Oil

- Oil has been trading under pressure since the beginning of July, despite the beginning of the driving season and decreases in crude oil inventories. However, petroleum product inventories remain at relatively high levels

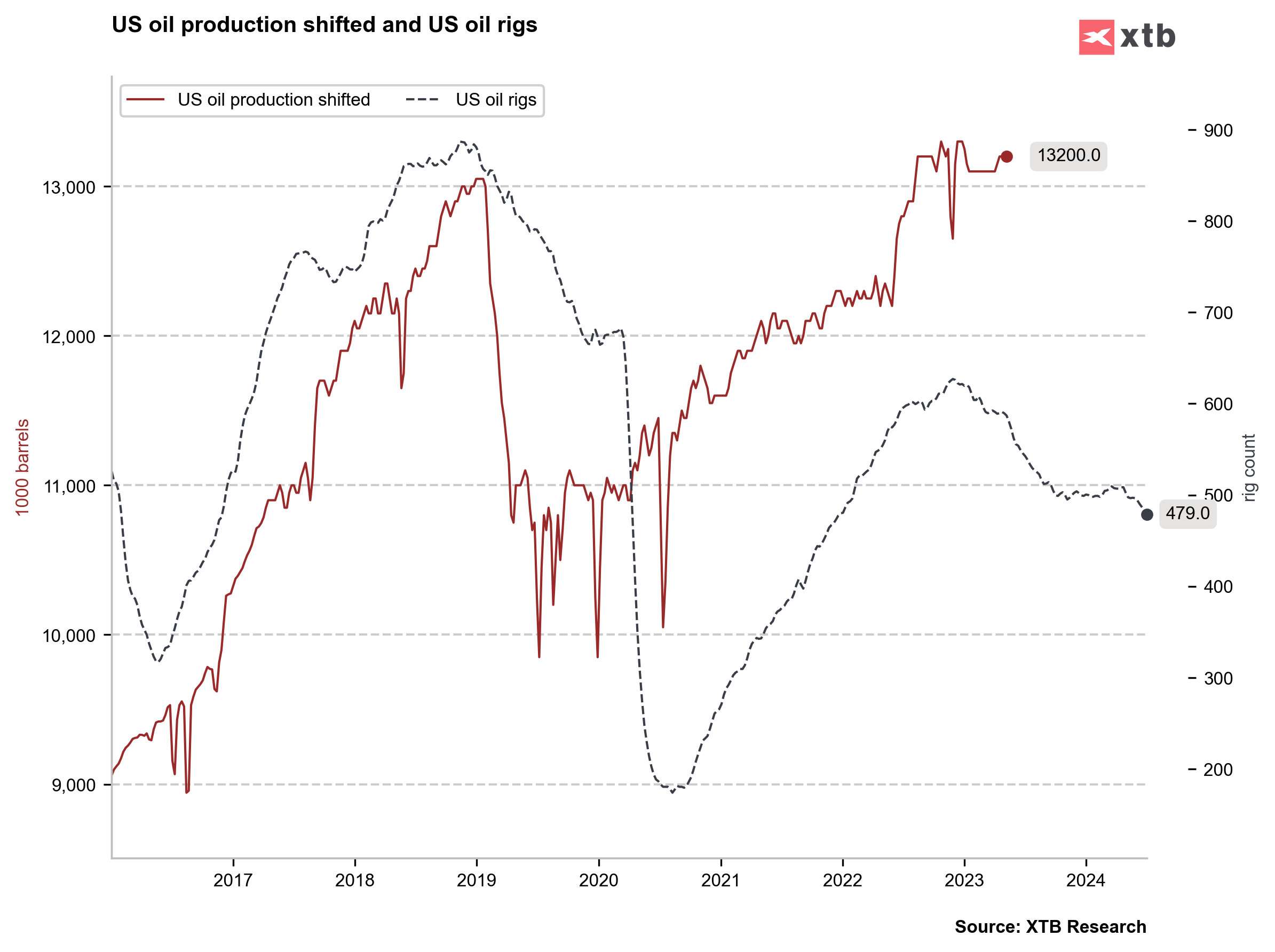

- Crude oil could be heavily influenced by the likelihood of Donald Trump winning the election. Although oil production remains high in the US, above 13 million barrels per day, Trump's presidency could restore the issuance of new drilling permits

- New potential drilling means a larger market share for the US and possible changes in strategy from OPEC+, which may not want to lose market share

- At the same time, the probable new Democratic Party candidate, Kamala Harris, is known for her very negative stance towards the oil extraction sector

- There are mixed reports about demand in China. However, recent actions by the central bank, in the form of interest rate cuts, may change the situation in the coming months

- The oil market also continues to observe excessively high backwardation, which in the past has signalled an oil revaluation

Start investing today or test a free demo

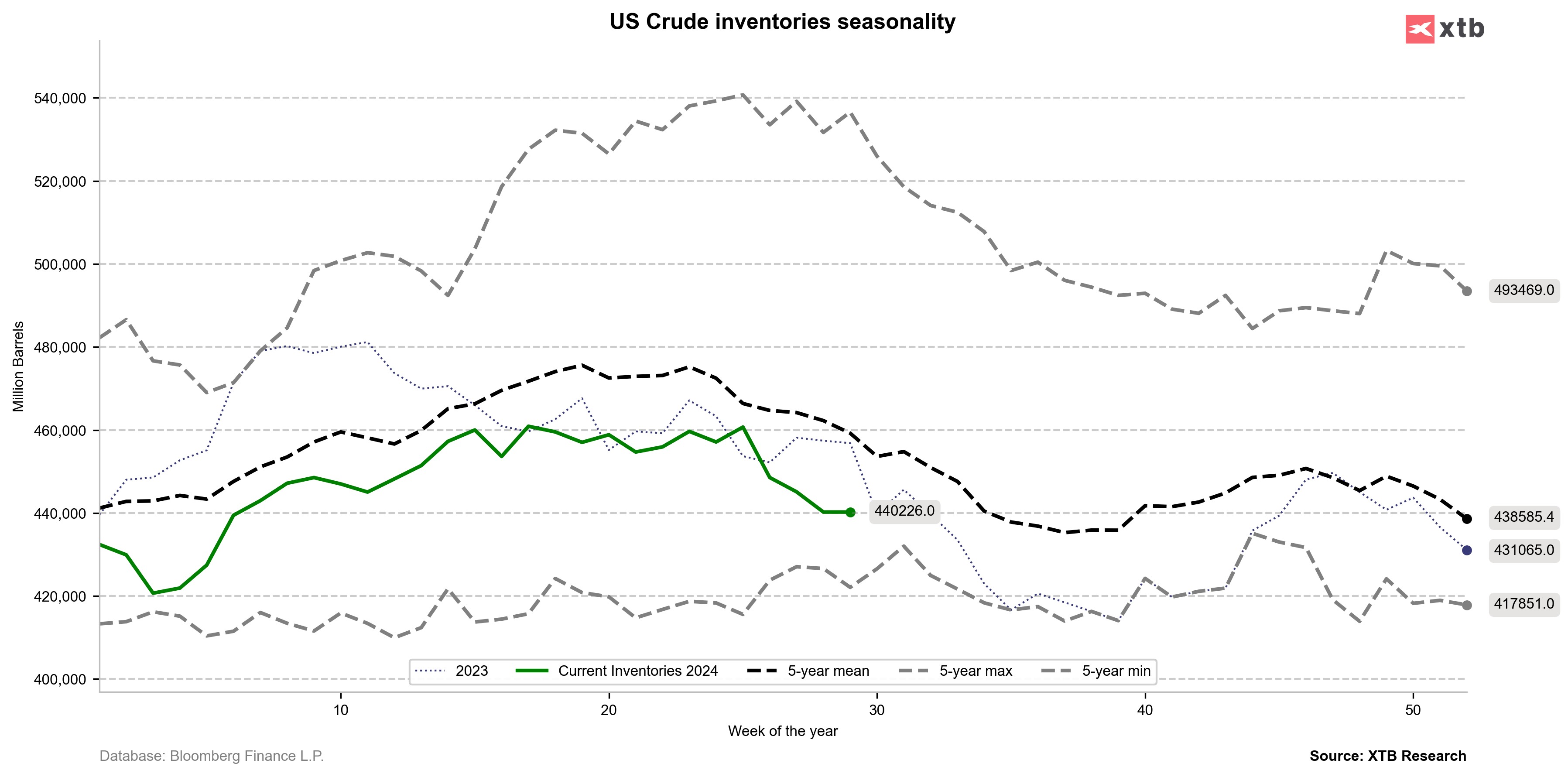

Create account Try a demo Download mobile app Download mobile appCrude oil inventories are falling more than suggested by seasonality, but this has failed to support oil prices. Source: Bloomberg Finance LP, XTB

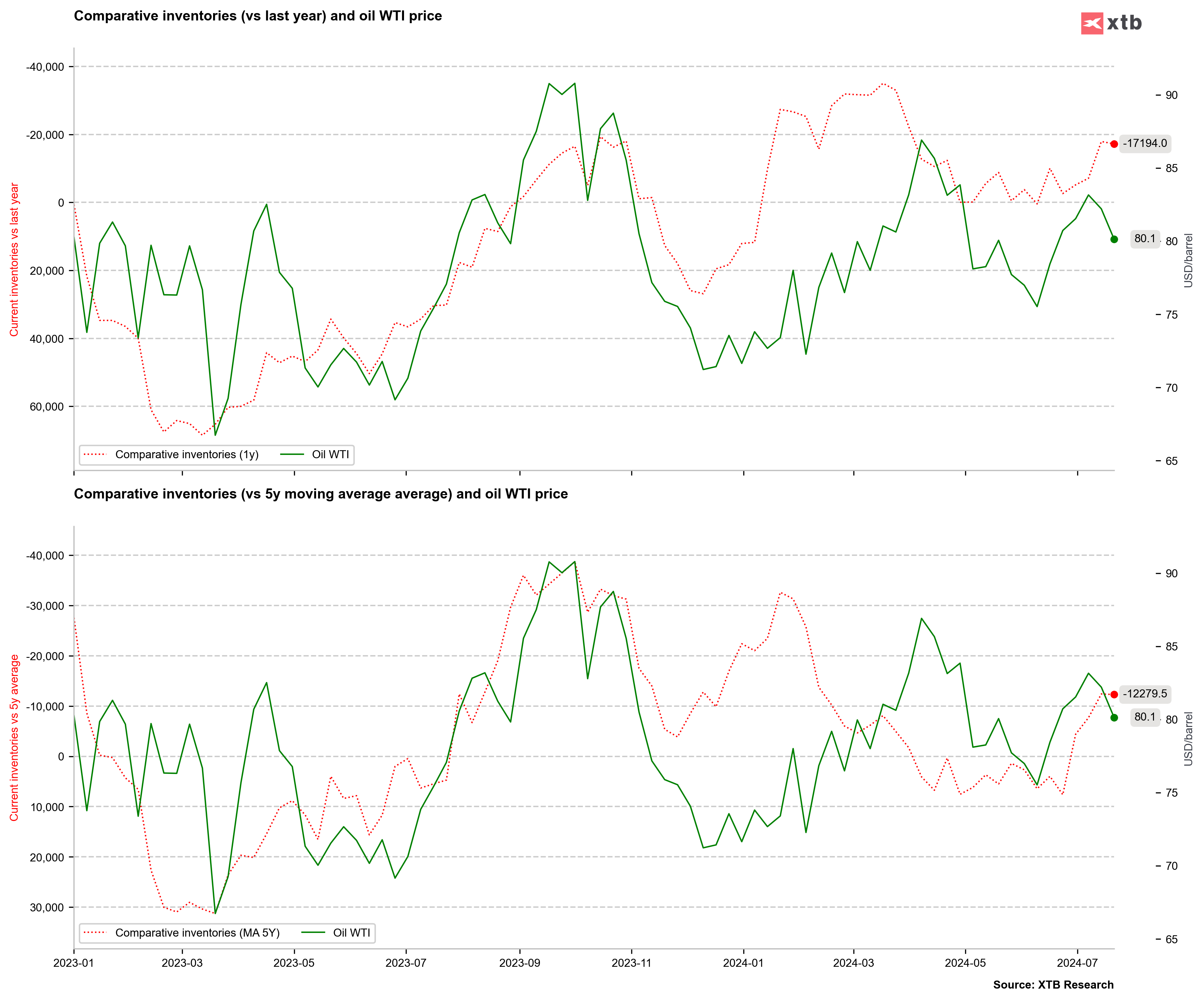

Comparative inventories also suggest that the recent declines may not be justified by current fundamentals but by future expectations. Source: Bloomberg Finance LP, XTB

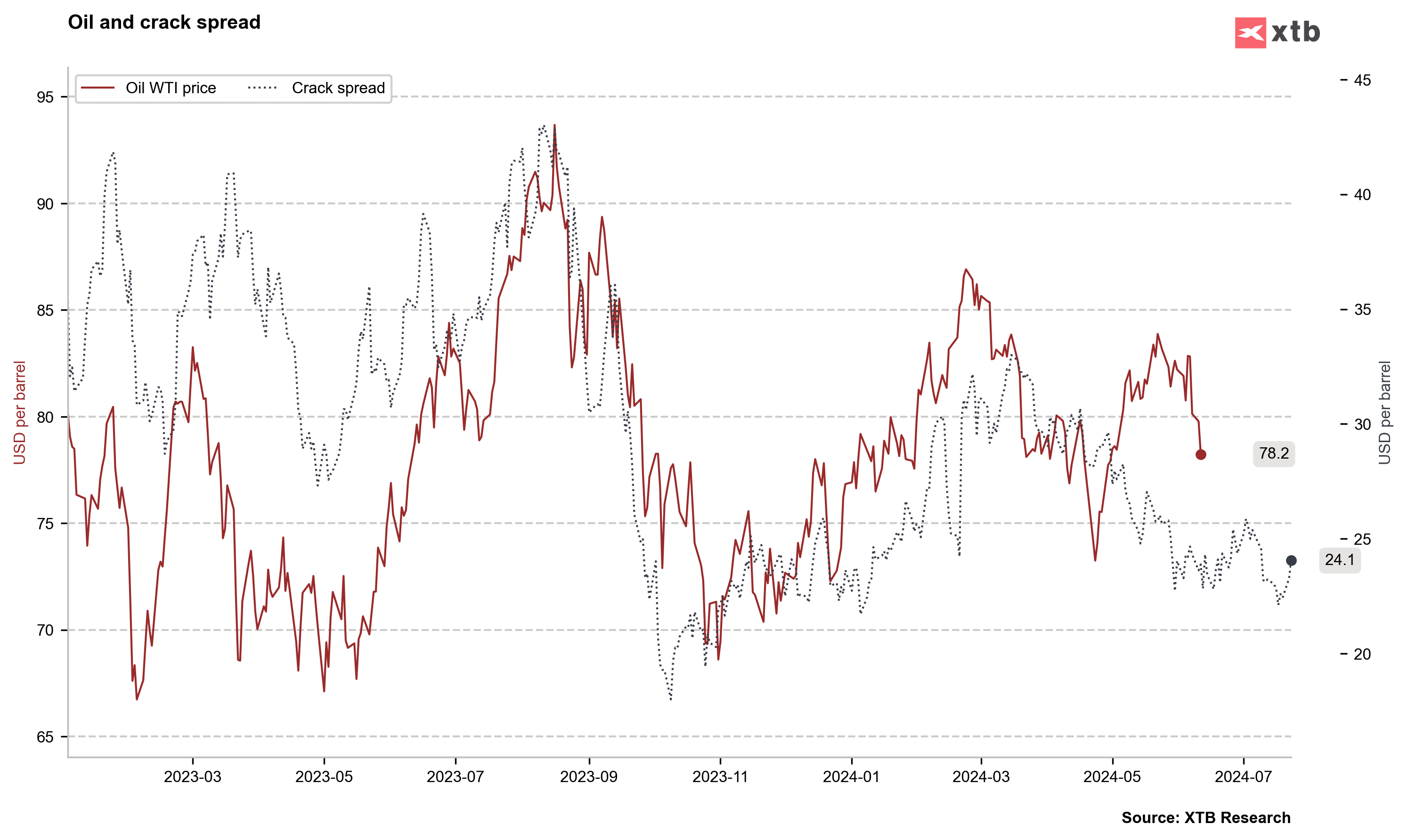

Simultaneously, the crack spread remains relatively low, which may suggest that fuel demand is not excessive and does not put pressure on oil prices. Source: Bloomberg Finance LP, XTB

US production remains near record levels, but drilling rigs continue to decline. Although Trump's potential actions will not immediately change the fundamental picture, they may pressure prices to fall. Source: Bloomberg Finance LP, XTB

Natural Gas

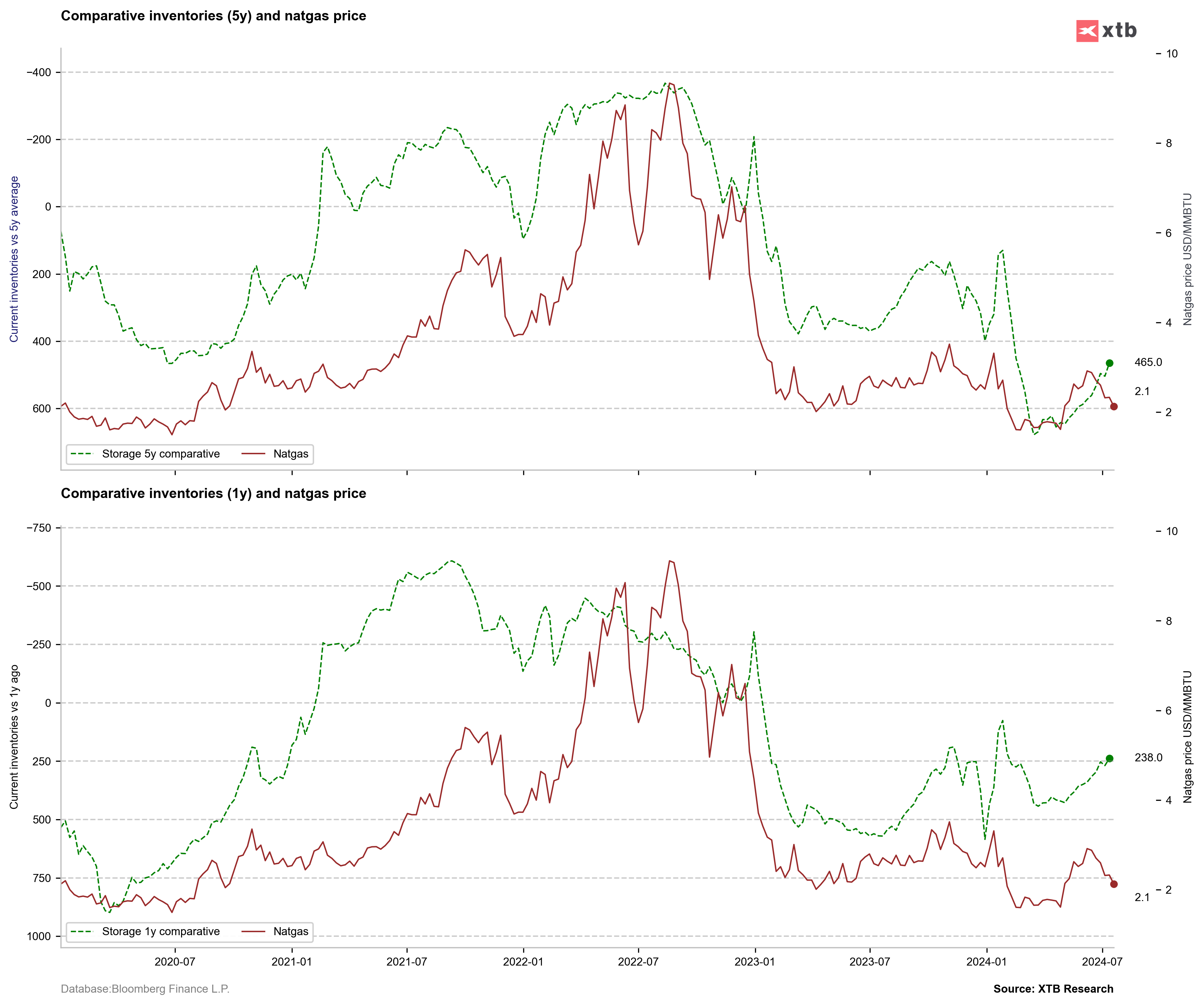

- US natural gas prices fell to around $2.0/MMBTU despite the period of increased demand for gas. In July, we observed a clear deviation from the 5-year average, but production has returned to a steady above 100 bcf per day

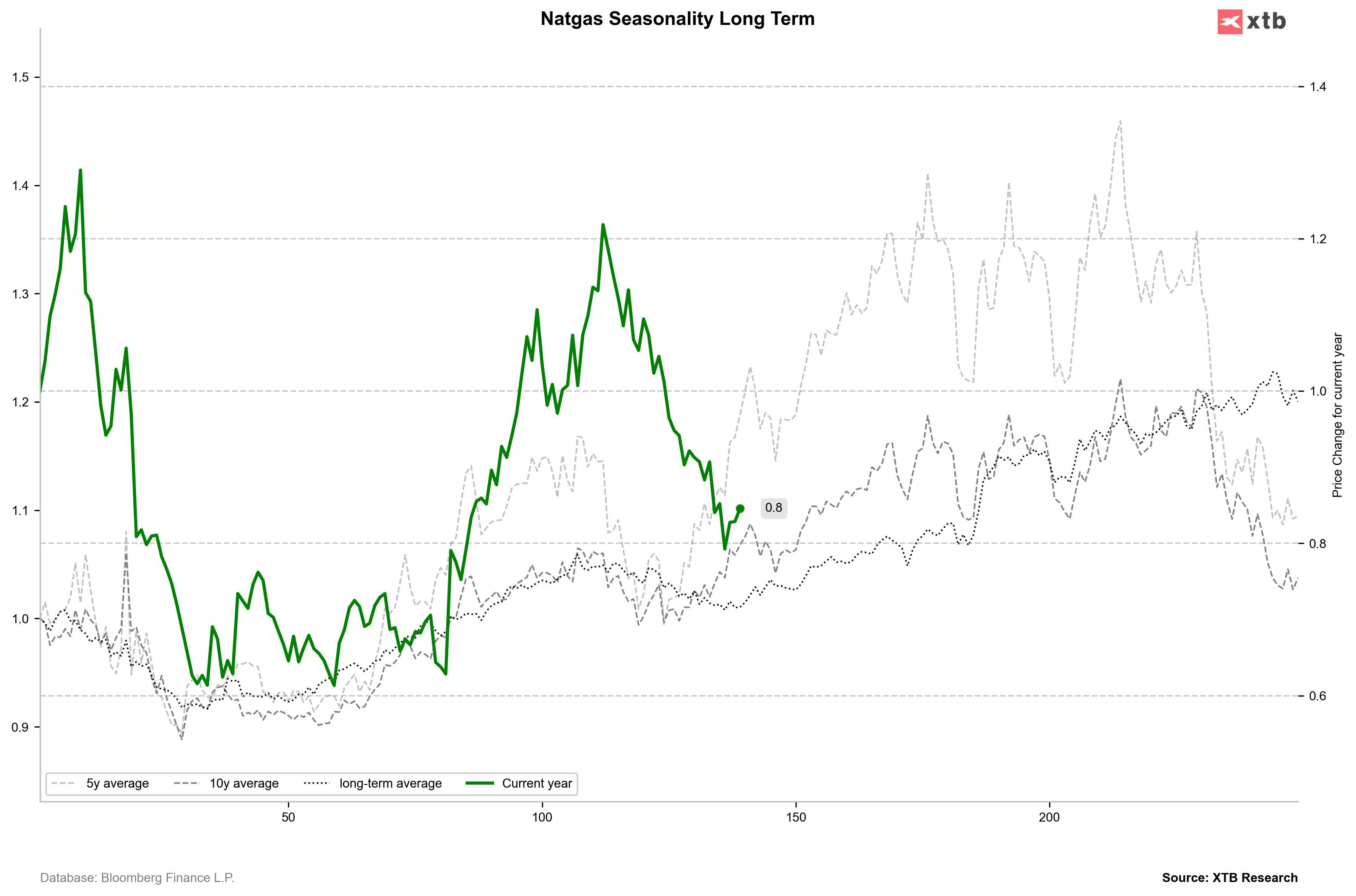

- Long-term seasonality indicators suggest that gas should gain in the near future. However, we must consider the very strong contango in the near term. For the January (peak) contract, contango is as high as 60%, while long-term seasonality indicators show an annual gain of 20%. This could mean that prices will be higher in the coming months, but this may be mainly due to the shape of the curve

- Comparative inventories show, however, that the recent sell-off in the gas market was excessive. At the same time, looking at trends related to gas consumption and fairly high supply, inventory growth should increase in the near future

Long-term seasonality indicates that we should be long past bottom in prices. However, it must be kept in mind that increases are largely due to the shape of the forward curve. For the January contract, contango is around 60%. Source: Bloomberg Finance LP, XTB

Inventories are not growing as quickly as they have at peak levels over the past 5 years. Comparative inventories indicate that the declines may have been excessive. Source: Bloomberg Finance LP, XTB

Recently, demand has been at levels consistent with supply, but demand fell rapidly, also due to lower average temperatures. As seasonality shows, we should expect a greater increase in inventories in the near future. Source: Bloomberg Finance LP, XTB

Cocoa

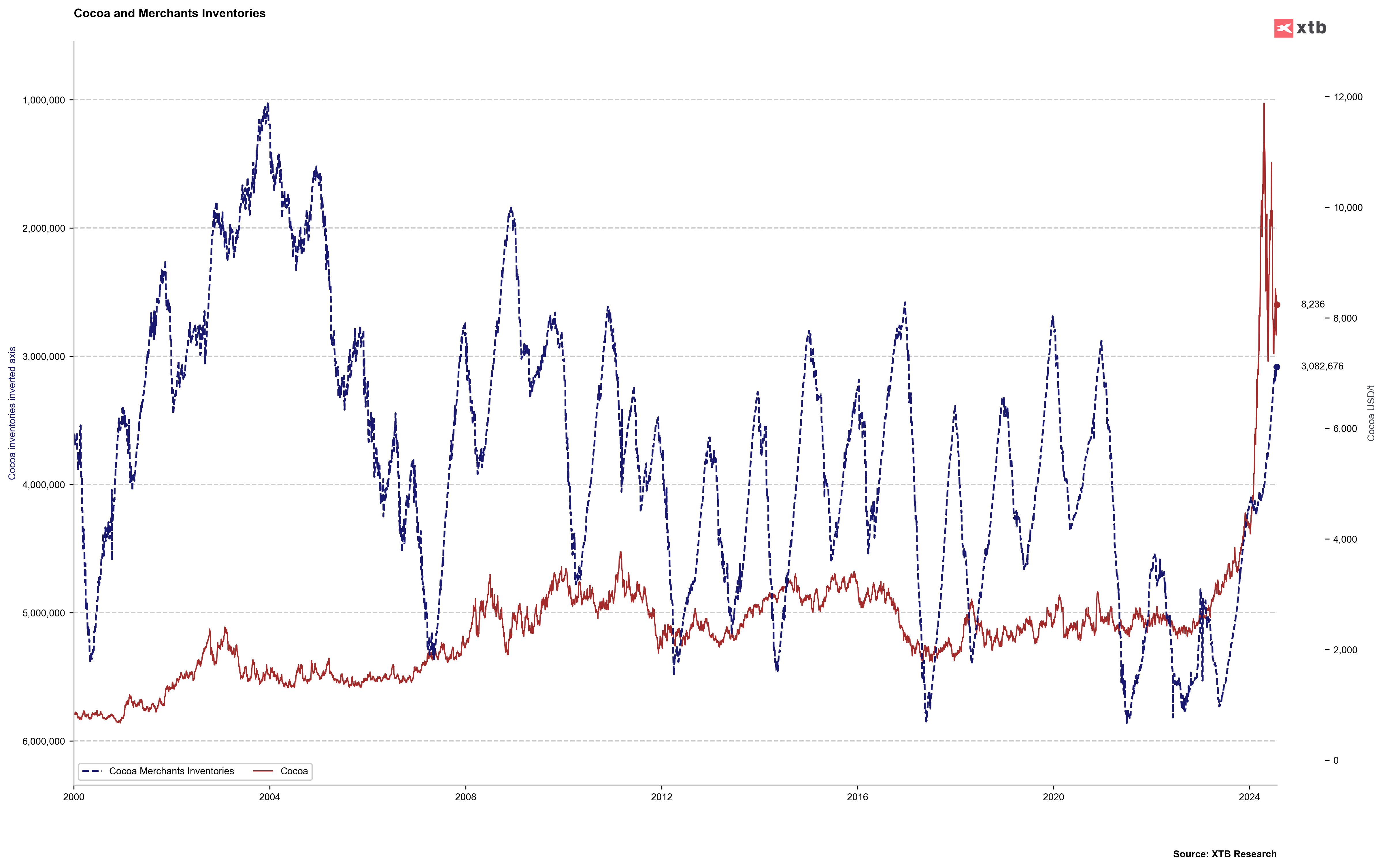

- Cocoa processing in North America in the second quarter of this year amounted to 104.8 thousand tons, representing an increase of about 2% year-on-year

- Cocoa processing in Asia in the second quarter amounted to about 211 thousand tons, representing a decrease of 4.7% year-on-year

- Cocoa processing in Europe in the second quarter amounted to 367.5 thousand tons and increased by 4.1% year-on-year

- Cocoa processing in Ivory Coast in June amounted to 45,172 thousand tons according to GEPEX data, representing a decrease of 25.9% year-on-year

- Total processing this season from October to June amounted to 468,831 thousand tons, representing a decrease of 13.3% year-on-year. The Ivory Coast has a cocoa processing capacity of 712 thousand tons

- Farmers from Ghana expect increased production in the 2024/2025 season. The slowly passing season was plagued by phenomena such as El Niño, smuggling, and tree diseases. However, farmers indicate that diseases are not currently present, which bodes well for future harvests

- Additionally, Ghana indicates that it plans to limit harvest sales for the next season and distribute orders to all, not just those who order the most

Cocoa stocks on the ICE exchange are still clearly declining, showing that the supply situation is not improving. Source: Bloomberg Finance LP, XTB

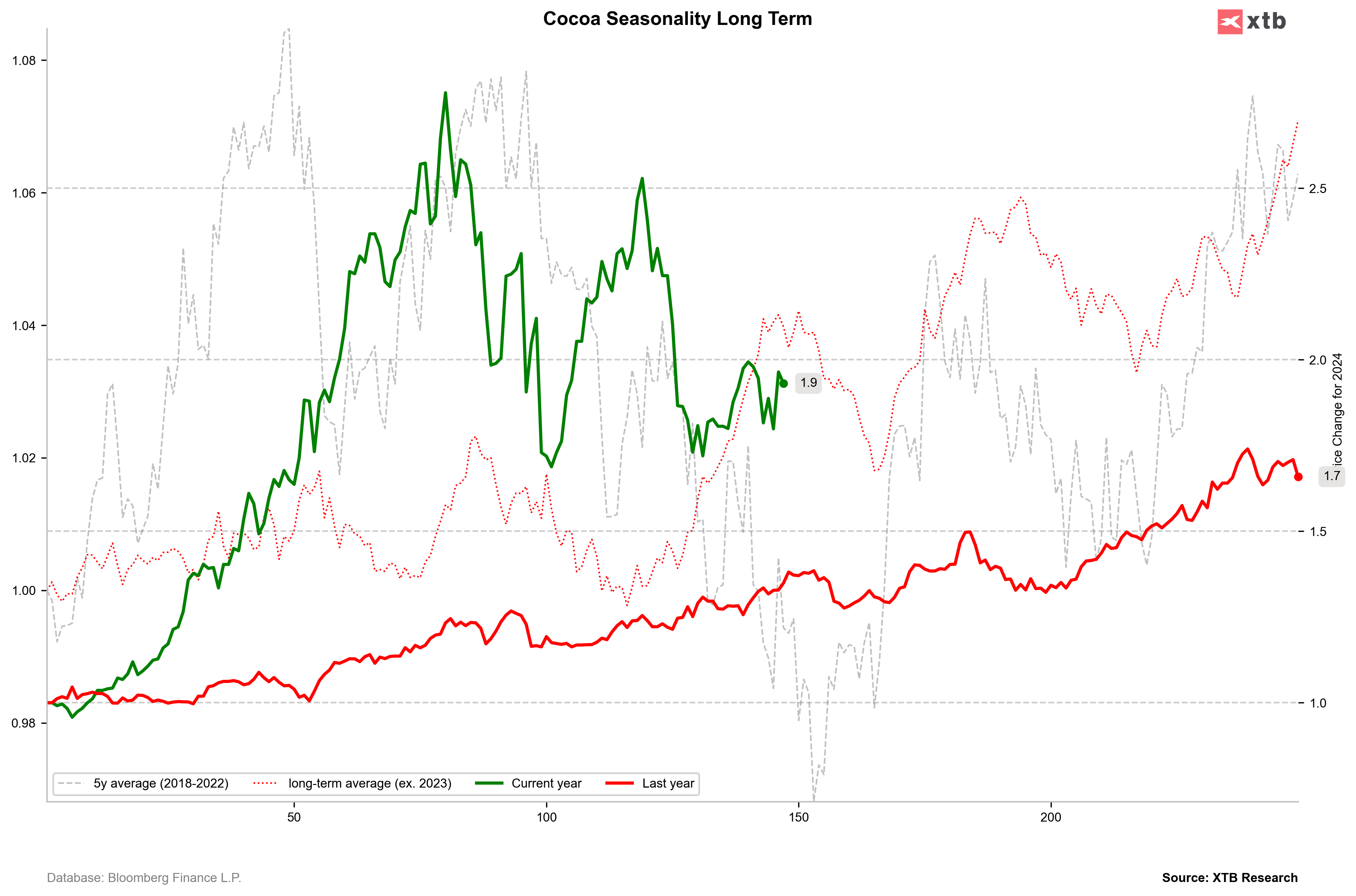

Cocoa remains under short-term pressure and begins to behave similarly to the 5-year average from 2018-2022. Theoretically, all averages suggest a local bottom around the end of August/September. Source: Bloomberg Finance LP, XTB

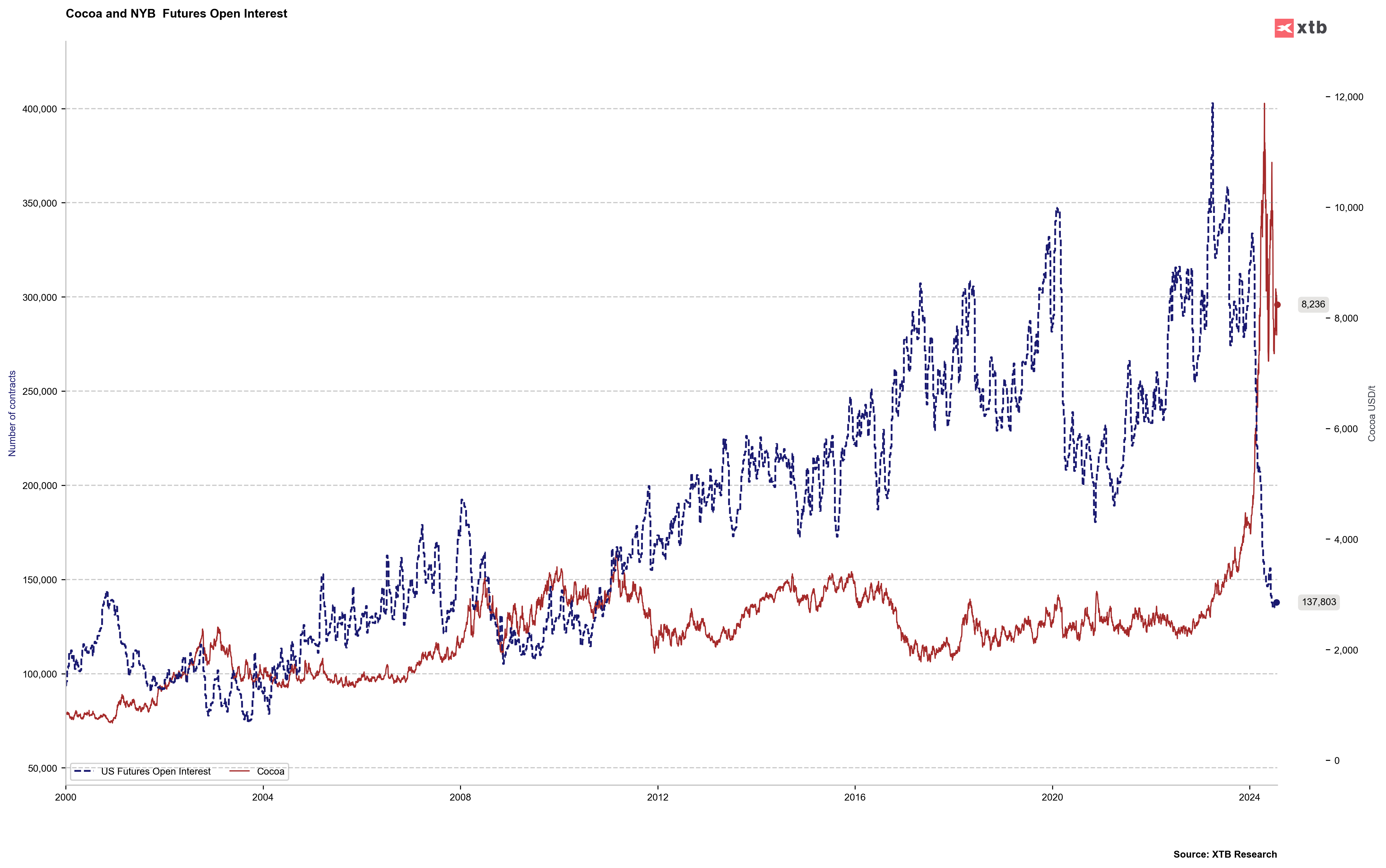

The number of open positions in the cocoa market remains extremely low, which is theoretically a negative factor in the medium and long term. Source: Bloomberg Finance LP, XTB

Coffee

- Coffee prices remain high. It is rumoured that production in Brazil will be significantly lower than initially suggested due to insufficient rainfall

- On the other hand, moderate increases in coffee stocks according to ICE are observed. These are already close to local peaks from early 2023

- Despite a weak Brazilian real, coffee producers in Brazil are not pressured to sell more coffee. Usually, in the case of a weak real, producers sell larger quantities than usual, allowing them to convert dollars into more of their currency

- Dealers indicate that July saw a lot of rain in Vietnam, which theoretically could improve the production situation of Robusta. Nevertheless, Robusta prices remain at record high levels, above $4,500 per ton

- The real remains very weak. The sugar price is also very low, creating a significant divergence with coffee

Coffee stocks are rising, but in the long term, they remain extremely low. Source: Bloomberg Finance LP, XTB

Coffee remains in an upward trend, although the recent weakening of the real and declines in sugar prices also caused a retreat of about 10 cents per pound of coffee. Support is in the range of 235-240 cents and at the rising trend line. Source: xStation5