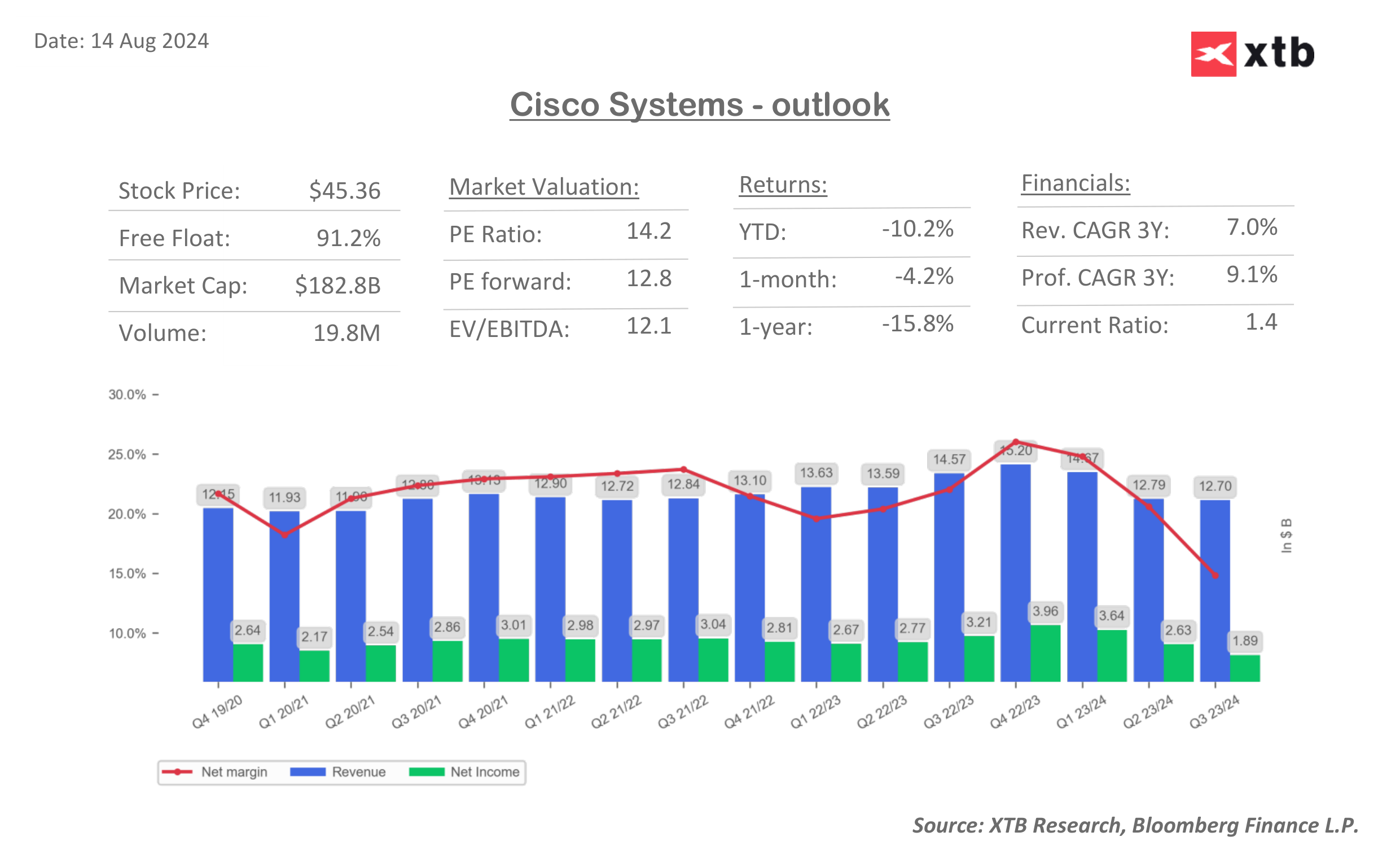

Cisco Systems (CSCO.US) awaits announcement of results for Q4 fiscal year 2024

Cisco Systems is preparing to publish results for the fourth quarter of fiscal year 2024, which will be announced after the market closes on Wednesday. Investors are eagerly awaiting data that may shed light on the state of corporate investments in computer networks and potential restructuring plans for the company.

Expected key financial data (analyst estimates): Revenue: $13.53 billion

- Decrease from $15.2 billion year-over-year

- Within the company's earlier guidance: $13.4-13.6 billion Adjusted earnings per share (EPS): $0.85

- Decrease from $1.14 year-over-year Net profit: $2.03 billion

- Decrease from $3.99 billion year-over-year

Forecasts for Q1 fiscal year 2025 (analyst estimates):

- Revenue: $13.65 billion

- Adjusted earnings per share: $0.85

- Adjusted gross margin: 67.1%

- Adjusted operating margin: 32%

Key issues to observe (according to analysts):

- Potential layoffs: Investors will closely monitor any information regarding planned job cuts that could affect thousands of employees. The scale of reduction may be similar to or slightly larger than the previous round of 4,000 layoffs in February.

- Order trends: Attention will be focused on order trends, which have stabilized in recent quarters after previous declines. Analysts will look for signs of improvement in this area.

- Impact of Splunk acquisition: Cisco is expected to provide updates on integration and growth in the Splunk segment following the finalization of the acquisition in March. Investors will be interested in the potential positive impact of this acquisition on financial results.

- Demand for AI solutions and data center investments: Cisco may present information about growing demand for artificial intelligence solutions and data center investments, which could be significant growth catalysts.

- Corporate appetite for spending: Cisco's results may provide valuable insights into companies' readiness to invest in network infrastructure in the face of economic uncertainty.

- Development in the security area: Analysts will look for updates on Cisco's security business, especially in the context of growing competition from companies like Palo Alto Networks or CrowdStrike.

- Outlook for networking and communications: Cisco is expected to present its vision for development in the network area, especially in the context of growing demand for SASE (Secure Access Service Edge) solutions and potential growth in demand for firewalls.

- AI strategies: Investors will be interested in Cisco's plans for using artificial intelligence in its products and services, as well as potential partnerships in this area, e.g., with Nvidia.

- Cloud development: In light of growing interest in cloud technologies, analysts may seek information on how cloud adoption is affecting Cisco's business.

Implied 1 Day Move: Based on historical data for the company, volatility of 6.84% can be expected. In previous years, Cisco tended to surprise positively, with an average consensus beat of 3.82%. It's also worth monitoring behavior during the session itself and watching if the stock price makes any specific move.

Recommendations: Cisco has 29 recommendations, of which 8 are "buy" with the highest target price of $76, 21 "hold", and 0 "sell". The 12-month average stock price forecast is $53.86, which indicates a potential upside of 18.7% compared to the current price.

Technical analysis: Cisco's stock has been in a downward trend since the beginning of the year. It's important to note that it's breaking through successive Fibonacci retracement levels. Currently, the resistance will be the 61.8% Fibonacci retracement at $46.06. Breaking through this level could trigger an attempt to approach the 50 SMA at $46.64. In case of worse-than-expected results, the first test will be the channel marked at the level of lows from October 2022. Breaking through it may herald testing of the 78.6% Fibonacci retracement at $42.77 and breaking out of the bottom of the downward channel. RSI currently remains in the neutral zone, close to overbought. MACD is at a similar minus as at the beginning of the year. This may indicate overbought conditions and allow for a short-term rebound.

Source: xStation

Source: xStation

Nvidia expands into software AI sector? Wired reports on NemoClaw

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster