The Russell 2000 Index of U.S. smaller-cap companies (US2000) has been on an upward surge for several days. In yesterday's session, it rose nearly 1.8% against a 1.7% decline in the Nasdaq, weakness in the S&P500 and the Dow index. Driven by oversold regional bank stocks in recent weeks, the benchmark has risen less than 7% since the beginning of the year, a weak performance against the major indexes. By comparison, it has gained nearly 8% in the past five days alone. Today's claims reading at 2:30 pm could mean additional volatility for the index.

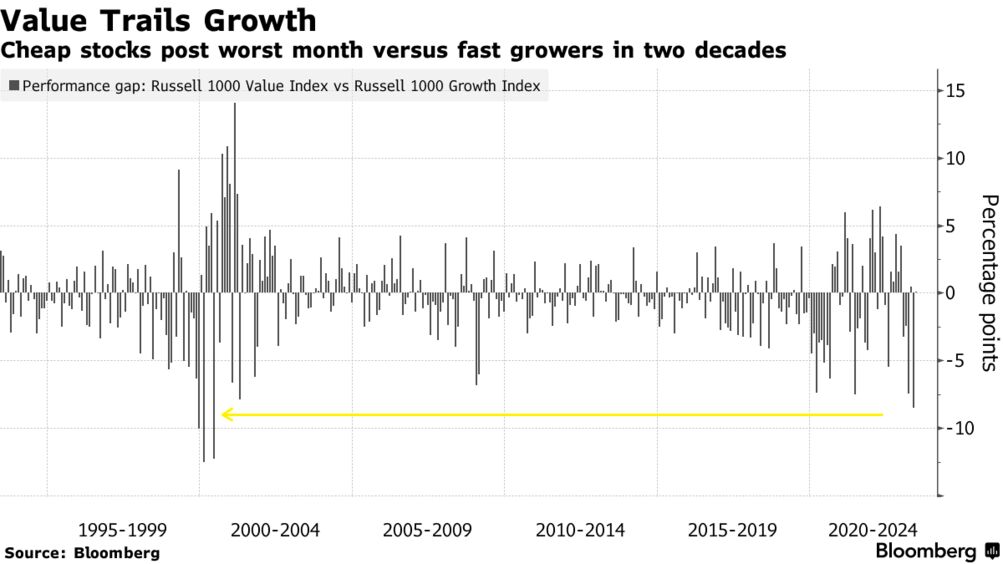

For now, the market is reassuring itself that the US economy remains quite strong (although industry is sending signals of weakness) with a strong labor market, and in view of consumer strength, revenues of listed companies are not in danger of collapsing at least in the foreseeable period. The increases in the major indexes are thus 'spilling over' slowly to smaller companies that have been bypassed for months, which is also helped by the Fed's rate hike cycle coming to an end. The Russell sub-index, which includes energy companies and banks, has recently lagged behind the sub-index linked to growth stocks (the largest disparity in more than 20 years) - primarily due to the frenzy related to AI and the strength of the largest BigTech companies (a situation reversed in comparison to 2022). In recent days, value companies from the Russell especially bank shares, have closed the gap somewhat by driving the benchmark.

US2000 broke out above the 38.2 Fibonacci retracement of the March 2020 upward wave and a rise above 1900 points could open the way for the bulls to reach the psychological resistance of 2000 and 2100 points, where the 23.6 Fibonacci retracement is visible. The index has formed a strong base near 1750 points, the strength of which has been 'tested' by the price several times - each time the bulls have managed to bounce higher. In the bearish scenario 1750 - 1800 points zone may be tested again.

Source: xStation5

Value companies were still at record lows against growth stocks in early June. Source: Bloomberg

Daily summary: Technology Drives Wall Street as Tehran Seeks Truce

US OPEN: Wall Street rebounds after AMD-Meta deal

Market wrap: reshuffling in European markets after trade turmoil – what to watch? 🔎

⛔ Trump’s tariffs ruled illegal: will companies receive billions of dollars in refunds?