Before the opening on Wall Street, the situation on the forex market is a bit calmer than yesterday. The dollar halted yesterday's declines and is even gaining slightly today. The market sentiment has cooled down a bit after yesterday's hawkish comments from FOMC bankers. The bankers want to slightly change the tone of the last Fed conference. Today, we are waiting for the second round of appearances. In this again, we will have the opportunity to listen to Fed Chairman Jerome Powell, who this time at the political panel at the annual research conference in Washington may provide a bit more insides than yesterday.

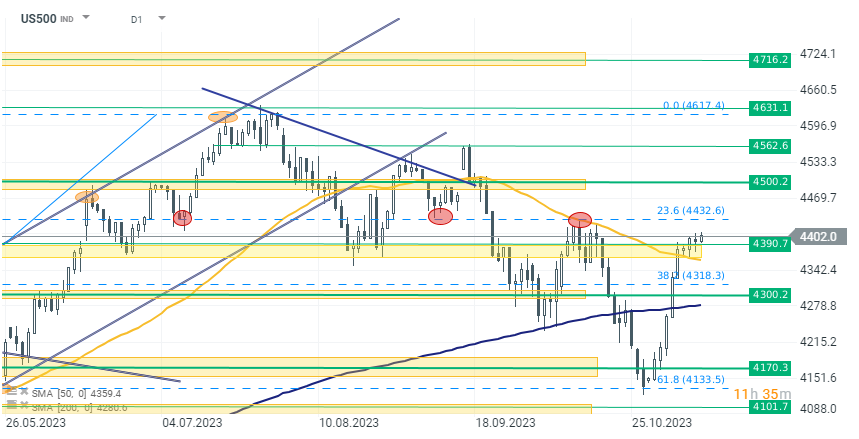

As a result, on the US500 index, we observe consolidation from 4 trading sessions. The index is quoted in the key resistance zone in the range of 4370-4400 points after recent dynamic increases. Currently, bulls are trying to break out of this zone, rising slightly above this level. If the good sentiment continues and today's bankers' appearances do not spoil it, we can observe the continuation of the uptrend towards 4430 points. This is not a distant level, but it is where the 23.6% Fibonacci retracement of the last uptrend runs. It also coincides with the local peak of the last downtrend and if it breaks above this level, we can talk about the index entering a new trend.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report