Companies from the cloud segment are facing some selling pressure on Wednesday after Microsoft (MSFT.US) issued a weak outlook for the Azure cloud-computing unit. Amazon.com (AMZN.US) and Alphabet (GOOGL.US) fell 1.3% and 3.4% respectively, after Microsoft said that in the current period its cloud computing business may experience slowdown due to a drop in demand, which threatens to envelop the broader software industry.

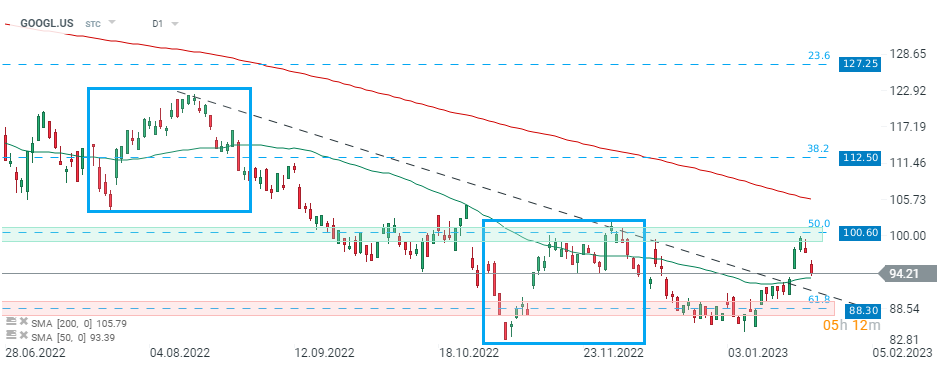

Alphabet (GOOGL.US) stock resumed downward move this week after buyers failed to break above crucial resistance at $100.60, which is marked with 50.0% Fibonacci retracement of the bullish wave started at the beginning of the pandemic. Currently stock is testing 50 SMA (green line), should break lower occur, downward move may deepen towards support at $88.30, where 61.8% retracement and earlier broken downward trendline can be found. Source: xStation5

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

Sentiments on Wall Street are falling 📉S&P 500 earnings season highlight

Daily summary: The beginning of the end of disinflation?