Swiss franc took a hit this morning following the release of CPI data for June from Switzerland. Report was expected to show a deceleration from 2.2 to 1.8% YoY and a monthly increase of 0.2% MoM. However, actual data showed a monthly increase of just 0.1% MoM and a deeper-than-expected drop in the annual gauge - from 2.2 to 1.7% YoY. Core annual CPI gauge also dropped - from 1.9 to 1.8% YoY - but it proves to be more sticky. Nevertheless, reading for June was the first one since January last year that showed headline CPI dropping below 2% SNB target.

Having said that, one should not be surprised by a drop in CHF as today's reading hints that Swiss National Bank may not need to be too hawkish going forward. Money market currently prices in an around-65% chance of a 25 basis point rate hike at SNB's next meeting in September. Less than 40 basis points of cumulative tightening is priced in over the next 12 months.

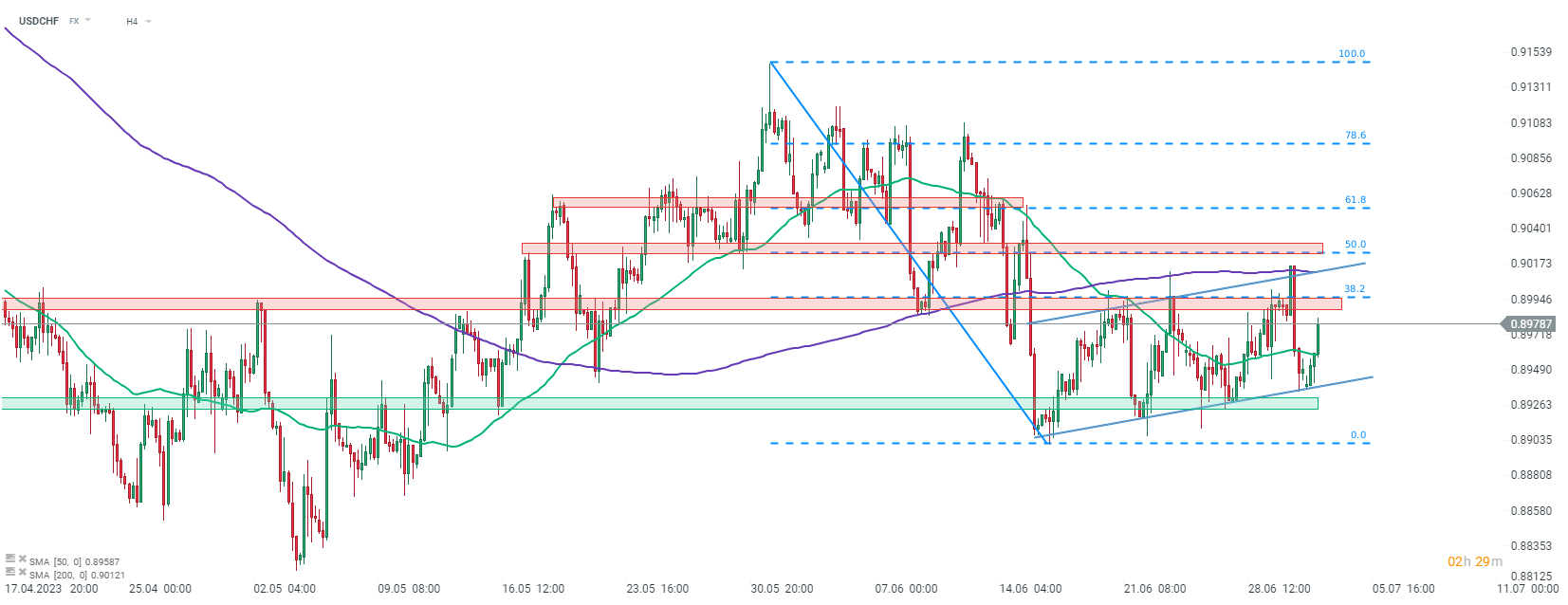

Taking a look at USDCHF chart at H4 interval, we can see that the pair has been trading in a short-term upward channel recently. Pair managed caught a bid today after release of Swiss inflation data and managed to climb above the 50-period moving average (green line). USDCHF is closing in on a resistance zone in the 0.9000 area, marked with the 38.2% retracement of the downward move launched at the turn of May and June 2023. Pair may see some additional volatility today at 3:00 pm BST when US manufacturing ISM index for June is released.

Source: xStation5

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Three markets to watch next week (27.02.2026)