Chinese indices were top performers during the first Asian session of a new week. There are some good reasons behind the improved sentiment towards the Chinese stocks today:

- Comments from Chinese President Xi Jinping, who said that China will continue to open up to foreign capital and investments, are also supporting market moods

- Country Garden, Chinese developer on a brink of bankruptcy, won an appeal to extend payments on its onshore bonds and also secure over $500 million in additional financing

- Domestic banks in China have recently lowered rates on mortgage loans amid pressures from authorities and in an attempt to support economy

- Markets are expecting Chinese authorities to announce more support measures for property sector - including new measures for first home purchases and relaxed restrictions on mortgage lenders

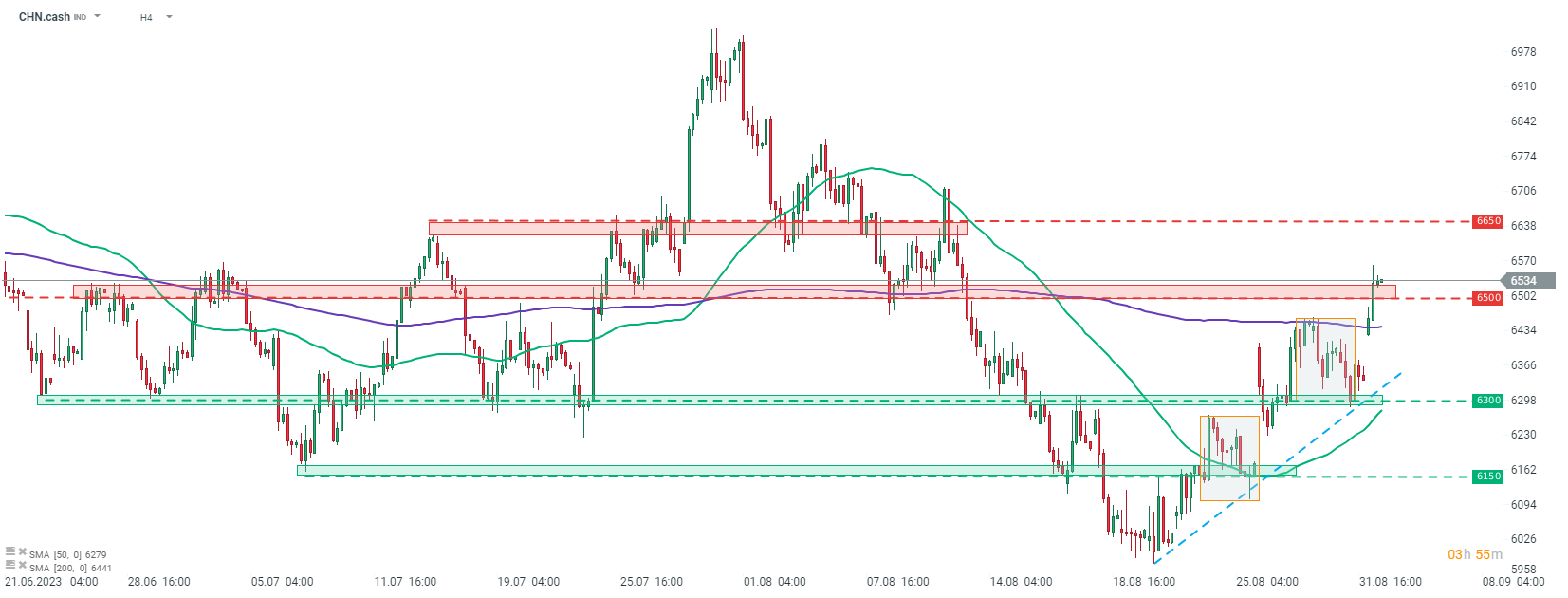

CHN.cash is extending its current recovery move today with an almost-3% gain. The index jumped over 9% over the past 2 weeks amid incoming news of economic support measures being undertaken by Chinese authorities. Taking a look at CHN.cash at H4 interval, we can see that the index is making a break above the 6,500 pts resistance zone today, reaching a fresh 3-week high in the process. Should upward move continue, the next near-term resistance to watch can be found in the area below 6,650 pts.

Source: xStation5

Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Daily summary: Weak US data drags markets down, precious metals under pressure again!