- The Japanese Yen is the best-performing currency

- USDJPY bouncing off a key resistance zone.

- Yen is appreciating amid growing concerns about intervention by the Bank of Japan (BoJ)

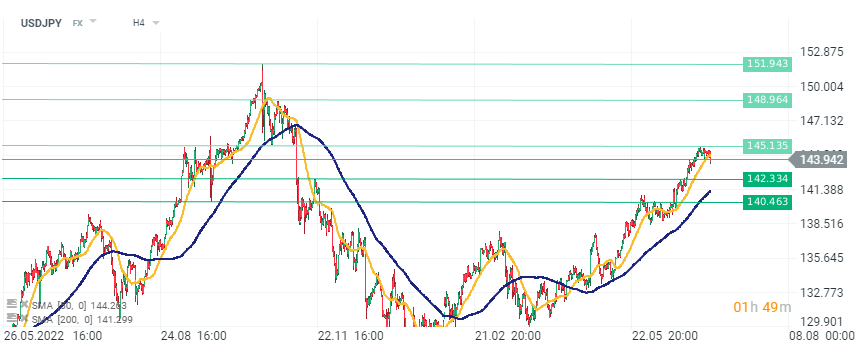

Last week, the Japanese Yen experienced significant losses against the US Dollar, and the USDJPY briefly crossed the 145 level. Since then, USDJPY has been consolidating for several days, but today selling pressure proved stronger, pushing the exchange rate down to 143, breaking below the consolidation channel.

Currency strength chart, the Japanese Yen (JPY) is currently the strongest currency among other major currencies, Source xStation 5

There could be two reasons for such a sharp strengthening of the Yen, not only against the Dollar but also other currencies. Firstly, recent strong gains may prompt investors to take profits, causing a short-term correction. However, the second, more fundamental reason is the market's fear of another intervention by the Bank of Japan. Downward pressure has increased following the statements by the country's leaders, including the finance minister, advocating for intervention against excessive depreciation of the domestic currency. The likelihood of another intervention is quite high, as evidenced by past experiences. In September and October 2022, the USDJPY experienced volatility after crossing the 145 and subsequently 150 levels. Intervention became necessary at those levels, significantly strengthening the Yen... however, only in the short term, as USDJPY started climbing again.

Currently, the USDJPY has rebounded from the 145 level and is trading at 143.8. If selling pressure does not weaken, the exchange rate could drop to around 142 or 140 levels. However, a return of USDJPY to an upward trajectory should be seen as an increasing probability of intervention by the Bank of Japan. In such a case, authorities will certainly resume their campaign to influence the currency market, which somewhat limits the upside potential. Nevertheless, a retest of the 145 level is still possible. Source xStation 5

Currently, the USDJPY has rebounded from the 145 level and is trading at 143.8. If selling pressure does not weaken, the exchange rate could drop to around 142 or 140 levels. However, a return of USDJPY to an upward trajectory should be seen as an increasing probability of intervention by the Bank of Japan. In such a case, authorities will certainly resume their campaign to influence the currency market, which somewhat limits the upside potential. Nevertheless, a retest of the 145 level is still possible. Source xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️