Rate decision from the Bank of Canada is a key event of the day. No change in rates or asset purchases is expected. However, traders should keep in mind that BoC delivered a hawkish surprise last time, saying that it now expects slack in the economy to be absorbed in 2022 rather than previously assumed 2023. Nevertheless, there is a growing expectation that today's announcement may be non-event. Why? The Bank of Canada is said to stay on the sidelines for some time and watch how the economy and inflation develops. Moreover, today's meeting will not be followed by a post-meeting press conference from Governor Macklem therefore it looks unlikely that the Bank of Canada will make any major announcement today.

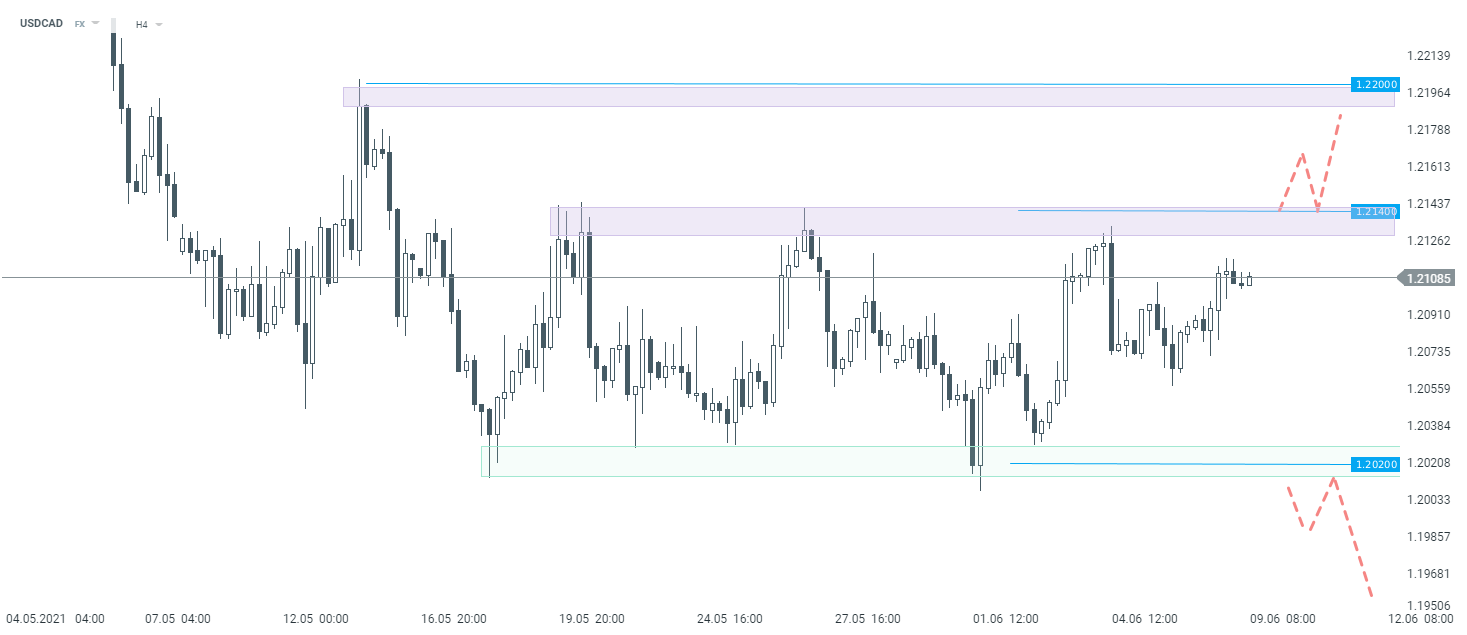

Still, short-term volatility around decision release (3:00 pm BST) may increase. Taking a look at USDCAD, we can see that the pair has been trading in a trading range recently, limited by a resistance at 1.2140 on the topside and a support at 1.2020 on the downside. The pair has been climbing towards the upper limit recently. Should BoC disappoint and hint that tightening is not as close as some have thought, a test of the 1.2140 resistance may be on the cards.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%