Oil

-

Oil prices plummeted yesterday amid broad market sell-off and expectations that EU will soften its planned embargo to secure support

-

WTI prices dropped from $110 to $100. However, $100 area provided a support and allowed bulls to launch a recovery

-

European Union most likely will not impose a ban on use of EU-registered tankers for transport of Russian crude. Previously it was seen as one of key parts of proposed embargo

-

China sends more signals pointing to an economic slowdown, what may limit crude imports. Of course, China may continue to buy cheap Russian crude but if sales are concealed from the market it does not have much of an impact on prices

-

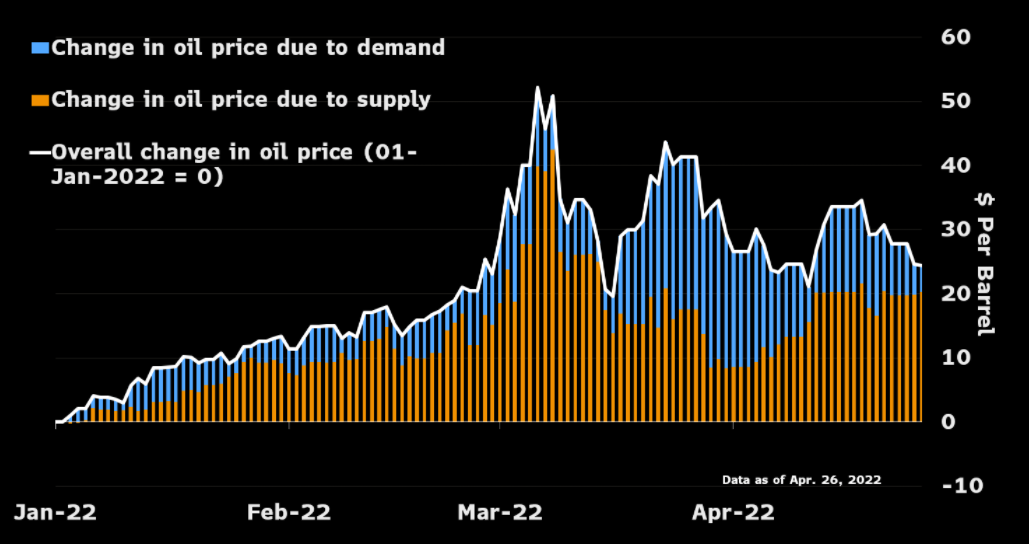

According to Bloomberg, there are more and more demand factors driving crude prices. It cannot be ruled out that slowdown or even recession will trigger negative demand shock that will outweigh positive supply developments

-

Refineries in Shandong boosted the amount of oil processed. However, they still operate at around 50% of capacity

Refineries in Shandong have a lot of spare capacity, suggesting that demand for fuel in China is limited. It is one of a key indicators of oil demand strength in world's second largest economy. Source: Bloomberg

Demand factors are having less contribution to the YTD change in oil price. Source: Bloomberg

WTI defended $100 per barrel area. However, a break below a recent short-term trendline may trigger a drop towards a key support zone in the $94 area. Source: xStation5

Gold

-

Gold has been trading in a downtrend for the past 3 months

-

A potential double top pattern with a neckline at $1,700 and a textbook range below $1,400

-

Yields may play a key role in future price moves which currently sit near 3%

-

10-years yields should reflect outlook on long-term neutral Fed rate. If Fed provides a clear guidance with an attempt of achieving "soft landing", neutral rate expectations may move to 2.0-2.5% from current 2.5-3.0%

-

However, gold price still have some room to fall in the short-term. Drop towards $1,700-1,800 remains a possibility. A drop below, potentially to $1,400 area, would be justified with S&P 500 dropping to 3,000 pts area

-

Gold may continue to drop as investors reduce number of long positions and pulled out money from ETFs in search for liquidity

Volatility on GOLD resembles the 2011-2013 period. However, we do not see declines of 2013 magnitude as highly probable now. However, they cannot be ruled out should a massive sell-off on Wall Street occur. In such a scenario, gold could drop to as low as $1,400. Source: xStation5

Investors reduce long positions on GOLD while ETFs sell out physical commodity. Source: Bloomberg

Aluminium

-

The aluminum market suggests that the situation in China is much worse than indicated by other metrics, such as copper prices

-

Aluminum prices have fallen 33% from all-time high and the situation is starting to resemble the 2008 financial crisis sell-off. Back then, the price fell to $ 2,100 level. If the situation repeats itself, aluminum could fell towards $ 2,000 level

-

If the slowdown in China is as severe as suggested by aluminum prices or the recent yuan depreciation, then it may lead to a sharp sell-off on the copper market

-

The key support for aluminum is located around $ 2,500 or so

-

However, it is worth mentioning that aluminum stockpiles are at a critically low level

The price of aluminum has fallen sharply recently, while copper remains stable. It is probably related to the fact that copper is used to secure financial transactions and as an investment asset. If reduced on both sides, the price of copper may decline similar to that of aluminum. Source: xStation5

The price of aluminum has fallen sharply recently, while copper remains stable. It is probably related to the fact that copper is used to secure financial transactions and as an investment asset. If reduced on both sides, the price of copper may decline similar to that of aluminum. Source: xStation5

Cocoa

-

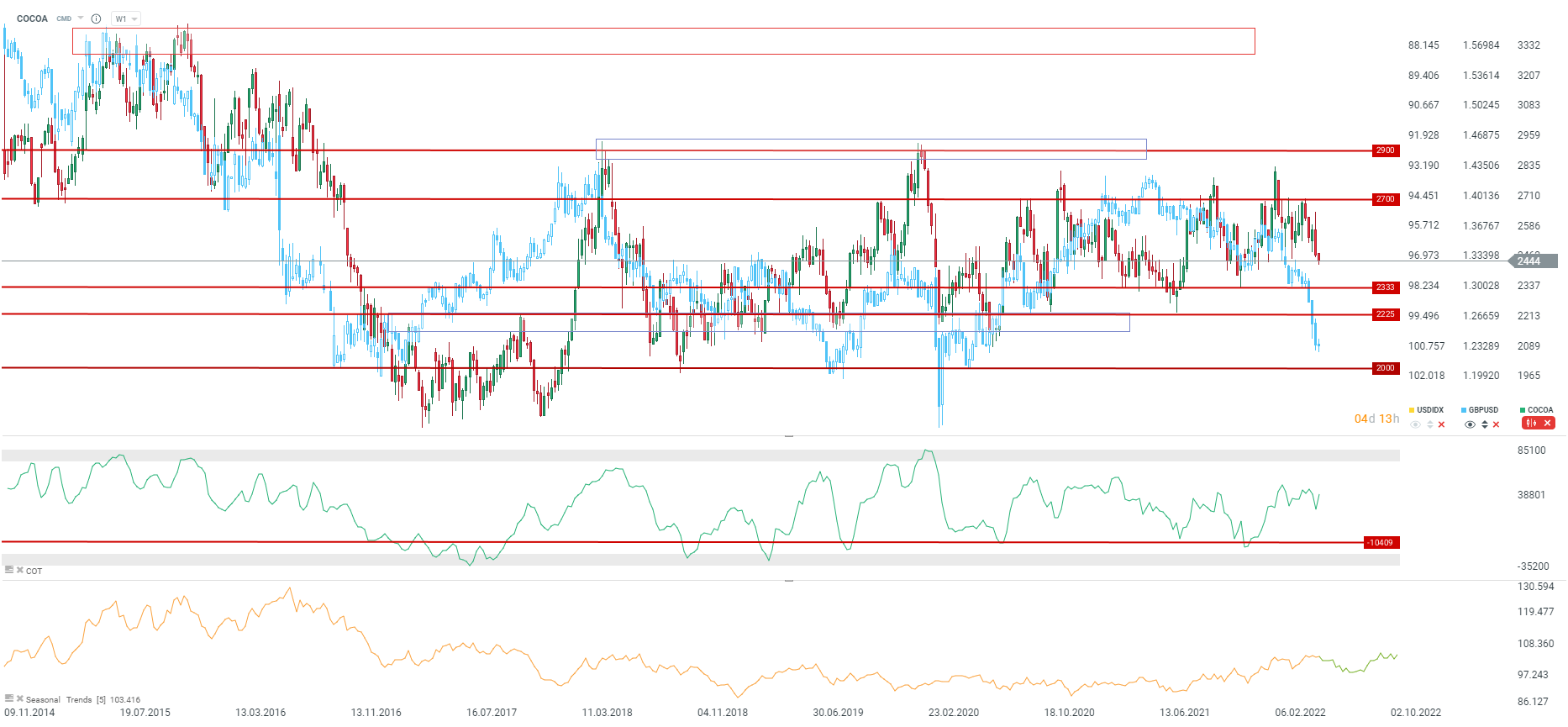

Cocoa is very vulnerable to a potential economic downturn

-

It is worth noting how drastic declines occurred at the start of the pandemic

-

The declines from 2008, 2011, 2016 usually halted around $ 2,000 level

-

The British pound lost ground recently, which also suggests a potential weakening of cocoa prices in the short to medium term

-

Seasonality indicates a possible pullback at the beginning of the summer holidays

-

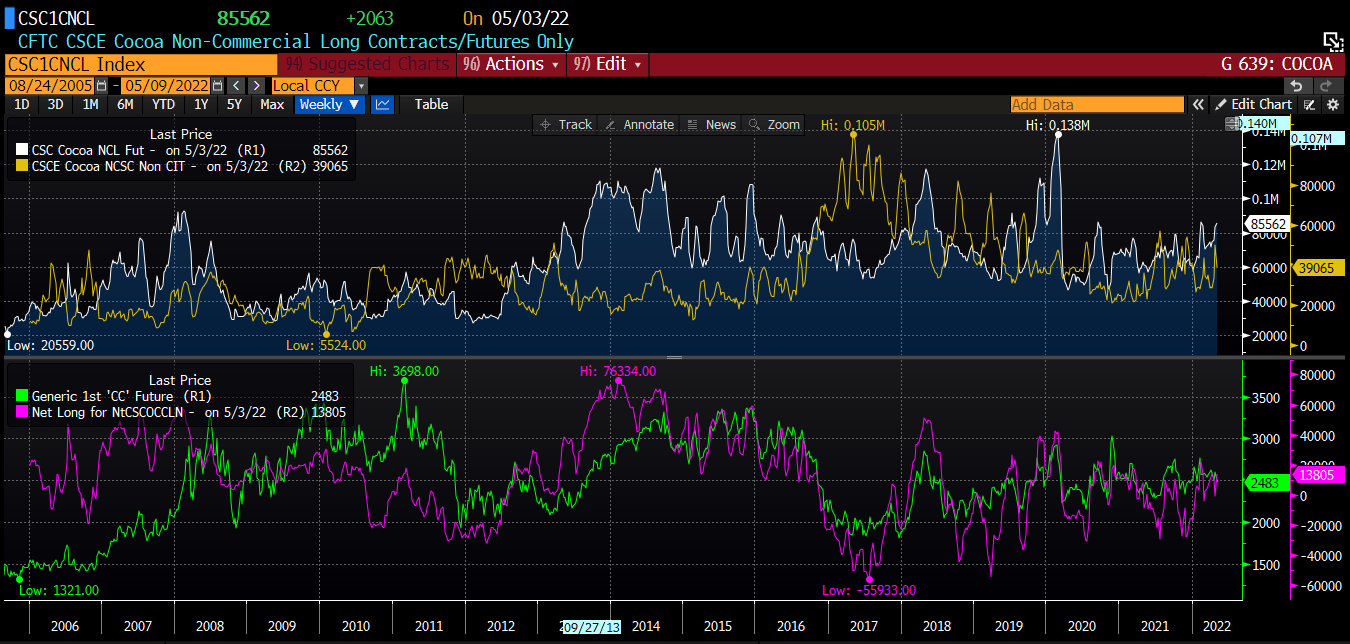

Futures point out that buyers still have advantage over sellers, but potential liquidity problems could change that

It's worth noting that the key support in the long term is located around $ 2,000. There are still many buyers on the market, although cocoa is not a very popular asset in times of crisis. Source: Bloomberg

It's worth noting that the key support in the long term is located around $ 2,000. There are still many buyers on the market, although cocoa is not a very popular asset in times of crisis. Source: Bloomberg

The price of cocoa correlates strongly with the British pound, due to the London market, where cocoa is still traded in pounds. The pound's recent total sell-off suggests cocoa may be in trouble. Source: xStation5

The price of cocoa correlates strongly with the British pound, due to the London market, where cocoa is still traded in pounds. The pound's recent total sell-off suggests cocoa may be in trouble. Source: xStation5

Chart of the day - OIL (03.11.2025)

Morning wrap (31.10.2025)

Daily Summary: ECB, FOMC and MAG7 - mixed signals and risk aversion

BREAKING: EIA gas inventories change slightly above expectations. NATGAS increase after EIA data 📌