Oil:

- The risk of a lockdown in the Beijing area raises concerns over demand shock demand in China

- On the other hand, PBOC has announced support for the economy, which eased selling pressure on commodities which are key for the Chinese economy

- According to an economist from Oversea-Chinese Banking Corp in Singapore, the supply situation is very tense, prompting investors to take advantage of the current low price opportunity

- However, crude oil prices fell to the level before Russian launched invasion on Ukraine

- Europe is to work on "smart" sanctions on Russian oil imports

- The spread for the upcoming contracts for Brent crude oil, i.e. June minus July, fell to 14 cents, while in March it reached over $ 4. This shows that the tension in the market is very low

- Number of open positions on WTI oil fell sharply which may suggest that volatility could increase in the near term given the high uncertainty. On the other hand, it may also indicate that investors are willing to leave a highly uncertain market.

The spread between the two upcoming contracts for Brent (the backwardation) has dropped to just 14 cents. Source: Bloomberg

The spread between the two upcoming contracts for Brent (the backwardation) has dropped to just 14 cents. Source: Bloomberg

Start investing today or test a free demo

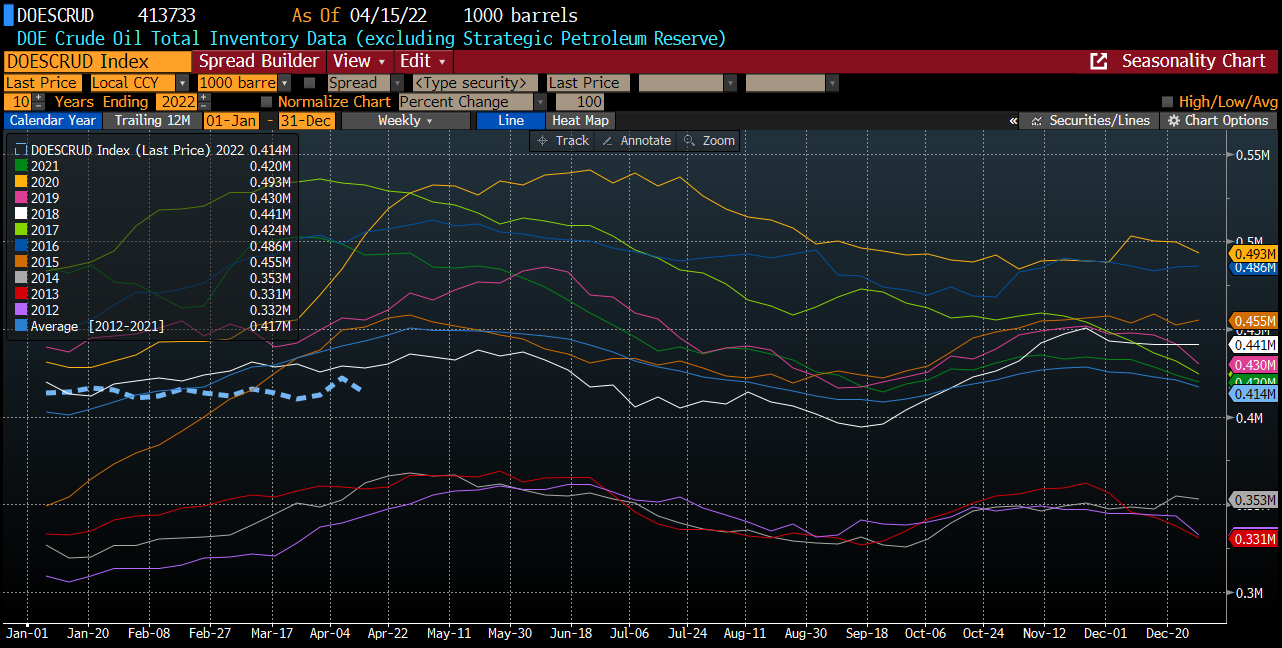

Create account Try a demo Download mobile app Download mobile app Oil stocks are moving flat this year and reached their lowest level since 2015. Source: Bloomberg

Oil stocks are moving flat this year and reached their lowest level since 2015. Source: Bloomberg

Brent is trading around$ 100.00 dollars a barrel, while $ 95.00 USD level should be considered as key support. On the other hand, the demand problems at the moment are considered more important than the supply problems. However, the situation may change around the summer season. Source: xStation5

Brent is trading around$ 100.00 dollars a barrel, while $ 95.00 USD level should be considered as key support. On the other hand, the demand problems at the moment are considered more important than the supply problems. However, the situation may change around the summer season. Source: xStation5

Copper:

- Further slowdown in China caused by Covid

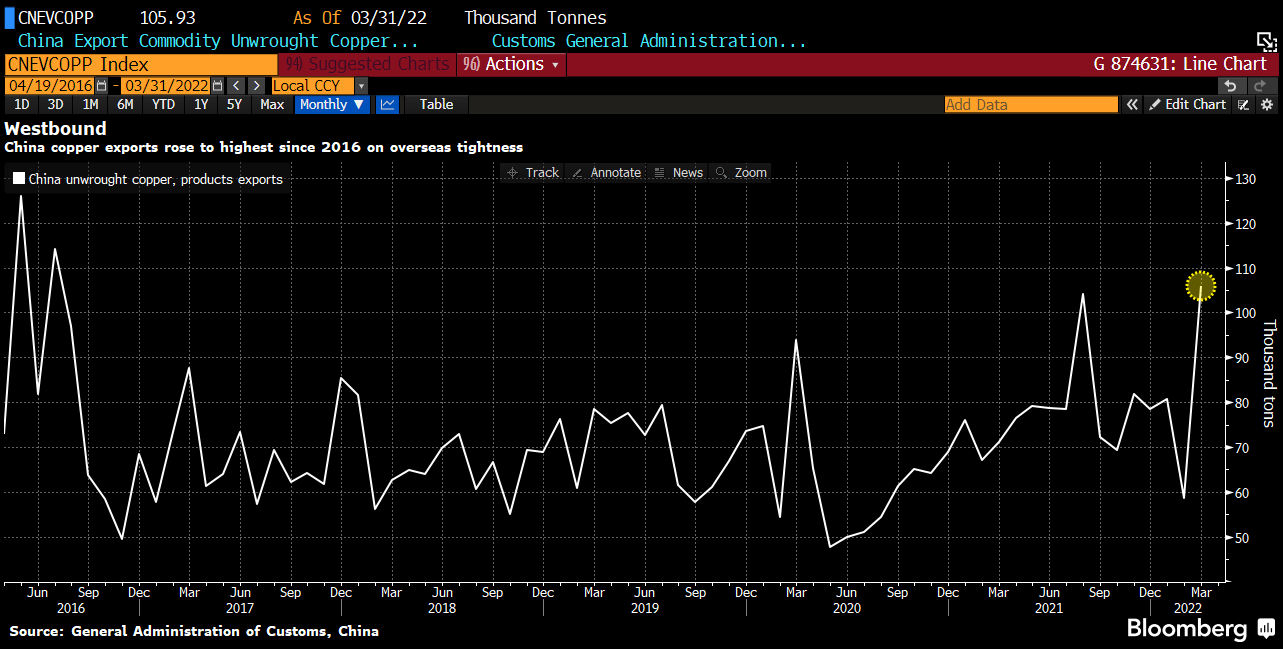

- China exports a large amount of copper, which is quite surprising news

- Higher copper exports may indicate that the domestic market is saturated despite low stockpiles

- Copper inventories around the world are rebounding, although they are still at low levels when looking from the long term perspective. China inventories have fallen, which may be related to increased exports

- The recent fall in China's reserve requirements for currencies has not stopped the yuan's decline

China's copper exports have almost doubled compared to February and reached the highest level since 2016. Source: Bloomberg

China's copper exports have almost doubled compared to February and reached the highest level since 2016. Source: Bloomberg

Global stockpiles are rising, while the situation in China is quite the opposite. Nevertheless, supply concerns decreased at least in the short term. Source: Bloomberg

Global stockpiles are rising, while the situation in China is quite the opposite. Nevertheless, supply concerns decreased at least in the short term. Source: Bloomberg

Copper broke below the lower limit of the consolidation in the range of $10,100-$10450 and extended downward move below $ 10,000. One can also notice the sharp reaction of yuan. The long-term correlation between the yuan and copper is high, as the yuan is a measure of the strength of the Chinese economy. From a technical point of view, copper defends the upward trend line. However should break lower occur, downward move may accelerate towards $9500, or even $9000. However, after the end of correction, copper could gain in the long term. Source: xStation5

Copper broke below the lower limit of the consolidation in the range of $10,100-$10450 and extended downward move below $ 10,000. One can also notice the sharp reaction of yuan. The long-term correlation between the yuan and copper is high, as the yuan is a measure of the strength of the Chinese economy. From a technical point of view, copper defends the upward trend line. However should break lower occur, downward move may accelerate towards $9500, or even $9000. However, after the end of correction, copper could gain in the long term. Source: xStation5

Gold:

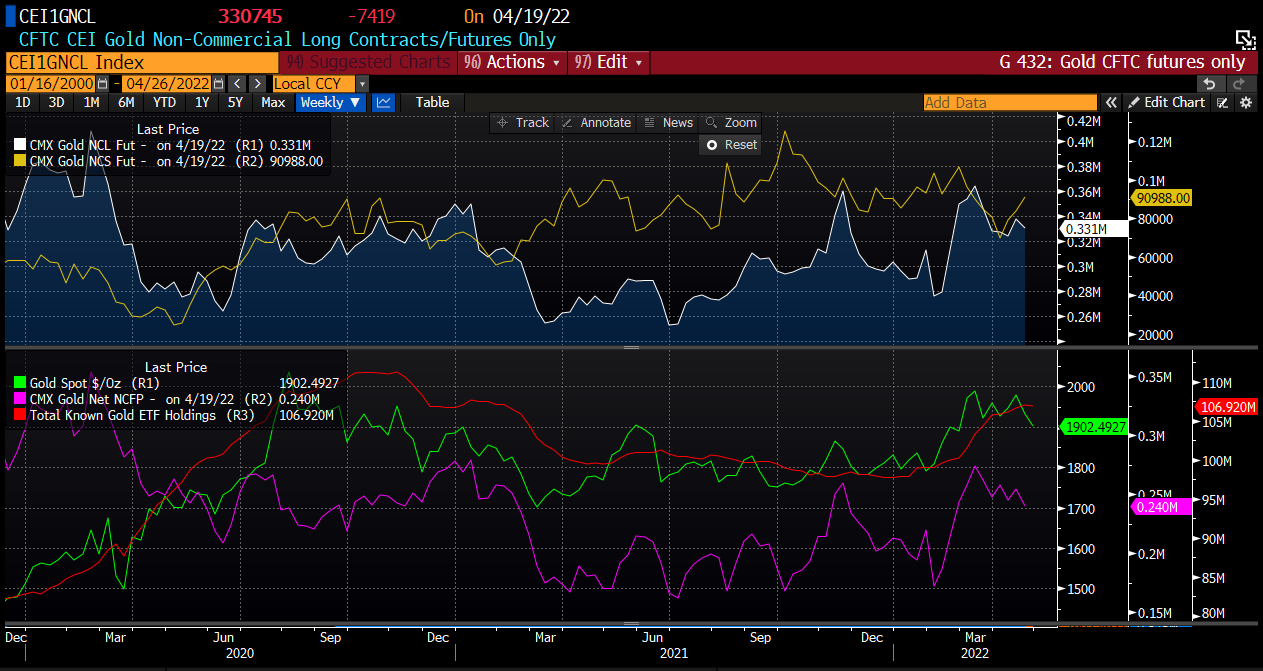

- Gold defended the $ 1,900 per ounce level

- The recent sell-off was caused by the expectations of three 50 bp rate hikes in the US

- The forecast for the US real interest rate in the 3-month perspective still points towards decline, while the real interest rate in the 12-month perspective is already starting to rebound, which may limit the market's bulls.

- On the other hand, the 12-month perspective shows that real interest rates will remain clearly below 0. The excess of inflation over interest rates is to be over 1.5%

- ETFs have been buying gold in recent weeks, but no change in the amount of gold held by funds is visible at the moment. If ETFs do not start selling gold, then prices may stabilize after the last sell-off.

Real interest rate expectations. Further support for gold in the 3-month perspective, while the 12-month perspective justifies the recent declines. Source: Bloomberg

Real interest rate expectations. Further support for gold in the 3-month perspective, while the 12-month perspective justifies the recent declines. Source: Bloomberg

ETFs keep a relatively large amount of gold over the past few months. Source: Bloomberg

ETFs keep a relatively large amount of gold over the past few months. Source: Bloomberg

Gold maintains a key support zone at $ 1890-1900 which coincides with 61.8% retracement of the last upward impulse. Source: xStation5

Gold maintains a key support zone at $ 1890-1900 which coincides with 61.8% retracement of the last upward impulse. Source: xStation5