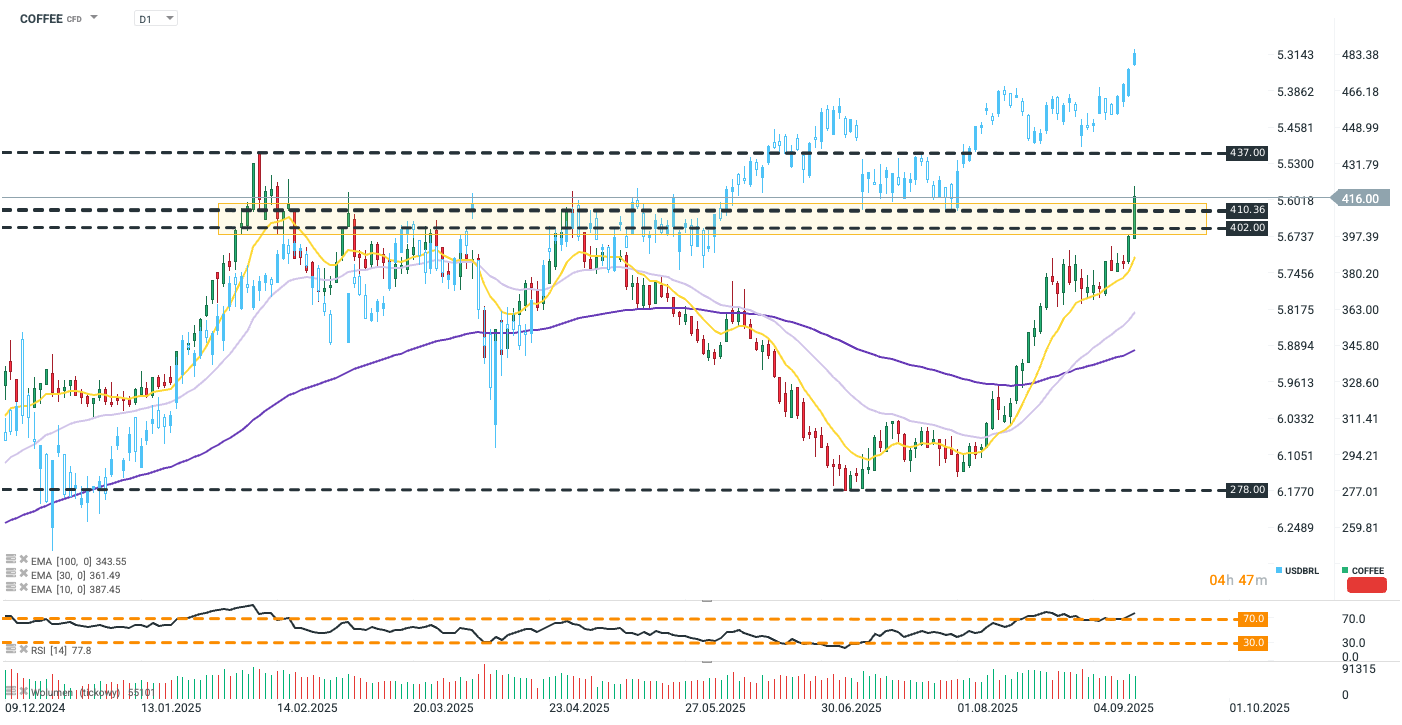

Arabica contracts extended Friday’s rebound by nearly 6%, pushing prices above the key resistance zone (402–410). Drought in Brazil, the world’s largest coffee producer, has reignited supply concerns, driving New York exchange prices above $4 per pound for the first time since April 2025.

Drought-stricken Brazil has been the main source of upward pressure in recent months, while conflicting weather forecasts for the coming weeks cast uncertainty over the September–November flowering. While Climatempo predicts a return of heavy rainfall, other sources say drought risk in the arabica belt remains too high to dismiss supply fears.

Non-climatic factors are also at play. Brazil was excluded from US tariff relief on coffee due to deteriorating diplomatic relations following Jair Bolsonaro’s conviction, leaving coffee subject to 50% reciprocal tariffs. Prices are also supported by the sharp appreciation of the Brazilian real, up 14% against the dollar since the start of the year.

COFFEE is now at its highest level since April 2025, approaching January highs. In blue: the inverted USDBRL rate, at its strongest since June 2024. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

BREAKING: US RETAIL SALES BELOW EXPECTATIONS