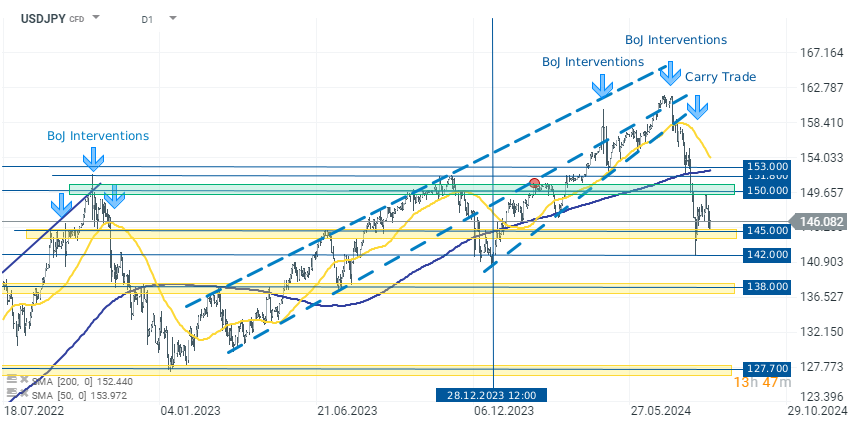

The Japanese yen is one of the weaker currencies today, with declines ranging from 0.5% to 0.7% against other G10 currencies. USDJPY is gaining 0.70% today, reaching the level of 146.1000. However, in the longer term, there is still a strong downward trend. Since the beginning of July, USDJPY has fallen by 10%.

Today's gains are more of a reaction to the support zone at the 145.0000 level. On the other hand, for the bulls, the nearest resistance level is the zone above 150.0000, which was also recently tested. The key will be breaking out of the current consolidation channel. If the price manages to break above the 150.0000 level, a continuation of the move significantly higher is possible. The next targets could be at the levels of 151-153.0000 JPY.

Conversely, breaking the support at 145.0000 JPY should indicate a continuation of the downward move. It is worth noting that the USD is also experiencing a very weak period, which supports the recent declines in the USDJPY pair.

Source: xStation 5

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

🚨EURUSD fights for 1.16 ahead of US CPI

AUDUSD: Is the RBA the first central bank returning to rate hikes? 🪙