Unexpected announcement from Silicon Valley Bank (SVB) yesterday sent shockwaves through Wall Street. SVB said that it is launching an equity offering to plug a hole in its balance sheet following a $1.8 billion pre-tax loss from a hasty sale of a $21 billion bond portfolio. According to the statement, sale of the bond portfolio was needed to shore up the bank's liquidity position.

The announcement triggered an around-60% plunge in SVB shares (SIVB.US) and has also triggered an over-5% drop in shares of major US banks, like JPMorgan (JPM.US), Wells Fargo (WFC.US) or Bank of America (BAC.US). KBW index, Nasdaq banking index, plugned 7.7% yesterday, marking the biggest single-day drop since mid-2020.

Key question now is whether this is an idiosyncratic risk (company-specific) or systemic, which would see contagion to other banks. There is a risk that this could be a broader issue as the reason behind massive losses on bond portfolios are Fed actions and their impact is not limited to a single bank. As interest rates rise, prices of bonds fall and the Fed has undertaken a very aggressive rate hiking over the past year. This means that other banks are also likely to have unrealized losses on their bond portfolios and things may turn sour should they need to access those funds and realize losses.

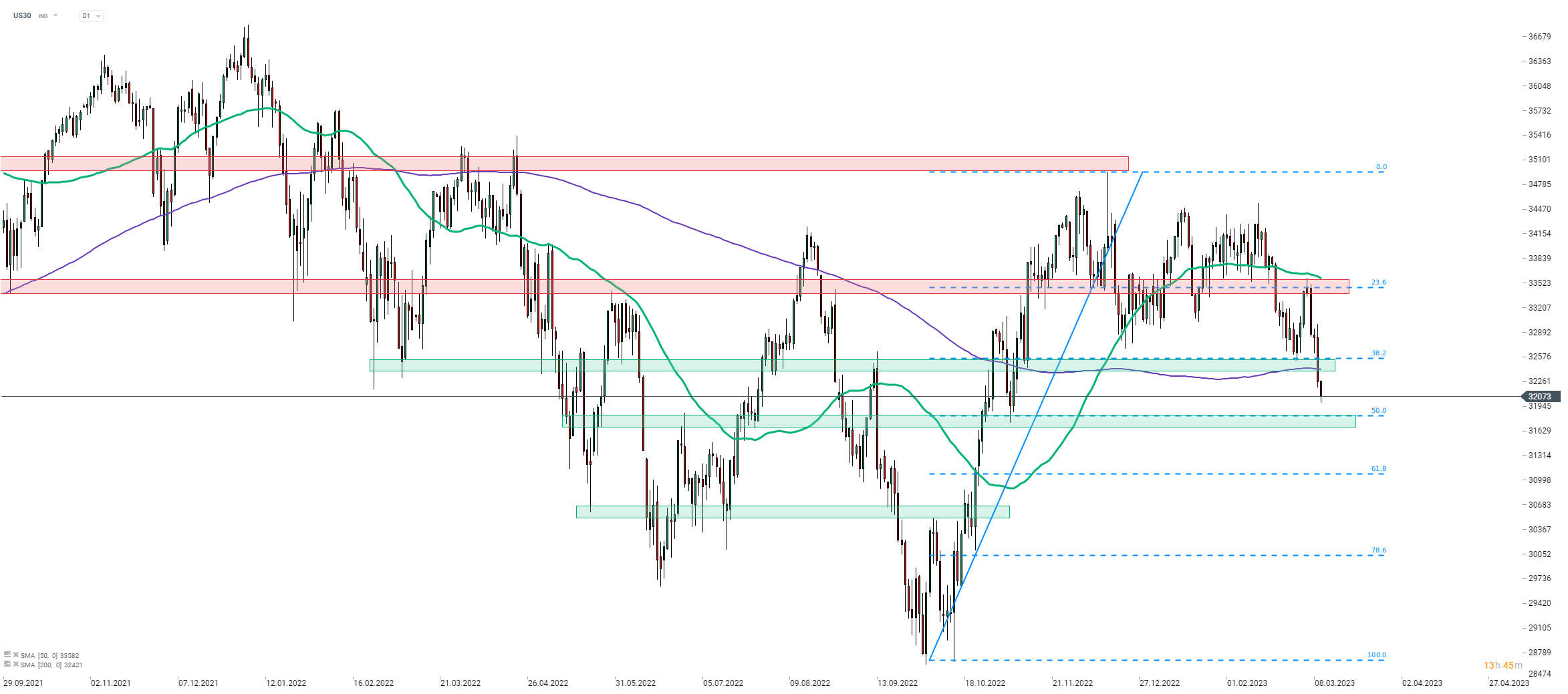

Taking a look at Dow Jones futures chart (US30) at D1 interval, we can see that the index has been trading lower for the past three days and the price is also dropping today. Steep drop on Tuesday was triggered by hawkish Powell while yesterday's plunge was driven by banking sector woes. A point to note is that the index broke below the support zone ranging between 38.2% retracement of recent upward impulse and the 200-session moving average (purple line). Note that this is the first time since early-November when the index is trading below this moving average. The next potential near-term support can be found ranging below the 50% retracement (31,800 pts). Investors should keep in mind that while struggles of US banks are the main theme in the markets right now, NFP report release at 1:30 pm GMT may also trigger some moves on the US equity markets.

Source: xStation5

Source: xStation5

Market wrap: European indices set new highs 🚀

Daily summary: The market looks for direction, oil and metals under pressure

US OPEN: Market under pressure from AI

Market wrap: European indices gain despite weakness on Wall Strete 🚩German ZEW lower than expected