Summary:

-

Chinese industrial output, retail sales, and fixed asset investments all dispappint in July

-

Stimulatory steps undertaken recently need more time to begin kicking in

-

White House adviser Bolton met with Turkish envoy to discuss US pastor detention

-

Industrial production rose 6% YoY, the consensus was 6.3% YoY, the prior value 6% YoY

-

Retail sales rose 8.8% YoY, the consensus was 9.1% YoY, the prior value 9% YoY

-

Fixed asset investments (YTD) rose 5.5% YoY, the consensus was 6% YoY, the prior value 6% YoY

A lot of misses depressed Chinese indices a bit suggesting that the country’s authorities may have to slow down a deleveraging process. Indeed, the money supply data for July showed M2 aggregate jumping to 8.5% YoY easily beating the median estimate of 8.2% YoY and a 8% pick-up registered in June which was the lowest on record. On top of that, new yuan outstanding loans slowed less than anticipated. All of that illustrates that the recovery in the country’s bank lending was evident underlining that the PBoC’s monetary easing is taking effect. However, while trends in lending may fluctuate quicker the hard data do not, hence July offered a baggage of disappointments as evidenced by the tally above. In addition, one cannot forget about a protracted trade dispute with the United States which may have also contributed negatively to the last month’s data. Having in mind that the Chinese officials vowed to boost lending to smaller firms one may suppose that these steps will kick-start later acting like a cushion for the entire economy.

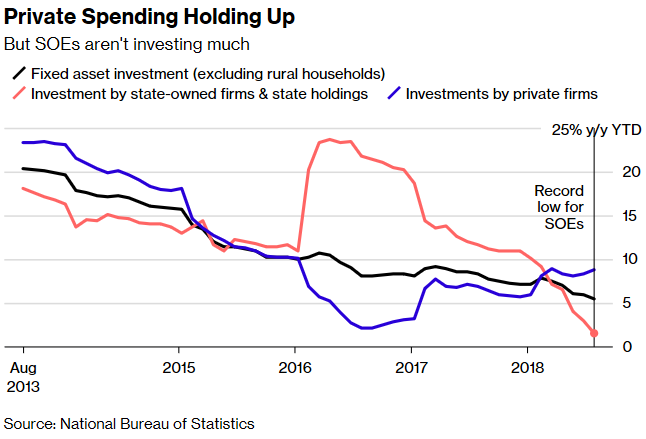

Private investment was still solid in July staying well above public investment. Source: Bloomberg

As one may spot, while public investment kept falling in July we got the different story in terms of investments made by private companies which grew 8.8% YoY, the fastest pace since March. Taking into account that the government will still want to rein in indebtedness (to slow increases of debt) one may expect that these trend will continue developing.

The China’s Hang Seng (CHNComp) fell today as the data showed that growth momentum stalled. However, given that bank lending slowed less than forecast could be a positive signal for bulls. Therefore, unless further substantial deterioration of relations with the US one may expect that the index to stay above 10400 points. Source: xStation5

The China’s Hang Seng (CHNComp) fell today as the data showed that growth momentum stalled. However, given that bank lending slowed less than forecast could be a positive signal for bulls. Therefore, unless further substantial deterioration of relations with the US one may expect that the index to stay above 10400 points. Source: xStation5

Beside the China’s data we also got some releases from Australia which, however, did not influence the AUD at all. Business confidence according to NAB improved in July with the value rising to 7 from 6, whereas business conditions worsened to 12 from 14. When it comes to the Turkish lira it is trading quite calmly this morning being even up 1% against the US dollar as of 7:07 am BST. In this respect one needs to mention the meeting between John Bolton, White House national security adviser, and Turkey’s ambassador to the US. It took place on Monday and concerned Turkey’s detention of a US pastor. What could be interesting, the White House said in a statement that no deadline had been set for release him and it is contradictory to remarks we were offered over the weekend from Erdogan. The meeting turned out to be a debacle as no solution was hammered out. In the morning we are seeing the weaker yen and slightly rebounding gold prices. Given that gold has been negatively correlated with the US dollar despite widespread distress across financial markets, one may suppose that morning’s trading is bringing at least temporary relief.

After numerous attempts to break higher, the USDTRY is finally retreating a bit, but do not expect any long-lived reversal until things are sorted out. Source: xStation5

After numerous attempts to break higher, the USDTRY is finally retreating a bit, but do not expect any long-lived reversal until things are sorted out. Source: xStation5