- Oil prices remain high thanks to hopes regarding coronavirus vaccines, which could lead to faster opening of economies

- OPEC + is likely maintain larger production cuts

- This positive news are probably already priced in by the market, which could lead to profit taking

- The strong supply zone is located in the range of USD 42-44 per barrel on WTI crude oil

- The flattening of the futures curve at the short end suggests lower concerns regarding oversupply (the 3-month spread on Brent narrowed from almost $ 1.5 to $ 0.5 compared to the beginning of the month and the second half of November)

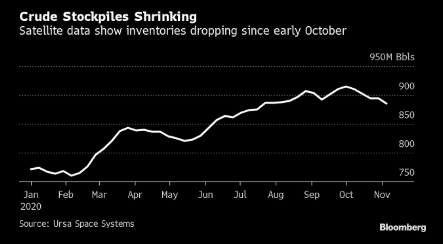

- Positive data from China - recovery in oil processing and a decline in inventories, which may suggest increased imports in the coming months

- On the other hand, the United States is gearing up for major coronavirus-related restrictions, which may reduce fuel demand

- A lot of uncertainty regarding the United States also concerns the stimulus package that would be introduced by the new administration. Biden is calling for a swift vote on the $ 2.4 trillion package. In turn, one of the Senators of the GOP indicates that he sees no chance for such a bill to be passed quickly and, moreover, he does not see such a possibility at a later date.

Oil processing in China is increasing. As a result, oil inventories are declining, but the same trend is noticeable in the case of petroleum products. Source: Bloomberg

Oil processing in China is increasing. As a result, oil inventories are declining, but the same trend is noticeable in the case of petroleum products. Source: Bloomberg

Crude oil inventories in China are declining, which means that we may see an increase in imports in the coming months. Source: Bloomberg

Crude oil inventories in China are declining, which means that we may see an increase in imports in the coming months. Source: Bloomberg

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appNatural gas:

- The recent decline in demand resulted in an increase in gas inventories. The high temperatures in the November may cause inventory levels to continue to increase for the next few weeks

- Rollover will take place tomorrow, although it should be small (0.1-0.2 USD per contract). In theory, this will be the last positive rollover this season

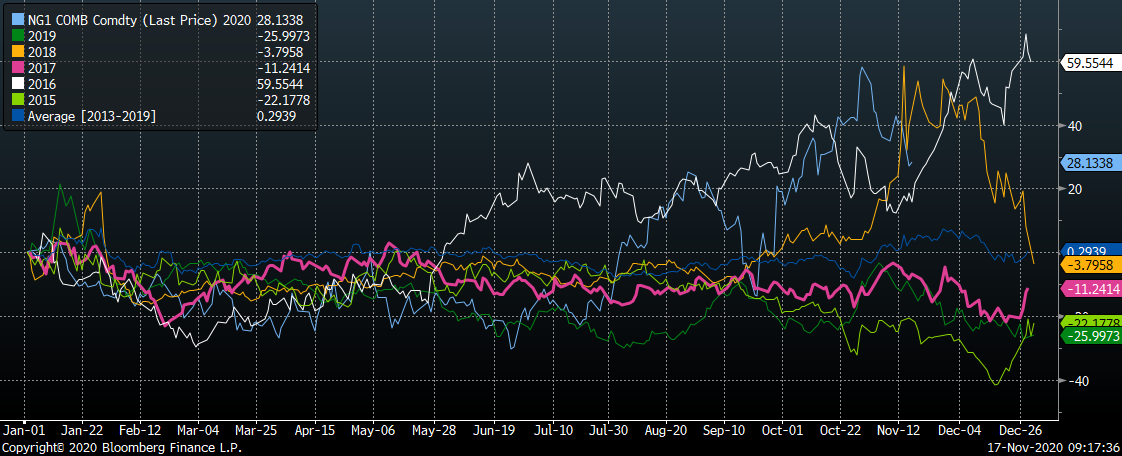

- It is worth noting that according to the seasonality, we should now be dealing with declines. However 2016 showed, that market bulls may not give up in the event of a sudden drop in temperatures

- A sudden drop in temperatures in combination with lower supply compared to last year could cause strong price increases, although this year's high should not be broken

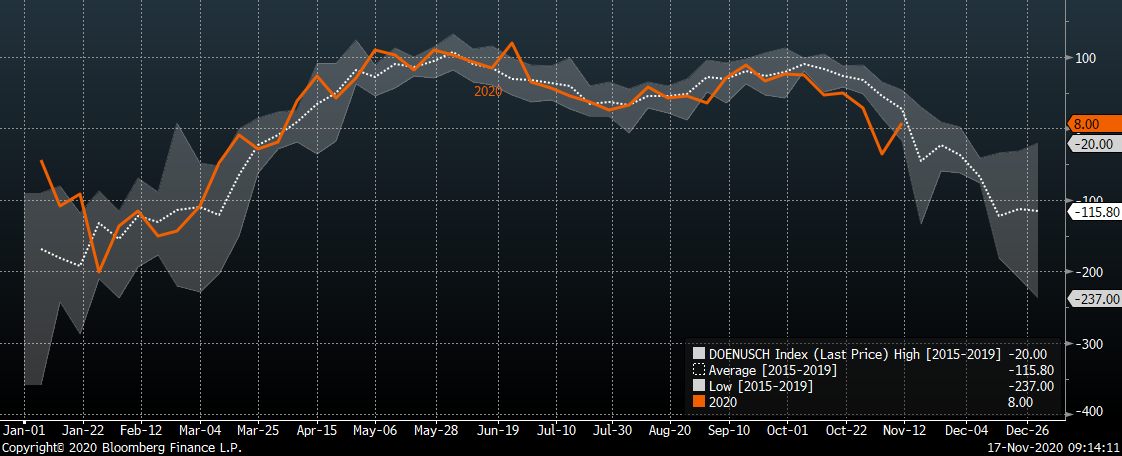

The recent increase in inventories was related to low demand. Of course, it is worth remembering that November is accountable for less than 20% of the entire heating period, so a lot may still change. Source: Bloomberg

The recent increase in inventories was related to low demand. Of course, it is worth remembering that November is accountable for less than 20% of the entire heating period, so a lot may still change. Source: Bloomberg

Seasonality shows that the price of gas tended to decline towards the end of the year, although 2016 was an exception. On the other hand, the entire first quarter usually brings strong declines. Source: Bloomberg

Seasonality shows that the price of gas tended to decline towards the end of the year, although 2016 was an exception. On the other hand, the entire first quarter usually brings strong declines. Source: Bloomberg

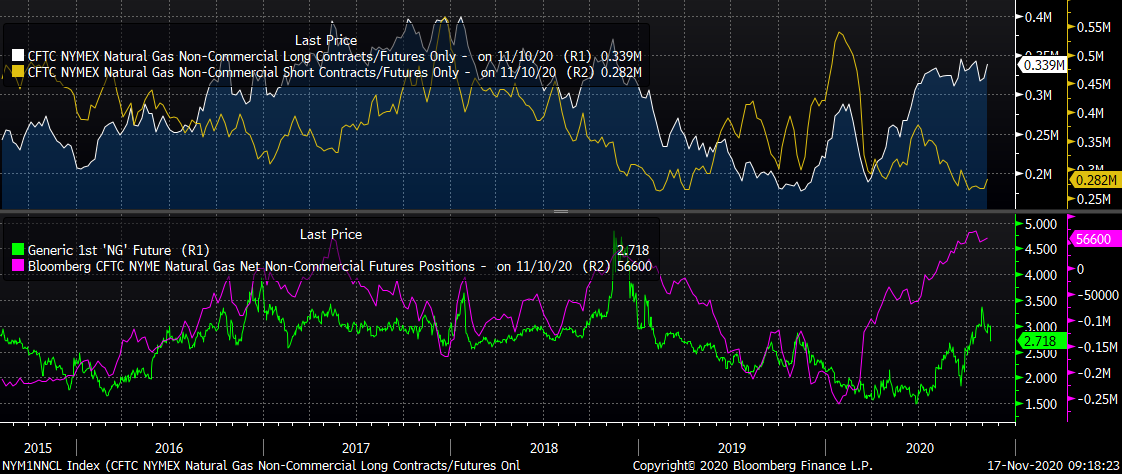

Positioning is at an extremely high level. However, before the major declines occur, buyers must surrender, which we have not observed recently (slight increase in the previous week). Source: Bloomberg

Positioning is at an extremely high level. However, before the major declines occur, buyers must surrender, which we have not observed recently (slight increase in the previous week). Source: Bloomberg

Copper:

- The signing of a trade agreement between 15 economies in the Asia-Pacific region led to a significant rebound in copper prices.

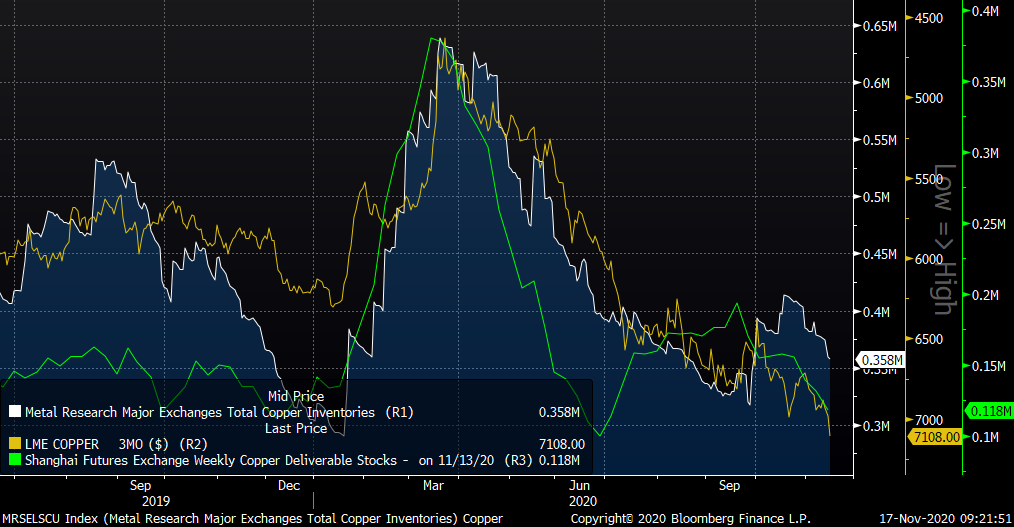

- The rise in copper prices is accompanied by a decline in inventories on the major exchanges

- There is a high probability that the price gap will be filled. However, looking at the previous copper rally during the recent financial crisis, new rally might have just started. It is worth noting that long-term demand will be driven by the increase in global electric car production.

The decline in copper inventories on global exchanges supports the recent recovery in the copper market. Source: Bloomberg

The decline in copper inventories on global exchanges supports the recent recovery in the copper market. Source: Bloomberg

Corn:

- The high prices are related to the inventories level in the USA - the lowest level of projected ending stocks since mid-2019

- On the other hand, global inventories remain relatively high historically, albeit also at their lowest level since mid-2019

- Extremely positive net positioning, the highest at least since 2018. Huge divergence between long and short positions. The lowest number of short positions in at least 5 years

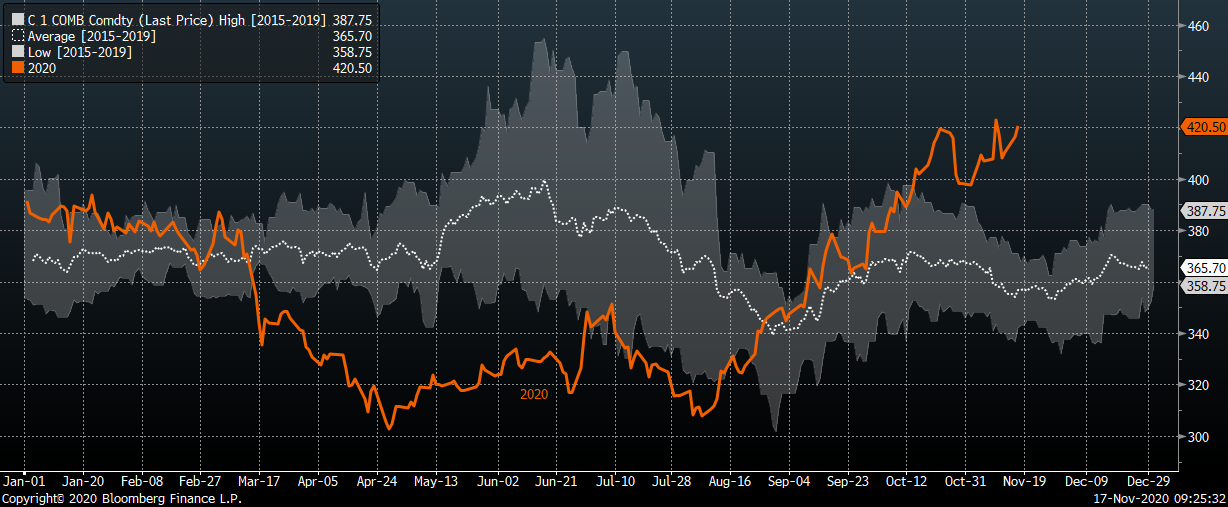

- Corn remain at high level in the context of the 5-year price range

Low US corn inventories, however in a historical context, global inventories remain at high level. Source: Bloomberg

Low US corn inventories, however in a historical context, global inventories remain at high level. Source: Bloomberg

Extremely high positioning, mainly caused by the lack of sellers. Source: Bloomberg

Extremely high positioning, mainly caused by the lack of sellers. Source: Bloomberg

Price significantly above average. Source: Bloomberg

Price significantly above average. Source: Bloomberg