Stock markets in Europe and the United States experienced a steep sell-off yesterday. German DAX (DE30) dropped 2.6% while US Dow Jones (US30) declined 2.1%. Market seems to be concerned over two things. Firstly, rising case count of Delta coronavirus variants may lead to new lockdowns, and therefore slowdown in growth. Apart from that, inflation remains a concern as well. Combination of those two things could decrease the effectiveness of monetary policy and future QE programmes.

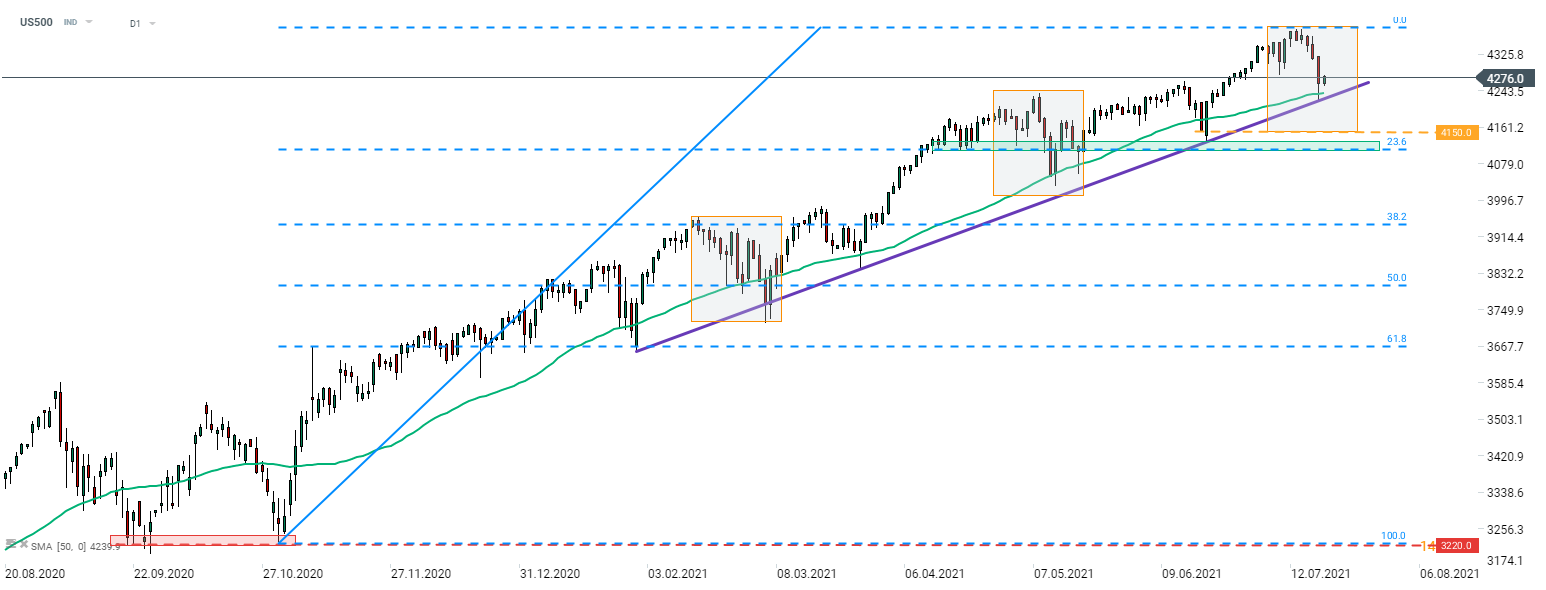

However, it looks like markets may be set for recovery today. S&P 500 futures (US500) trade 20 points above yesterday's cash close while major indices from Western Europe gain over 1%. Taking a look at US500 from a technical point of view, we can see that bulls managed to halt declines on the 50-session moving average (green line) and upward trendline. While recent declines may have seemed big, the drop was smaller than previous corrections during the current upward impulse.

Source: xStation5

Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments