The US dollar index is one of the best performing G10 currencies today. USD gains on safe haven flows amid deterioration in overall market moods. A looming economic recession is putting pressure on price of risk assets, causing investors to seek safety. Meanwhile, US dollar is also being support by outlook for a more hawkish monetary policy in the months to come.

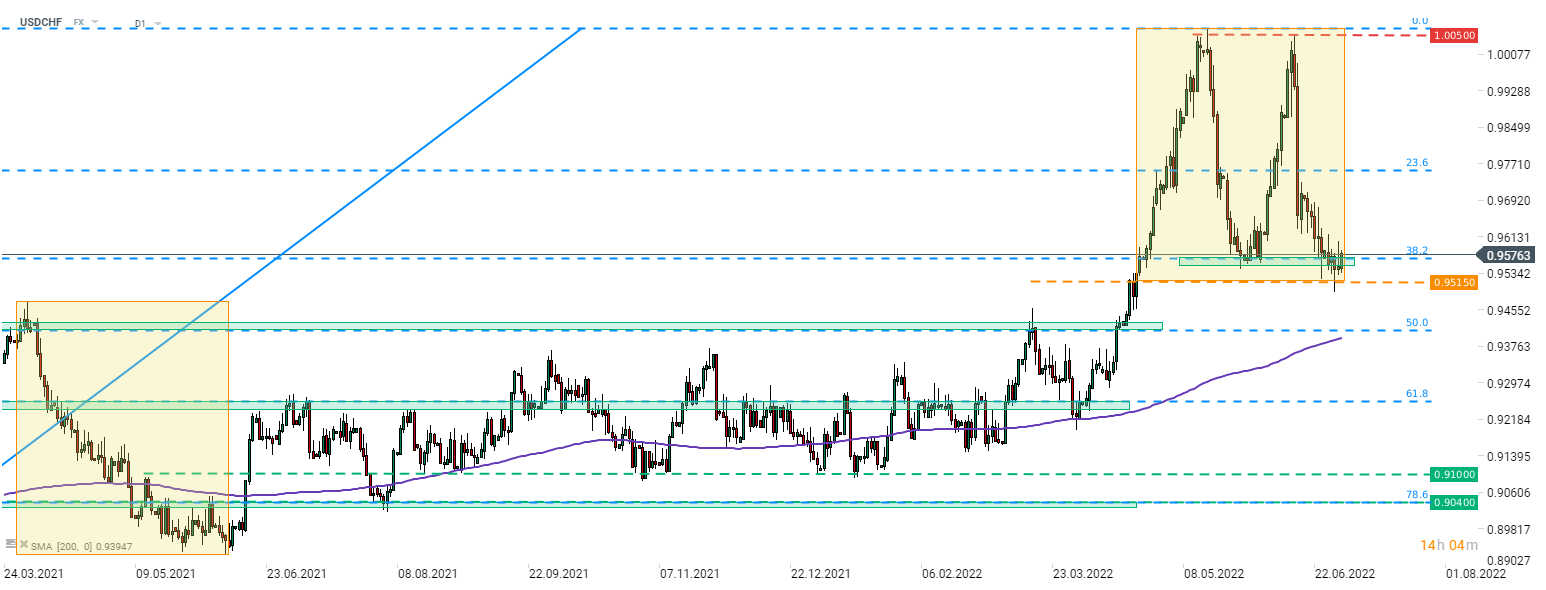

Taking a look at USDCHF chart at D1 interval, we can see that the pair painted a double top in the 1.0050 area. A quick drop occurred later on and USDCHF began assault on support zone at 38.2% retracement of the upward move launched at the beginning of 2021, that also marks the neckline of the double top pattern (0.9560 area). The lower limit of the Overbalance structure can be found slightly below this zone. After an unsuccessful attempt at breaking below the Overbalance structure, the pair started to recover and is making its way back above 38.2% retracement today, suggesting that the uptrend is still in play. Pair may experience a jump in short-term volatility around ISM manufacturing release today at 3:00 pm BST.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%