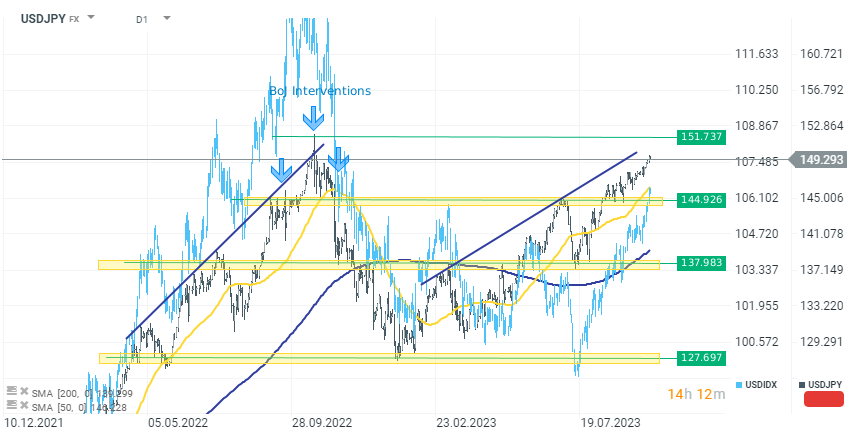

The Japanese yen remains weak against most currencies, including the USD, EUR, and CAD. Coupled with the strengthening dollar, the USDJPY rate is entering higher territories and is currently approaching the historical high of 151.7. Leading representatives of the Japanese government and the Central Bank have repeatedly indicated that the yen is currently too weak.

- Today, Japanese Finance Minister Shunichi Suzuki again warned against speculative trading of the yen, which is approaching an 11-month low with USDJPY close to the 150 level. Although the minister did not confirm any plans regarding interest rate control or intervention, he leaves all options open to address excessive currency volatility.

However, an open question remains regarding an agreement with the US government concerning BoJ intervention, which would likely be necessary before any significant actions. For this reason, many analysts argue that the bar for intervention is set higher this time than the last and beyond market current expectations.

Looking at the USDJPY chart, we see that the rate is approaching its historical peak and the psychological level of 150. However, comparing the USDJPY rate to the dollar index, one can notice that reaching the current levels is not only due to the strengthening dollar but also a greater depreciation of the yen compared to October 2022. Currently, the dollar remains 7.5% lower than its peak last year.

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

🚨EURUSD fights for 1.16 ahead of US CPI

AUDUSD: Is the RBA the first central bank returning to rate hikes? 🪙