USDCAD is one of the FX pairs to watch today. The pair will get a chance to move at 1:30 pm BST as Canadian retail sales data for May will be released. Report is expected to show another month of declining sales (on a month-over-month basis). Sometime later at 2:45 pm BST, US PMI indices for July will be released and is expected to show improvement in services sector and small deterioration in manufacturing. Both events are likely to trigger some short-term volatility

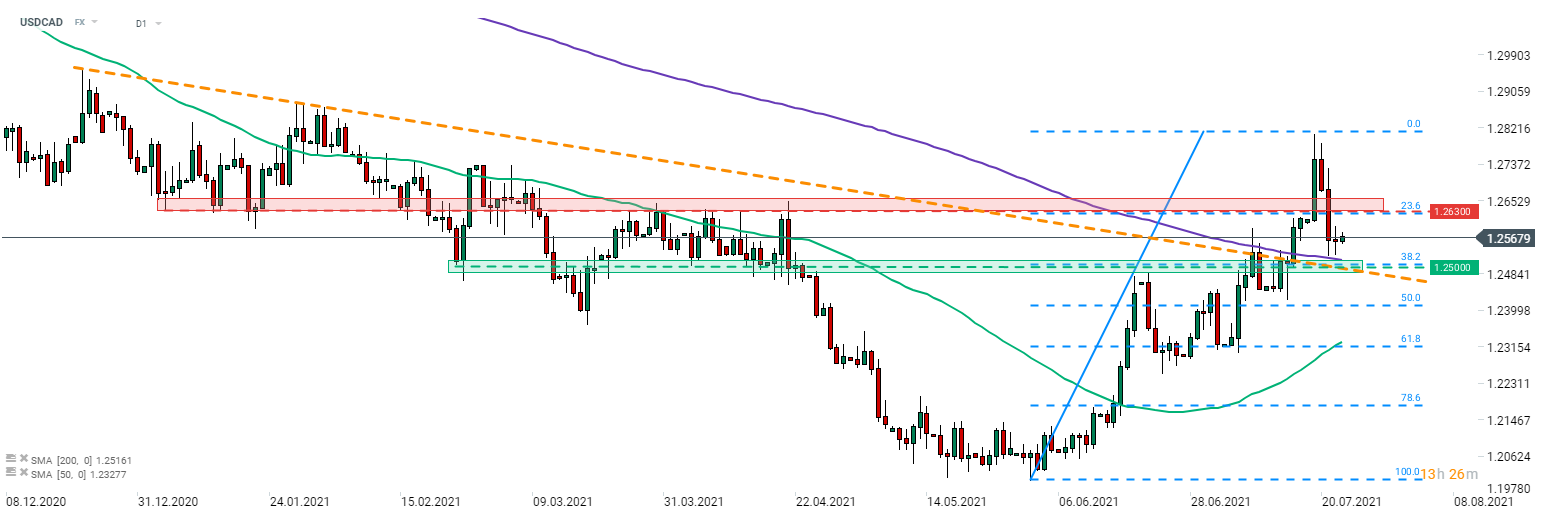

Taking a look at USDCAD chart at D1 interval, we can see that the pair has pulled back from a recent 6-month high. However, a drop was halted at the 1.25 support area. This zone is marked with previous price reactions, 38.2% retracement of recent upward impulse, 200-session moving average as well as the earlier-broken downward trendline. Positive price reaction to a mix of technical support may hint that uptrend is about to resume. The first near-term resistance to watch can be found in the 1.2630 area (23.6% retracement).

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%