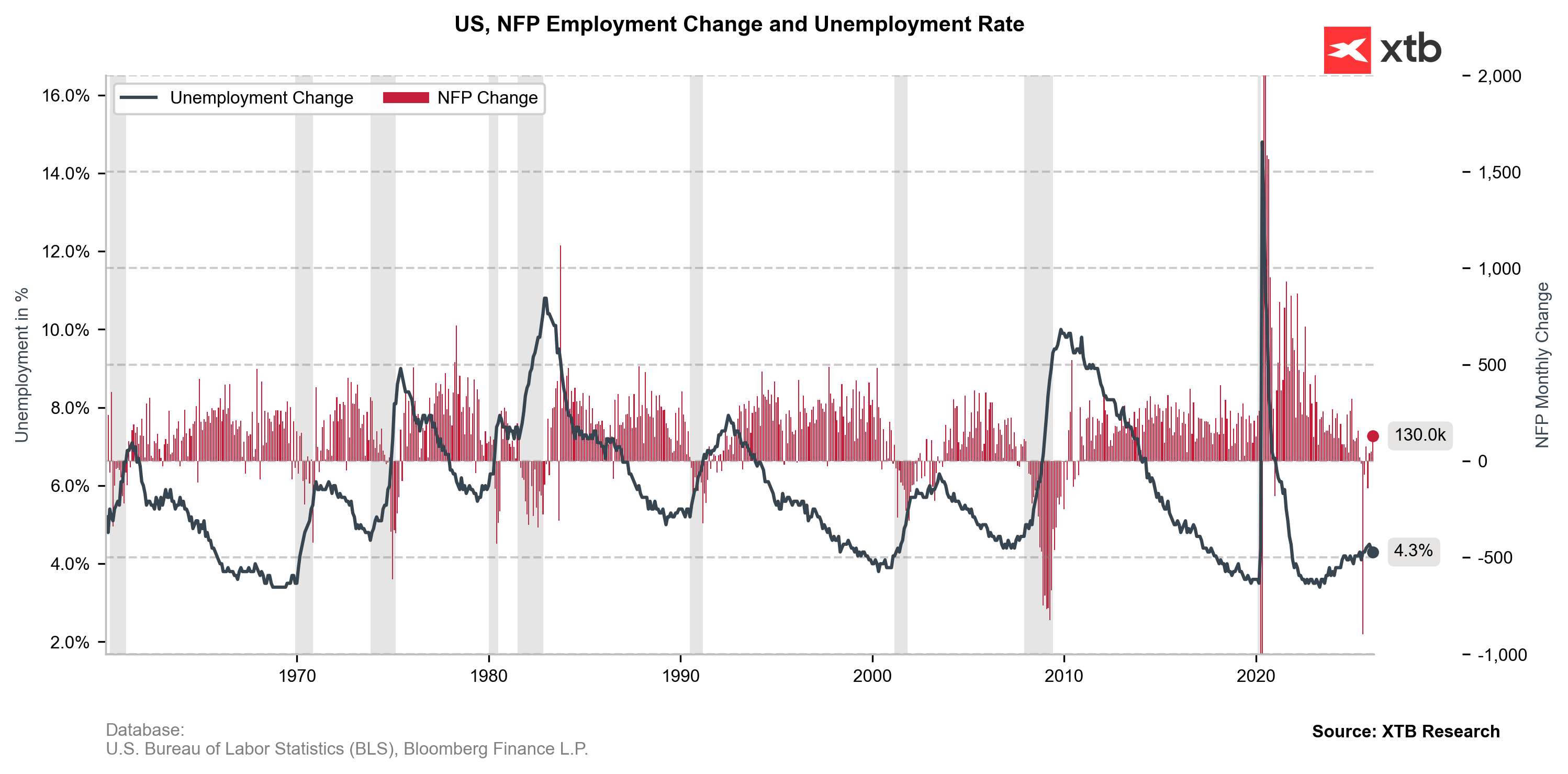

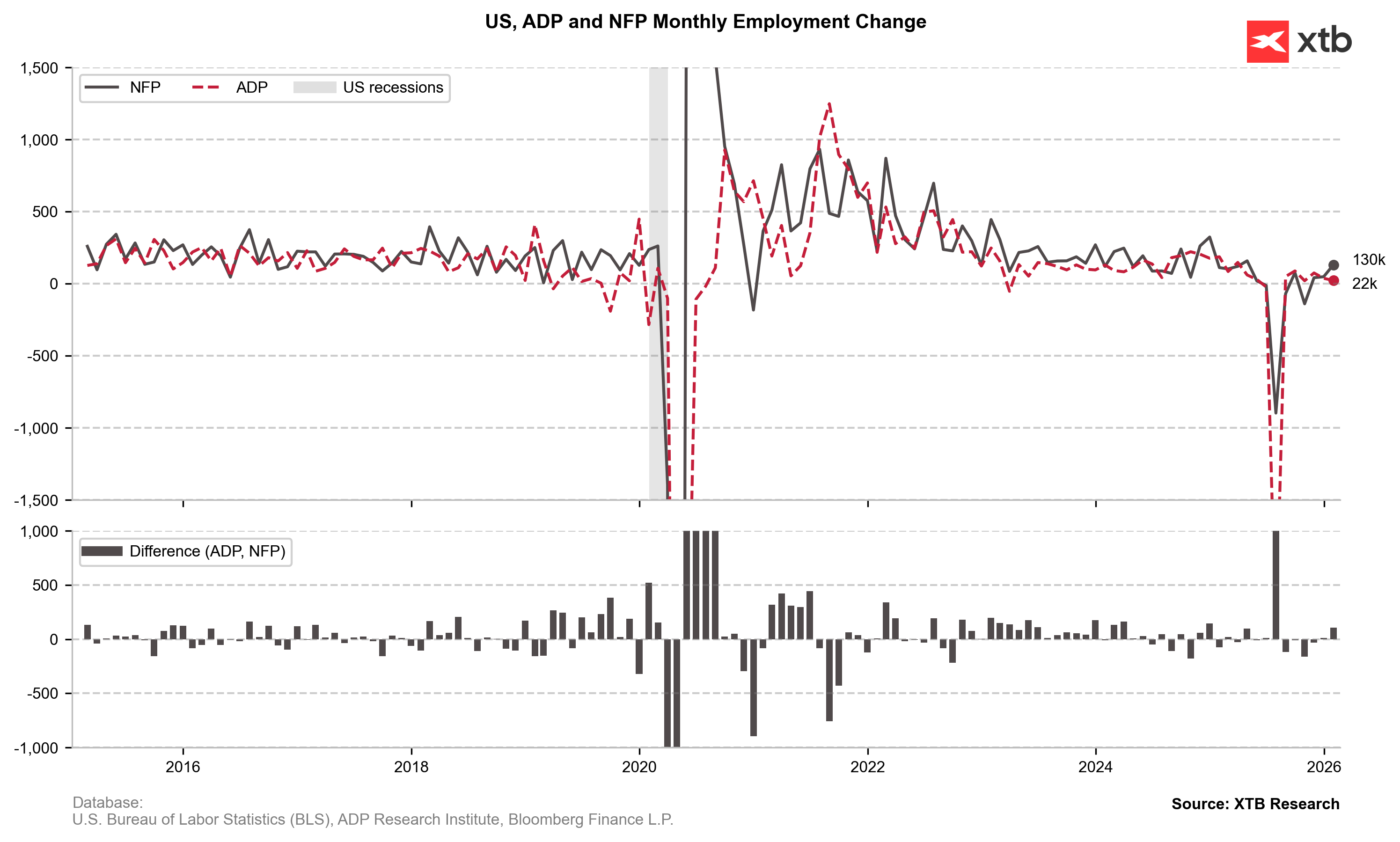

US Nonfarm Payrolls: 130k (Forecast 65k, Previous 50k)

Private payrolls: 172k vs 68k exp. and 37k previously

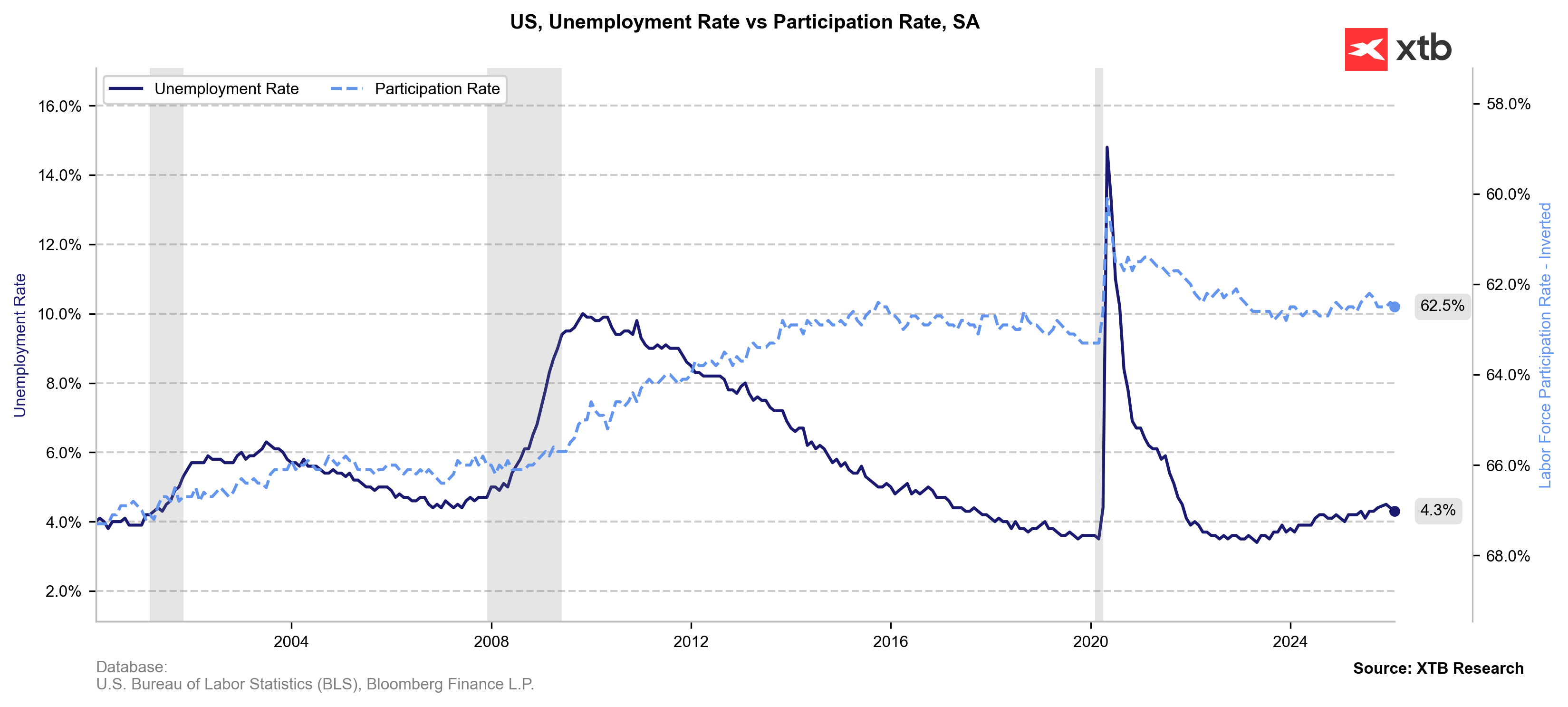

Unemployment rate: 4,3% vs 4,4% exp. and 4,4% previously

Average earnings MoM: 0.4% vs 0.3% exp. and 0.3% previously

Average earnings YoY: 3,7% vs 3,7% exp. and 3,7% previously

US indices gain in first reaction to quite strong US labour market data. Non-farm payrolls (especially private market numbers) showed much higher than expected employment change and unexpected drop in unemployment rate.

Source: xStation5

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment