The Norwegian krone is gaining value against other G10 currencies during this morning. This is related to today's inflation reading in Norway, which showed a slower decline in the growth dynamics of the prices of goods and services than expected by the consensus. In year-on-year terms, CPI inflation stood at 6.4%, above expectations of 6.1% and a previous reading of 6.5%. However, investors were drawn to the monthly reading, which showed a growth of 1.1% compared to expected 0.7% and a previous growth of 0.8%.

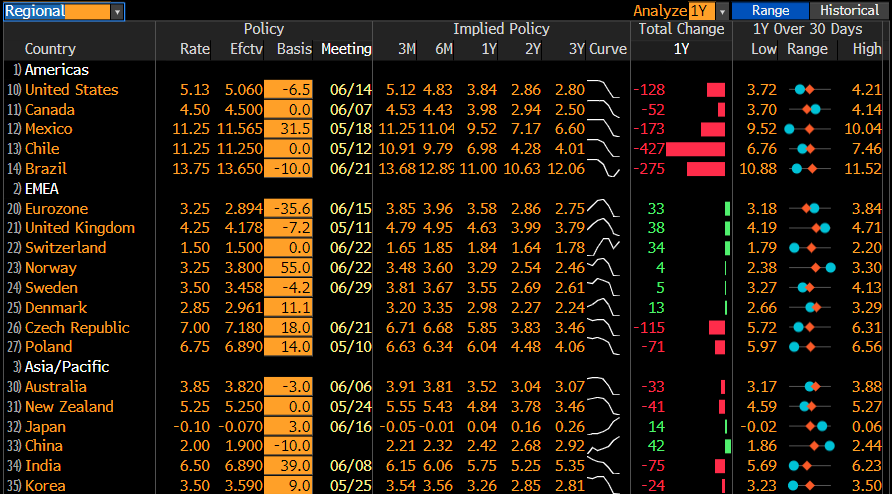

NOK has been under downward pressure in recent weeks, which was reinforced by the sell-offs in the oil market. During its last meeting, Norges Bank signaled that it would be more responsive to changes in the Norwegian krone's FX market quotes, which, with higher inflation readings, may prompt Norges Bank to raise interest rates further. At the moment, the money market is pricing in another rate hike at the June meeting with a high probability.

The money market implies a continuation of the cycle of interest rate hikes in Norway. Source: Bloomberg

The money market implies a continuation of the cycle of interest rate hikes in Norway. Source: Bloomberg

The USDNOK pair, daily interval. The pair is currently moving in accordance with the upward trend line set in early March 2022 (support line), which, however, is experiencing selling pressure in the 10.85 zone. Source: xStation 5

The USDNOK pair, daily interval. The pair is currently moving in accordance with the upward trend line set in early March 2022 (support line), which, however, is experiencing selling pressure in the 10.85 zone. Source: xStation 5

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Three markets to watch next week (27.02.2026)