbook range of the upside breakout from this pattern hints at a potential move above the 2,500 pts mark, over 6% above the current market price. FOMC meeting tomorrow is expected to a have a big impact on equity indices, including US2000.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report